Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

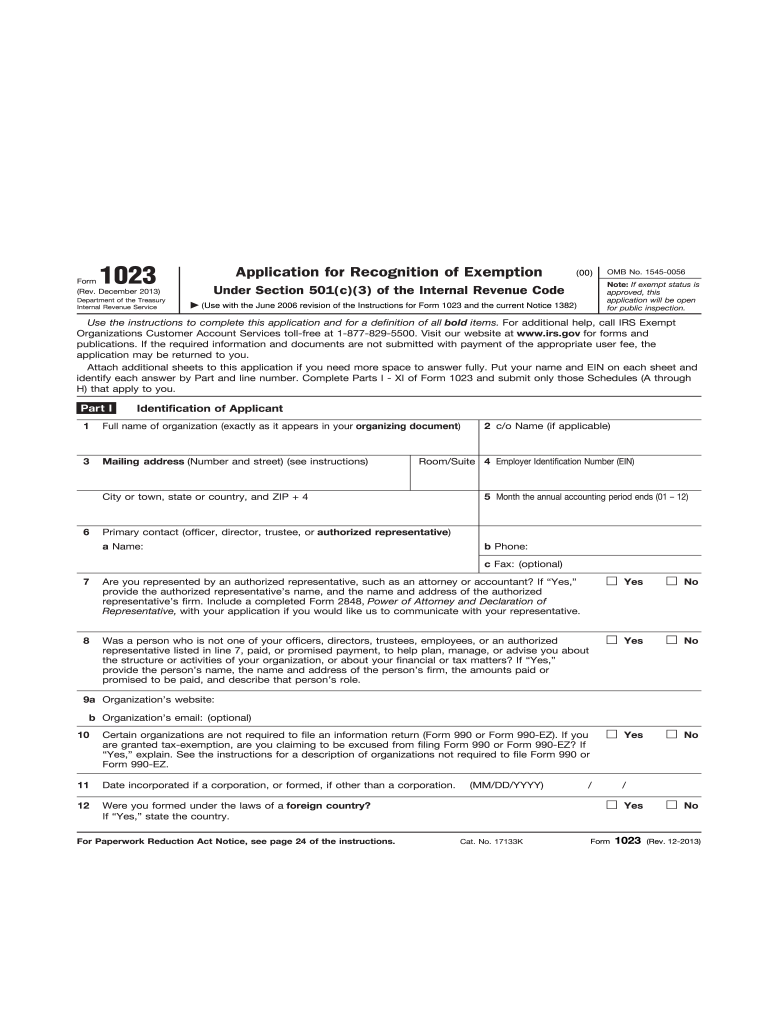

The 1023 form is a document issued by the Internal Revenue Service (IRS) in the United States. It is used for the application of tax-exempt status under section 501(c)(3) of the Internal Revenue Code. Nonprofit organizations, such as charitable, educational, religious, and other types of organizations, use the 1023 form to apply for recognition as tax-exempt entities. The form requires detailed information about the organization's purpose, structure, governance, finances, activities, and more. It is a crucial step for organizations seeking tax-exempt status.

Who is required to file 1023 form?

The 1023 form, also known as the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, is typically filed by organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This includes charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and prevention of cruelty to children or animals organizations.

How to fill out 1023 form?

Filling out Form 1023, also known as the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, can be a complex process. Here is a general overview of how to fill out the form:

1. Gather required information: Before starting, collect all the necessary information and documents, such as the organization's name, address, mission statement, articles of incorporation, bylaws, financial statements, and details about directors and officers.

2. Read the instructions: Review the instructions provided with Form 1023 carefully to understand the specific requirements and the attachments needed. The IRS provides a detailed guide (IRS Publication 557) that may also be helpful.

3. Complete Part I: This section requires basic organizational and contact information, such as the organization's name, address, formation date, and Employer Identification Number (EIN).

4. Complete Part II: This section asks for details about the organization's purpose and activities. Provide a clear and concise statement of your organization's mission, along with a description of its current and planned activities.

5. Complete Part III: This part focuses on the organization's specific programs and services. Describe in detail the programs, how they are conducted, when they occur, and who benefits.

6. Complete Part IV: This section covers your organization's history, including when it was formed, any predecessor organizations, and a summary of its activities to date.

7. Complete Part V: Answer the questions relating to the organization's compliance with various legal requirements, including conflict of interest policies, private benefit rules, and excess benefit transactions.

8. Complete Part VI: This section requires detailed financial information, including revenue and expense details, statement of assets and liabilities, and statement of revenue and support.

9. Complete Part VII: For organizations with a membership structure, you will need to provide details about your membership and voting rights.

10. Complete Part VIII: This part asks about any user fee submitted with the application, payment details, etc.

11. Complete Schedules: The 1023 form may require additional schedules, such as Schedule A (required for churches and schools), Schedule B (for additional financial information), and others. Carefully complete any necessary schedules based on your organization's specific circumstances.

12. Review and sign: Thoroughly review the completed form, ensuring accuracy and completeness. Have an authorized representative of the organization sign and date the form.

13. Attach supporting documents: Include all required attachments, such as articles of incorporation, bylaws, financial statements, and any other relevant documents.

14. Submit the form: Make a copy for your records and submit the completed form, along with all attachments and the appropriate user fee (if applicable), to the IRS. Note that the form requires mailing rather than electronic submission.

It is important to note that this is just a general overview, and the actual process may vary depending on your organization's unique circumstances. If you are unsure about any specific sections or requirements, it is recommended to consult with an attorney or tax professional experienced in nonprofit law or IRS matters to ensure accurate completion of the form.

What is the purpose of 1023 form?

The purpose of Form 1023 is to apply for tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This form is filed with the Internal Revenue Service (IRS) by organizations seeking recognition as a tax-exempt charitable organization. The IRS evaluates the information provided in the form to determine if the organization meets the requirements to qualify for tax-exempt status.

What information must be reported on 1023 form?

The Form 1023, also known as the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, is used by nonprofit organizations in the United States to apply for tax-exempt status. The following information needs to be reported on the Form 1023:

1. General information: This includes the organization's name, address, contact details, formation date, and type of nonprofit (corporation, trust, or association).

2. Organizational structure: This section requires information on the organization's governing body, such as board of directors or trustees, officers, and key employees. It also asks about any related organizations, previous or current affiliations, and potential conflicts of interest.

3. Purposes and activities: The organization needs to provide a detailed description of its mission, objectives, and activities. This should include information about programs, services, and target beneficiaries.

4. Financial information: Financial details are crucial to demonstrate the organization's viability and mission. This includes providing a statement of revenues and expenses, balance sheets, and projected budgets. The 1023 form also asks about the organization's sources of income and any compensation arrangements.

5. Fundraising and business transactions: Organizations are required to disclose their planned methods of fundraising and any anticipated business transactions, such as purchasing or selling goods or services.

6. Compliance with requirements: Detailed information about the organization's compliance with legal requirements, such as holding meetings, record-keeping, and document retention policies, must be reported.

7. Supporting documentation: The organization needs to attach various supporting documents, such as articles of incorporation, bylaws, organizational charts, financial statements, and copies of contracts or leases.

It is essential to carefully review and complete all sections of the Form 1023 accurately to ensure compliance with the Internal Revenue Service (IRS) regulations and increase the chances of obtaining tax-exempt status. It is often recommended to consult with legal or tax professionals to navigate the complex application process.

When is the deadline to file 1023 form in 2023?

The deadline to file Form 1023 in 2023 is typically the end of the organization's fifth month. For example, if an organization is formed in January 2023, the deadline to file Form 1023 would be May 31, 2023. It is important to note that this deadline can vary depending on the specific circumstances, so it is recommended to consult with a tax professional or refer to the IRS website for the most accurate and up-to-date information.

What is the penalty for the late filing of 1023 form?

The penalty for the late filing of Form 1023, also known as the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, is $20 for each day the organization is late, with a maximum penalty of $10,000. This penalty applies unless the organization can demonstrate reasonable cause for the delay in filing. It's important to note that this penalty is subject to change, so it is advisable to consult the current regulations or seek professional advice for the most accurate and up-to-date information.

Can I create an electronic signature for signing my 2013 1023 form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your 2013 1023 form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I edit 2013 1023 form on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit 2013 1023 form.

How do I fill out 2013 1023 form on an Android device?

Complete 2013 1023 form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.