AL DoR COM: ACC 2011 free printable template

Show details

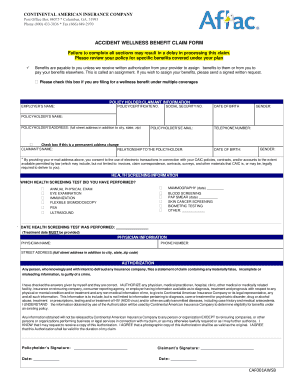

ALABAMA DEPARTMENT OF REVENUE FORM COM: ACC 5/2011 Application for Certificate of Compliance NOTE: If you have questions concerning the completion of this form, please call (334) 242-1189. 1 TAXPAYER

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your certificate of compliance alabama form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of compliance alabama form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificate of compliance alabama online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit alabama certificate of compliance form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

AL DoR COM: ACC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out certificate of compliance alabama

How to fill out certificate of compliance Alabama?

01

Start by obtaining the certificate of compliance form from the Alabama Department of Revenue. This form can usually be downloaded from their website or requested in person.

02

Fill out the basic information section of the form, including your name, address, and contact information. Make sure to provide accurate and up-to-date information.

03

Provide details about your business, including the legal structure (such as sole proprietorship or corporation) and the date of establishment.

04

Enter your federal Employer Identification Number (EIN) if applicable. This is a unique identification number assigned by the IRS to businesses for tax purposes.

05

If you have any employees, provide information about your payroll, such as the number of employees you have, their wages, and any tax withholdings.

06

Include any additional information or attachments that may be required for your specific situation. This could include documentation related to sales tax, use tax, or any other relevant tax requirements.

07

Review the completed form for accuracy and ensure that all necessary sections have been filled out. Make any necessary corrections or additions before submitting the form.

08

Sign and date the form where required, certifying that the information provided is true and accurate to the best of your knowledge.

09

Submit the completed certificate of compliance form to the Alabama Department of Revenue as instructed. This may involve mailing the form or submitting it electronically through their online portal.

Who needs certificate of compliance Alabama?

01

Individuals or businesses operating in the state of Alabama who are required to collect and remit sales tax.

02

Businesses that have a physical presence in Alabama, such as a storefront or office, and engage in taxable activities.

03

Contractors or vendors who provide goods or services to Alabama state agencies or entities and are required to certify their compliance with state tax laws.

Note: It is always recommended to consult with a tax professional or the Alabama Department of Revenue for specific guidance regarding the certificate of compliance and filing requirements.

Fill form : Try Risk Free

People Also Ask about certificate of compliance alabama

How do I get a certificate of Compliance in Alabama?

What is Form 40 Alabama?

What is a certificate of compliance in the state of Alabama?

Is the certificate of Compliance the same as certificate of good standing in Alabama?

What is a certificate of Compliance?

What is a good standing certificate in Alabama?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is certificate of compliance alabama?

Certificate of Compliance Alabama is a document issued by the Alabama Department of Revenue (ADOR) that certifies that a business is in compliance with all applicable state tax laws and regulations. The certificate is required for businesses to be able to register for certain tax types, such as sales and use taxes. It is also required for certain types of business activities, such as the sale of alcohol.

How to fill out certificate of compliance alabama?

1. Start by filling out the top section of the form, including the name of the state (Alabama) and the name of the certificate holder.

2. In the next section, fill in the name of the agency or department responsible for issuing the certificate of compliance.

3. In the next section, provide details about the specific project or work that the certificate applies to.

4. In the next section, provide the date of the certificate.

5. In the next section, provide the name of the signer of the certificate.

6. In the next section, provide the name of the company or entity that is being certified as compliant.

7. In the last section, provide the signature of the signer and the date of the signature.

What is the purpose of certificate of compliance alabama?

The purpose of a Certificate of Compliance in Alabama is to certify that a business or individual is in compliance with applicable state laws and regulations. The certificate is issued by the Alabama Secretary of State's office. It can be used to register a business or apply for a professional license. It is also a requirement for many government contracts.

Who is required to file certificate of compliance alabama?

The Alabama Department of Revenue requires a Certificate of Compliance to be filed by businesses or individuals seeking to enter into contracts with state agencies, apply for state licenses or permits, or bid on public works projects. This certificate ensures that the entity is in compliance with its state tax obligations.

What information must be reported on certificate of compliance alabama?

The information that must be reported on a Certificate of Compliance in Alabama can vary depending on the specific circumstances and requirements of the situation. However, some common information that may be required includes:

1. Name and contact information of the individual or business issuing the certificate.

2. Name and contact information of the recipient or party for whom the certificate is being issued.

3. Date of issuance.

4. Description of the compliance being certified (e.g., compliance with certain laws, regulations, or standards).

5. Specific details or references to the relevant laws, regulations, or standards that are being complied with.

6. Any supporting documentation or evidence that may be required to demonstrate compliance.

7. Identification numbers or other unique identifiers related to the compliance being certified (if applicable).

8. Signature and title of the individual issuing the certificate.

9. Any additional information or requirements specific to the situation or industry in which the compliance is being certified.

It is important to consult the relevant authorities, laws, regulations, or guidelines to ensure that all necessary information is included on the certificate for compliance in Alabama.

What is the penalty for the late filing of certificate of compliance alabama?

The penalty for late filing of a Certificate of Compliance in Alabama can vary depending on the specific circumstances and the governing agency. In general, there may be a late filing fee or penalty assessed for filing the certificate after the designated deadline. It is advisable to consult with the appropriate agency or legal professional for accurate and up-to-date information on the specific penalty for late filing in Alabama.

How can I manage my certificate of compliance alabama directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your alabama certificate of compliance form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit certification and assurance form alabama straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing alabama certification and assurance form.

How do I edit certification and assurance form with the state of alabama on an Android device?

You can edit, sign, and distribute alabama department of revenue certificate of compliance form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your certificate of compliance alabama online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certification And Assurance Form Alabama is not the form you're looking for?Search for another form here.

Keywords relevant to al certificate of compliance form

Related to form com acc from al department of revenue

If you believe that this page should be taken down, please follow our DMCA take down process

here

.