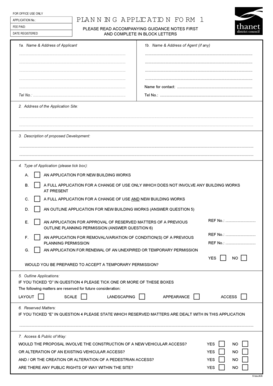

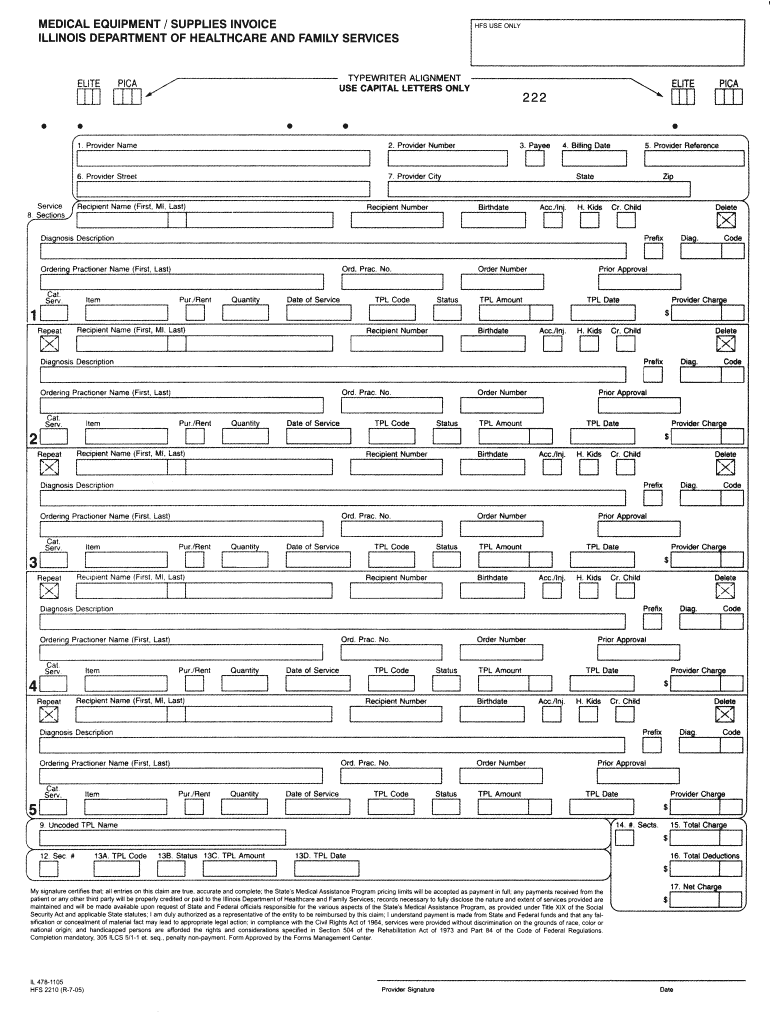

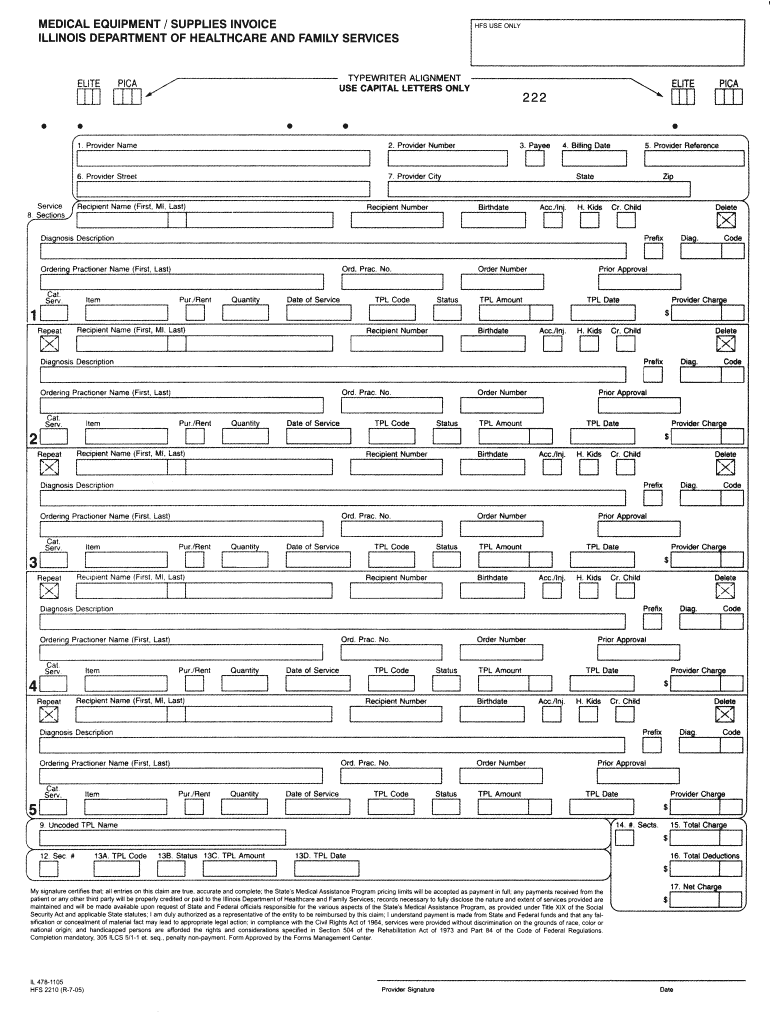

IL HFS 2210 2005-2024 free printable template

Show details

Completion mandatory 305 ILLS 5/14 ET. seq, penalty nonpayment. Form Approved by the Forms Management Center. IL 4784105. HFS 2210 (R 7 O5) ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your il hfs 2210 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your il hfs 2210 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing il hfs 2210 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hfs 2210 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

How to fill out il hfs 2210 form

How to fill out withheld IL:

01

Obtain the IL form from the concerned authority.

02

Fill in your personal information accurately, including your name, address, and social security number.

03

Provide details about any withholding adjustments or exemptions that apply to you.

04

Declare your income for the relevant tax year by entering the necessary amounts in the appropriate sections.

05

Calculate your total tax liability or refund based on the information provided.

06

Attach any supporting documents or additional forms as required.

07

Double-check all the entries and ensure the form is signed and dated before submission.

Who needs withheld IL:

01

Individuals who earn income subject to income tax withholding may need to fill out a withheld IL form.

02

Employers are required to provide this form to their employees so they can report their income and taxes withheld accurately.

03

Self-employed individuals and freelancers who meet certain criteria may also be required to fill out this form to report their estimated tax payments.

Fill you hfs 2210 form : Try Risk Free

People Also Ask about il hfs 2210

Does claiming 1 or 0 give you more money?

How do I file withholding in Illinois?

Does Illinois have a withholding form?

Should I claim 1 or 0?

Is it worth claiming 0 on taxes?

What is a tax withheld form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is withheld il?

It appears that "withheld il" is an incomplete or unclear phrase. It is difficult to provide a specific answer without more context or clarification. Could you please provide more information or specify what you are referring to?

Who is required to file withheld il?

Employers are required to file withheld il.

How to fill out withheld il?

To fill out a Form IL-W-4, which is the Illinois withholding allowance certificate, follow these steps:

1. Personal Information: Provide your full name, social security number, and current address.

2. Marital Status: Indicate your marital status by checking the appropriate box (single, married, or legally separated).

3. Allowances: Enter the number of allowances you wish to claim on line 1. This number represents the exemptions you are claiming for yourself, your spouse, and dependents.

4. Additional Allowances: If you qualify for additional allowances, such as being blind or over 65, enter the number on line 2. Refer to the instructions provided with the form to determine your eligibility.

5. Spouse's Allowances: If you have a working spouse, and you are both claiming allowances, complete lines 3a and 3b. This will help determine the proper amount of withholding.

6. Nonresident Spouse: If you are a resident of Illinois and your spouse is a nonresident, check the box provided in line 4.

7. Optional Deductions: If you have any optional deductions, such as student loan interest, on line 5, enter the total amount.

8. Exempt Status: If you qualify for exempt status and do not want any income taxes withheld from your wages, check the box on line 6. You must meet certain criteria outlined in the instructions to claim exempt status.

9. Signature and Date: Sign and date the form to certify that the information provided is true and accurate.

Remember to consult the instructions for Form IL-W-4 to ensure you are providing the correct information and claiming the appropriate allowances.

What is the purpose of withheld il?

Without further context, it is not clear what "withheld il" refers to. Can you please provide more information or clarify your question?

What information must be reported on withheld il?

In the context of income withholding, certain information must be reported. Here are the key details that typically need to be reported:

1. Employer Information: The name, address, and identification number (such as the Employer Identification Number or Social Security Number) of the employer who is withholding the income must be reported.

2. Employee Information: The name, address, and social security number or taxpayer identification number of the employee from whom the income is being withheld must be reported.

3. Payment Details: The amount of income that is being withheld from the employee's wages or salary must be reported. This includes both the total amount of income withheld for a specific pay period and the cumulative withheld amount for the year.

4. Dates: The pay period, as well as the date on which the withholding occurred, should be reported.

5. Reason for Withholding: The reason for income withholding should be stated, such as child support, tax debt, creditor garnishment, or other court-ordered withholding.

6. Deductions and Contributions: Any pre-tax deductions or contributions, such as retirement plans or health insurance premiums, should be properly reported along with the withheld income.

It's important to note that specific reporting requirements may vary depending on local tax regulations and applicable laws. It is advisable to consult with the appropriate tax authority or seek professional advice for accurate and up-to-date information related to income withholding reporting.

What is the penalty for the late filing of withheld il?

The penalty for late filing of withheld income tax varies depending on the country and jurisdiction. In the United States, for example, the penalty for the late filing of withheld income tax can be up to 5% of the unpaid tax amount per month, up to a maximum of 25%. Additionally, there may be interest charges on the unpaid tax amount. It is advisable to consult the specific tax regulations of the relevant jurisdiction for accurate and up-to-date information on penalties for late filing of withheld income tax.

Where do I find il hfs 2210?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the hfs 2210 form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I sign the hfs 2210 form pdf electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your 2210 form hfs2210 fill in minutes.

How can I edit il employee on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing hfs 2210 fill form.

Fill out your il hfs 2210 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hfs 2210 Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to form hfs2210 form

Related to hfs 2210 hfs2210 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.