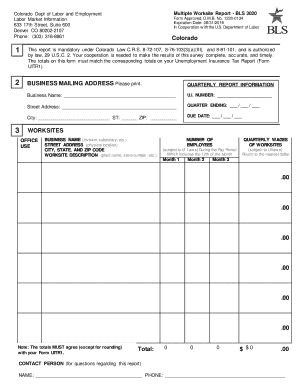

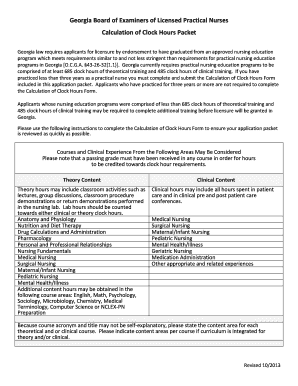

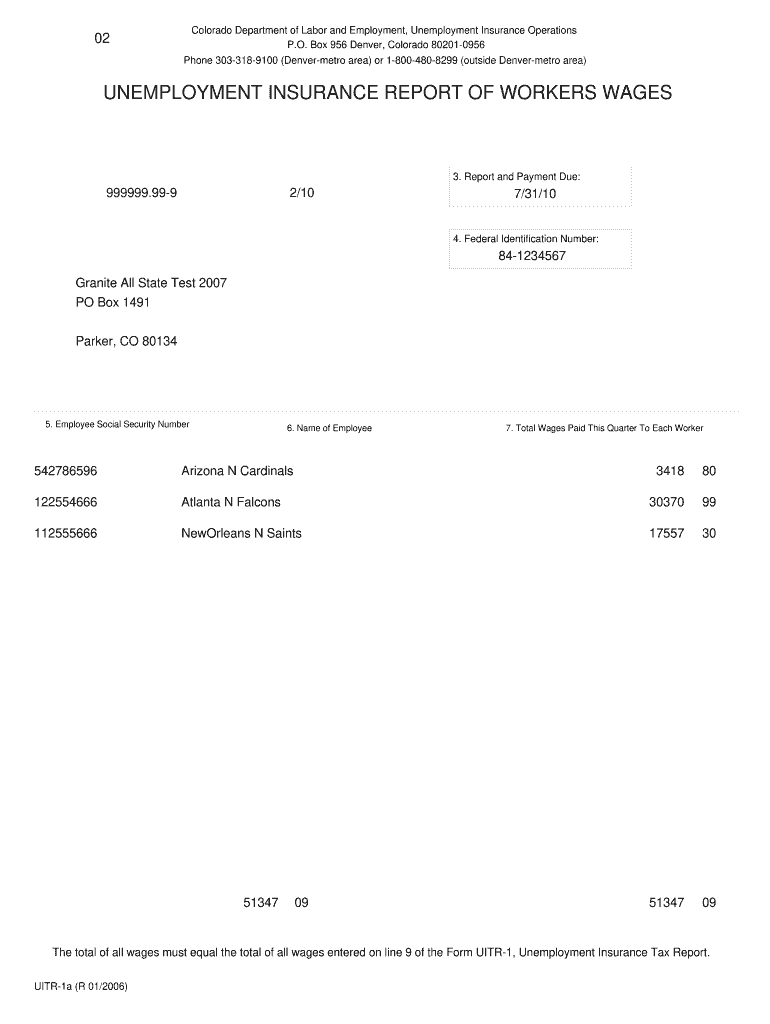

Get the free UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES

Show details

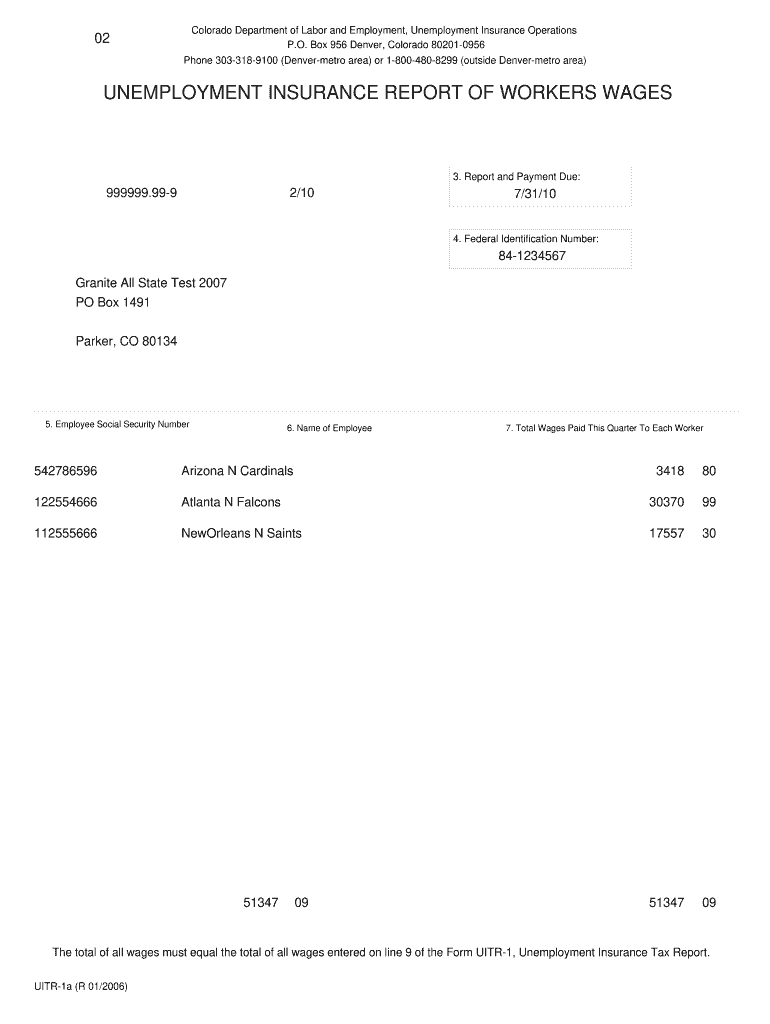

999999.99-9. 2/10. 7/31/10. 84-1234567. Granite All State Test 2007. PO Box 1491. Parker, CO 80134. 02. Colorado Department of Labor and Employment, ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your unemployment insurance report of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unemployment insurance report of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit unemployment insurance report of online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit unemployment insurance report of. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out unemployment insurance report of

How to fill out unemployment insurance report of:

01

Gather necessary information: Before filling out the unemployment insurance report, make sure you have all the necessary information at hand. This includes personal details such as your full name, address, contact information, social security number, and employee identification number (if applicable).

02

Review eligibility requirements: Familiarize yourself with the eligibility requirements for unemployment insurance. Each state may have different criteria, so it's crucial to understand if you meet the necessary conditions to apply or continue receiving benefits.

03

Understand reporting periods: Determine the reporting periods for which you need to file the unemployment insurance report. These reporting periods often cover a specific week or multiple weeks, and it's important to accurately report the dates and duration for which you are claiming benefits.

04

File online or via mail: Depending on your state's procedures, you may need to file your unemployment insurance report online through the designated website or mail a physical form. Ensure that you follow the correct method instructed by the state's unemployment agency.

05

Provide employment details: When filling out the report, you may be required to provide detailed information about your past employment. This could include the name and address of previous employers, dates of employment, job titles, and reasons for separation. Make sure to accurately provide this information, as it will be used to determine your eligibility and benefits.

06

Report wages earned: If you had any earnings during the reporting period, ensure that you accurately report them on the unemployment insurance report. This includes wages from part-time jobs, freelance work, or any other source of income. Failure to report earnings correctly may result in penalties or loss of benefits.

07

Certify your eligibility and availability: In some cases, you may need to certify that you are actively seeking employment and available for work during the reporting period. This could involve answering questions or providing additional information to prove your current job search status.

08

Double-check before submission: Before submitting your unemployment insurance report, review all the information you provided. Ensure that there are no errors or incorrect details that may potentially delay the processing of your claim or generate discrepancies in your benefits calculation.

Who needs unemployment insurance report of:

01

Individuals who have lost their job: Those who have lost their job and are eligible for unemployment benefits may need to fill out an unemployment insurance report. This report serves as a means to claim benefits during the period of unemployment.

02

Workers whose hours have been reduced: If you are still employed but have had your hours significantly reduced and now meet the state's criteria for partial unemployment benefits, you may need to file an unemployment insurance report to access those benefits.

03

Individuals whose employment was terminated for specific reasons: Some individuals may be eligible for unemployment insurance benefits if their employment was terminated due to specific reasons such as company-wide layoffs, business closures, or qualifying personal circumstances.

In summary, individuals who have lost their job, experienced reduced work hours, or had their employment terminated for specific reasons may need to fill out an unemployment insurance report to claim or continue receiving benefits. The process involves gathering necessary information, understanding reporting periods, providing employment details and earnings, certifying eligibility, and double-checking before submission.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is unemployment insurance report of?

Unemployment insurance report is a document that contains information about the wages paid to employees and the amount of taxes withheld for unemployment insurance purposes.

Who is required to file unemployment insurance report of?

Employers are required to file unemployment insurance reports for each of their employees.

How to fill out unemployment insurance report of?

Unemployment insurance reports can usually be filled out online through the state's labor department website.

What is the purpose of unemployment insurance report of?

The purpose of unemployment insurance reports is to ensure that employees are receiving the correct amount of benefits if they become unemployed.

What information must be reported on unemployment insurance report of?

The information that must be reported on unemployment insurance reports typically includes employee wages, hours worked, and taxes withheld.

When is the deadline to file unemployment insurance report of in 2023?

The deadline to file unemployment insurance reports in 2023 is usually in January of the following year.

What is the penalty for the late filing of unemployment insurance report of?

The penalty for late filing of unemployment insurance reports can vary by state, but may include fines or interest on unpaid taxes.

Can I create an electronic signature for the unemployment insurance report of in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your unemployment insurance report of.

How do I edit unemployment insurance report of on an iOS device?

Create, modify, and share unemployment insurance report of using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I fill out unemployment insurance report of on an Android device?

On Android, use the pdfFiller mobile app to finish your unemployment insurance report of. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your unemployment insurance report of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.