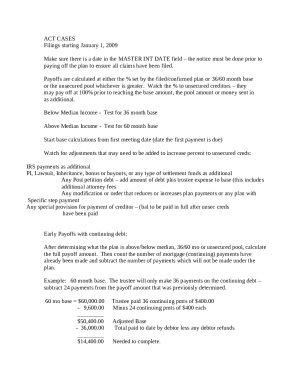

. The maximum rating is less than 100,000; or. . . When, the flood risk is more than one in 500; or. . . When there is a combination of factors, e.g., that the area to be covered is primarily or solely within a major flood way, flood hazard or flood way boundary; or. . . The rating is higher that the maximum rating, or the area is more than one in 500. This changes will not be effective immediately at flood insurance offices, and will only become effective at the end of January 2009. This change of policies is in full compliance with applicable state statutes and regulations. The Agency is working with FEMA to review and re-evaluate the impact of similar guidance in other state codes. As discussed below, FEMA's role is to ensure that all jurisdictions use the most hazardous rating when possible. The rating system used and available at the time FEMA issued the May 1, 2008, reissue for all flood zones is based on the “flood danger score” developed by FEMA's National Flood Insurance Program (FIP), an independent agency of the Federal government. The FIP designates the risk rating of a flood zone based on the following criteria: Where the flooding is expected to last 30 days or longer, use a flood danger score of 1 on a scale of 10; Where the flooding is predicted to last 2 months to one year, use a flood danger score of 2; Where the flooding is predicted to last 3 months to 3 years, use a flood danger score of 3. In each case, the rating of the flood zone is based on the likelihood that flooding of the particular area will occur and the associated impact on the life of a person or property therein. This methodology applies equally to high risk areas and low risk areas. The FIP uses the following ratings: 10 for low risk areas, and one for high risk areas. Flood hazard ratings are based on the actual level of risk expected in a particular area, and are based on a risk analysis of the particular area or its surroundings by FEMA or an engineering consultant. The risk ratings are established by taking into account the probability of occurrence on the basis of the characteristics of the area and its surroundings, as well as the magnitude of the expected flooding; the rate at which expected flood events occur compared to the historical averages; and the total number of events expected since the last FIP flood hazard analysis. Flood hazard ratings represent the expected level of flooding and are therefore a measure of an area's risk.

Get the free June 2008 Dear Flood Insurance Manual Subscribers In ... - FEMA - fema

Show details

U*S* Department of Homeland Security 500 C Street SW Washington DC 20472 June 2008 Dear Flood Insurance Manual Subscribers In response to important recent underwriting guidance FEMA has prepared supplemental changes to the May 1 2008 reissue of the Flood Insurance Manual* The affected pages are attached along with related table of contents and index pages and their backups. Following is a description of the changes. Agents are directed to use the most hazardous flood zone for rating when...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your june 2008 dear flood form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your june 2008 dear flood form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit june 2008 dear flood online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit june 2008 dear flood. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is june dear flood insurance?

June dear flood insurance is a type of insurance coverage specifically designed to protect property owners from financial losses incurred due to flooding in the month of June.

Who is required to file june dear flood insurance?

Property owners located in areas prone to flooding in the month of June are typically required to file june dear flood insurance. However, specific requirements may vary depending on local regulations and insurance policies.

How to fill out june dear flood insurance?

To fill out june dear flood insurance, you will need to contact an insurance provider that offers this type of coverage. They will provide you with the necessary forms and instructions to complete the application.

What is the purpose of june dear flood insurance?

The purpose of june dear flood insurance is to provide financial protection to property owners in case of flood-related damage or losses specifically occurring in the month of June.

What information must be reported on june dear flood insurance?

The specific information that must be reported on june dear flood insurance may vary depending on the insurance provider and policy. However, typically, you will need to provide details about your property, its location, and the coverage amount you require.

When is the deadline to file june dear flood insurance in 2023?

The deadline to file june dear flood insurance in 2023 may vary depending on the insurance provider and local regulations. It is recommended to contact your insurance provider for the specific deadline.

What is the penalty for the late filing of june dear flood insurance?

The penalty for the late filing of june dear flood insurance may vary depending on the insurance provider and local regulations. It is advisable to check your insurance policy documents or contact your insurance provider to understand the potential penalties for late filing.

How can I send june 2008 dear flood for eSignature?

Once your june 2008 dear flood is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the june 2008 dear flood electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your june 2008 dear flood and you'll be done in minutes.

How do I fill out june 2008 dear flood on an Android device?

Use the pdfFiller mobile app to complete your june 2008 dear flood on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your june 2008 dear flood online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.