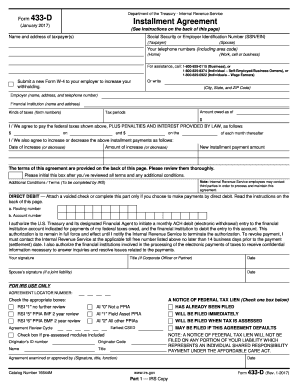

IRS 433-D 2015 free printable template

FAQ about IRS 433-D

What should I do if I realize I've made a mistake on my 2015 installment form after submission?

If you've discovered an error on your filed 2015 installment form, you should file an amended version to correct it. Ensure that you clearly indicate that it's an amended return and include any necessary adjustments. Keep a copy for your records as this will help with consistency and accountability.

How can I check the status of my 2015 installment form submission?

To verify the status of your 2015 installment form submission, you can use the IRS online tracking tool or contact their customer service. Be prepared with your identification information, as they may ask for this to provide you with specific details on your submission.

Are there specific legal requirements regarding the retention of records related to the 2015 installment form?

Yes, it's essential to retain records associated with your 2015 installment form for at least three years from the filing date. Proper documentation ensures compliance with IRS regulations and protections in case of audits or inquiries regarding your filings.

What common mistakes should I avoid when filing the 2015 installment form?

Common errors on the 2015 installment form include incorrect payment amounts, missing signatures, and filing with the wrong attachment. Double-check all entries and ensure you follow the guidelines to avoid rejections or delays in processing.

Can I e-file the 2015 installment form using specific software or mobile devices?

Yes, various e-filing software options support the 2015 installment form, but ensure that the version you use meets IRS requirements. Additionally, check system compatibility for the device you intend to use to guarantee a smooth filing experience.

See what our users say