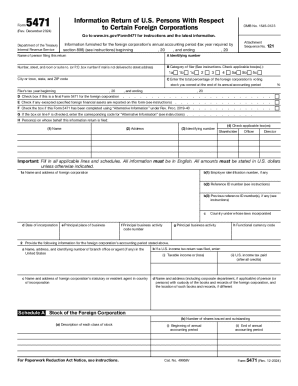

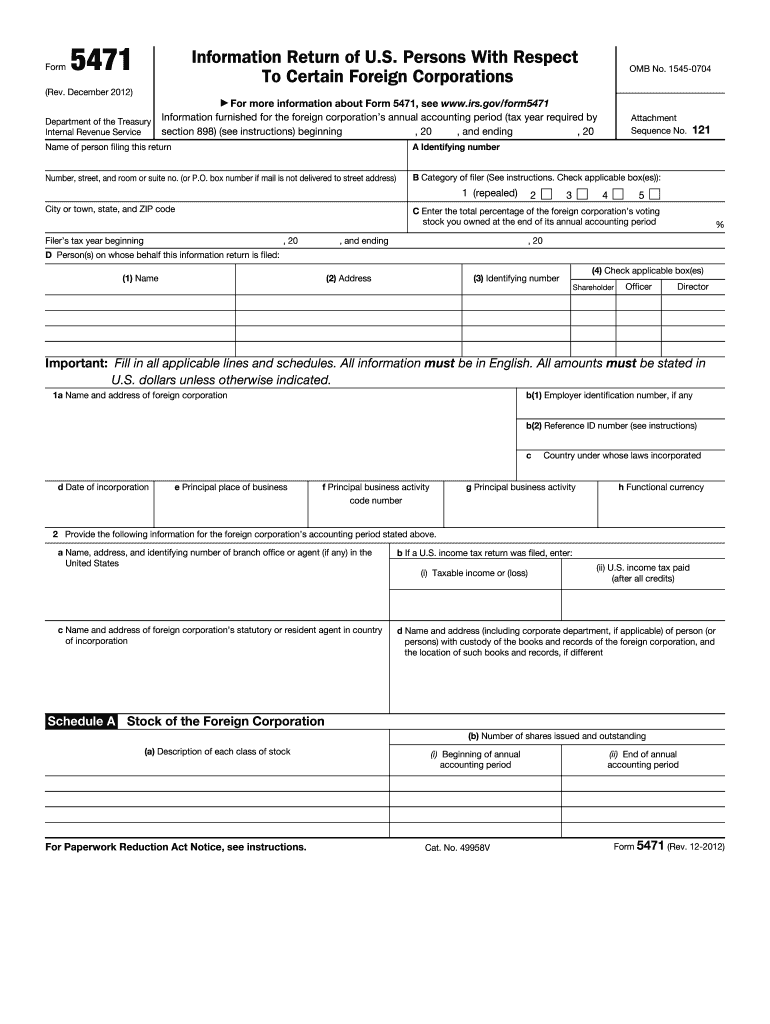

IRS 5471 2012 free printable template

Instructions and Help about IRS 5471

How to edit IRS 5471

How to fill out IRS 5471

About IRS 5 previous version

What is IRS 5471?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 5471

What should I do if I find an error on my submitted 2012 form 5471?

If you discover an error after submitting your 2012 form 5471, you should file an amended return as soon as possible. Make sure to use the correct form and indicate that it is an amendment. Keep thorough documentation of all changes and corrections for your records.

How can I check the status of my 2012 form 5471 after filing?

To verify the status of your submitted 2012 form 5471, you can contact the IRS directly or use their online tools, if available. Be prepared to provide identifying information such as your name, Social Security number, and any reference numbers related to your submission.

What do I do if my e-filed 2012 form 5471 gets rejected?

In the event that your e-filed 2012 form 5471 is rejected, carefully review the rejection code provided. Address the specific issue mentioned, make the necessary corrections, and then resubmit the form promptly to avoid any penalties.

Are there any specific technical requirements for e-filing the 2012 form 5471?

Yes, certain technical requirements must be met when e-filing the 2012 form 5471. Ensure that you are using compatible software that meets IRS specifications, has the latest updates, and is capable of securely transmitting your information. Additionally, check that your internet connection is stable to avoid interruptions during submission.