Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

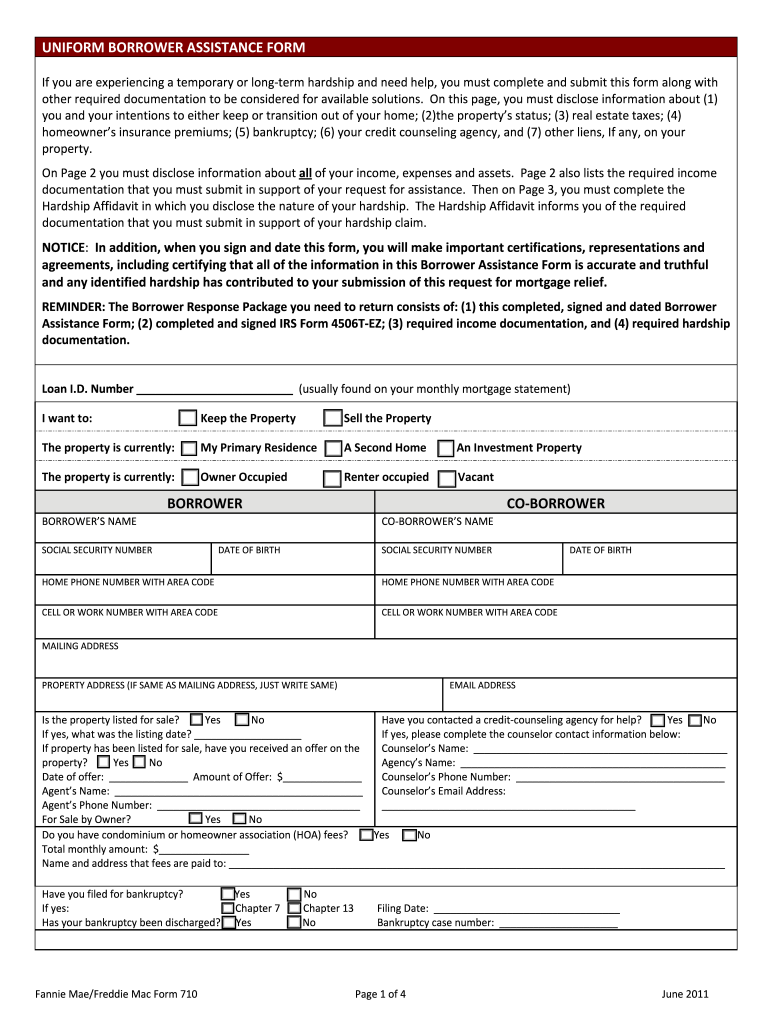

What is mortgage assistance application form?

A mortgage assistance application form is a document that individuals fill out in order to apply for help or support with their mortgage payments. This form typically asks for personal and financial information, such as the applicant's name, contact details, employment status, income, expenses, and details about their mortgage loan. The purpose of this form is to assess the applicant's eligibility for various mortgage assistance programs offered by government agencies, non-profit organizations, or mortgage lenders.

Who is required to file mortgage assistance application form?

The individuals or households who are facing difficulty in making their mortgage payments and seek assistance can file a mortgage assistance application form. This includes homeowners who may be experiencing financial hardship due to various reasons such as unemployment, medical expenses, or other unforeseen circumstances. The specific eligibility criteria and requirements may vary depending on the mortgage assistance program and the lender.

How to fill out mortgage assistance application form?

Filling out a mortgage assistance application form typically involves providing detailed information about your financial situation and the reasons for requesting assistance. Here is a step-by-step guide to help you fill out a mortgage assistance application form:

1. Read the instructions: Start by carefully reading the instructions provided with the application form. Make sure you understand the requirements and gather all the necessary documents and information before you begin.

2. Personal information: Fill out your personal information accurately, including your name, address, phone number, email address, and social security number.

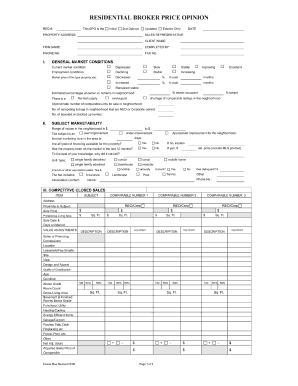

3. Property information: Provide details about the property for which you are seeking mortgage assistance, such as property address, type of property (single-family, condo, etc.), and the current market value.

4. Loan information: Provide information about your current loan, including the lender's name, loan number, loan balance, monthly mortgage payment, and interest rate.

5. Financial information: This section requires detailed information about your income, expenses, and assets. This may include your employment status, employer details, monthly income, monthly expenses (such as utilities, insurance, debts), and asset information (such as bank accounts, investments, and real estate).

6. Hardship explanation: Explain the reason for your mortgage assistance request in detail. This may involve describing the specific financial hardship you are facing (job loss, medical expenses, divorce, etc.). Be honest and provide supporting documents if required.

7. Supporting documents: Many mortgage assistance applications require supporting documents to validate the information provided. Gather necessary documents such as pay stubs, bank statements, tax returns, proof of hardship, and any other documents specified in the application instructions.

8. Review and sign: Before submitting the application, carefully review all the information you have provided to ensure accuracy. Sign and date the form as required.

9. Submission: Submit the application form according to the instructions provided, either electronically or through mail. Make copies of the completed form and supporting documents for your records.

It is important to remember that each mortgage assistance program may have different requirements and application processes. Following the instructions provided with the application and seeking assistance from a housing counselor if needed can help ensure your application is filled out correctly.

What is the purpose of mortgage assistance application form?

The purpose of a mortgage assistance application form is to collect and gather information from individuals who are seeking financial assistance with their mortgage payments. This form typically requires borrowers to provide details about their financial situation, income, expenses, assets, and liabilities. The information supplied in the application form helps mortgage lenders or loan servicers to assess the borrower's eligibility for various mortgage assistance programs or options, such as loan modification, forbearance, or refinancing. The form assists in the evaluation process by allowing the lender to determine the borrower's ability to repay the loan and to understand their specific financial circumstances.

What information must be reported on mortgage assistance application form?

The specific information required on a mortgage assistance application form may vary depending on the lender and the specific program being applied for. However, some common information that is typically required includes:

1. Personal Information: This includes the applicant's full legal name, date of birth, Social Security number, and contact details (address, email, and phone number).

2. Employment Information: The applicant may need to provide details regarding their current employer, job title, length of employment, and monthly income.

3. Financial Information: This includes information about the applicant's bank accounts, assets, and liabilities. It may involve providing bank statements, investment statements, retirement account details, and information about other debts or loans.

4. Property Information: Details about the property for which mortgage assistance is being sought may include the address, type of property, current market value, and outstanding mortgage balance.

5. Loan Information: The applicant should provide information about their current mortgage, including the lender's name, loan type, interest rate, payment amount, and the date the mortgage was originated.

6. Hardship Explanation: The applicant may need to provide a written explanation detailing the reason for seeking mortgage assistance and describing the financial hardship they are facing.

7. Documentation: The lender may require various supporting documents such as pay stubs, tax returns, W-2 forms, proof of unemployment benefits, or proof of income loss to validate the information provided on the application.

It is important to note that the specific requirements may vary, so individuals should consult the lender or program guidelines to ensure accurate completion of the application form.

What is the penalty for the late filing of mortgage assistance application form?

The penalty for the late filing of a mortgage assistance application form can vary depending on the specific circumstances and jurisdiction. In some cases, there may be a late filing fee imposed by the lender or mortgage servicer. Additionally, filing the application after a specified deadline may result in delays or denial of the requested assistance. It is advisable to check with the specific lender or mortgage assistance program for the consequences of late filing.

How can I send mortgage assistance application form to be eSigned by others?

To distribute your mortgage assistance application form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I edit mortgage assistance application form on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing mortgage assistance application form, you can start right away.

Can I edit mortgage assistance application form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute mortgage assistance application form from anywhere with an internet connection. Take use of the app's mobile capabilities.