The Form 990 will be provided to the Pasadena City College Foundation Board and auditors.

Get the free Form 990 Review Policy - Pasadena City College - pasadena

Show details

Pasadena City College Foundation, Inc. Form 990 Review Policy Approved by Executive Committee on August 27, 2009, Ratified by Foundation Board on September 22, 2009, The Form 990 will be completed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 990 review policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 990 review policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 990 review policy online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 990 review policy. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

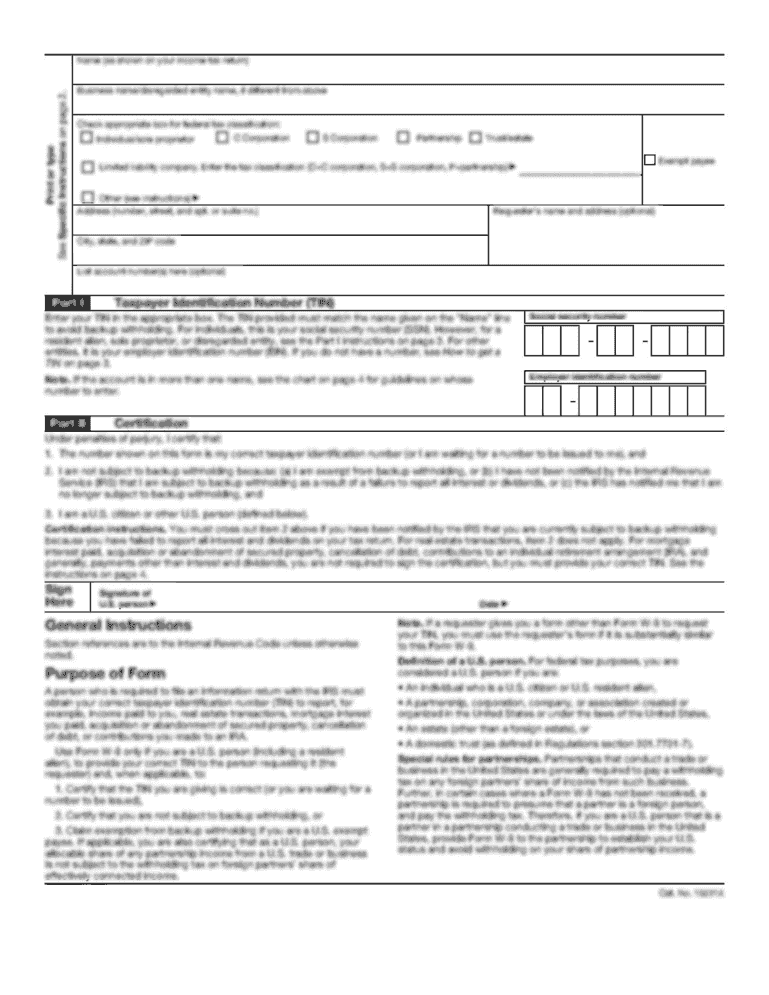

What is form 990 review policy?

Form 990 review policy is a set of guidelines and procedures adopted by organizations to ensure the accurate and thorough completion of Form 990, which is an annual information return filed by tax-exempt organizations.

Who is required to file form 990 review policy?

All tax-exempt organizations, except for churches and certain other religious organizations, are required to file Form 990 review policy if their annual gross receipts exceed or are expected to exceed $50,000. Additionally, organizations with gross assets over $250,000 must also file Form 990.

How to fill out form 990 review policy?

To fill out Form 990 review policy, organizations need to gather financial information, programmatic achievements, governance structure, compensation details, and other relevant data. They should accurately complete each section of the form, including schedules and attachments, following the instructions provided by the Internal Revenue Service (IRS). It is recommended to seek professional assistance to ensure compliance with the complex reporting requirements.

What is the purpose of form 990 review policy?

The purpose of Form 990 review policy is to provide the IRS and the public with information about a tax-exempt organization's mission, activities, governance, financial status, and executive compensation. It helps ensure transparency and accountability of tax-exempt organizations to maintain public trust and confidence.

What information must be reported on form 990 review policy?

Form 990 review policy requires organizations to report information such as their mission statement, program accomplishments, governance and management structure, fundraising activities, financial statements, compensation of key employees, and details about grants and other financial transactions.

When is the deadline to file form 990 review policy in 2023?

The deadline to file Form 990 review policy for tax year 2022 would be May 15, 2023, for calendar year organizations. However, it is important to consult the IRS website or a tax professional for the most accurate and up-to-date deadline information.

What is the penalty for the late filing of form 990 review policy?

The penalty for late filing of Form 990 review policy can vary depending on the organization's gross receipts. For organizations with gross receipts over $1,000,000, the penalty is $105 per day, up to a maximum of $52,500. For organizations with gross receipts less than $1,000,000, the penalty is $20 per day, up to a maximum of $10,500. It is important to note that reasonable cause exceptions may apply in certain circumstances.

How do I execute form 990 review policy online?

pdfFiller has made it simple to fill out and eSign form 990 review policy. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit form 990 review policy in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing form 990 review policy and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit form 990 review policy on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign form 990 review policy on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your form 990 review policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.