IN Form 102 1988-2025 free printable template

Show details

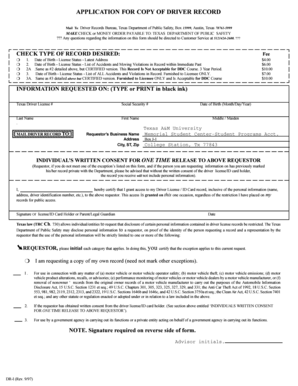

State board of Accounts Form 102 Approved 12/88 City of Indianapolis Marion County Indiana Standard Questionnaires and Financial Statement for Bidders For use in investigating the qualifications of bidders on public works contracts when the aggregate cost of such contract will be a hundred thousand dollars 100 000 or more. This form may be used for any other contract when the ordering department requests it. These statements are to be submitted under oath by each bidder with and as a part of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN Form 102

Edit your IN Form 102 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN Form 102 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IN Form 102 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IN Form 102. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out IN Form 102

How to fill out IN Form 102

01

Obtain IN Form 102 from the official website or designated office.

02

Read the instructions carefully before starting to fill out the form.

03

Provide personal information in the first section, including your full name and contact details.

04

Fill out the sections related to your immigration status or the purpose of filing the form.

05

Attach any required supporting documents or evidence as specified in the instructions.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form according to the submission guidelines provided, either electronically or by mail.

Who needs IN Form 102?

01

Individuals applying for specific immigration benefits or changes in status.

02

Those seeking to notify immigration authorities of a change in personal circumstances.

03

Applicants who are required to provide additional information related to their immigration case.

Fill

form

: Try Risk Free

People Also Ask about

What age do you stop paying property taxes in Indiana?

You must meet these requirements to receive the deduction: Turned 65 or older by December 31 of the prior year. You can also receive the deduction if your spouse was 65 or older at the time of death. You must be 60 or older and have not remarried.

What are the pools for personal property in Indiana?

The pools to be utilized for Indiana property tax purposes are as follows: (1) Pool No. 1: All assets that have a life of one (1) through four (4) years for federal income tax purposes. (2) Pool No. 2: All assets that have a life of five (5) through eight (8) years for federal income tax purposes.

What is the home tax exemption in Indiana?

The standard homestead deduction is either 60% of your property's assessed value or a maximum of $45,000, whichever is less. The supplemental homestead deduction is based on the assessed value of your property and equals: 35% of the assessed value of a property that is less than $600,000.

How do I find the assessed value of my property in Indiana?

You will receive notice of your property's value in one of two ways: the county assessor may send you a notice of assessment, known as a Form 11. Otherwise, the assessed value of your property can be found on your tax bill. This document is known as the TS-1 tax comparison statement.

Do seniors have to file taxes in Indiana?

Filing Requirements You do not need to file an Indiana income tax return if: You are an Indiana resident (you've maintained legal residence in Indiana for the entire year); and. The total value of your personal, elderly and blind exemptions exceeds your federal gross income before deductions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IN Form 102 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including IN Form 102, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete IN Form 102 online?

pdfFiller makes it easy to finish and sign IN Form 102 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out the IN Form 102 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign IN Form 102 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is IN Form 102?

IN Form 102 is a form used in India for reporting financial transactions, particularly by institutions to maintain compliance with regulatory and tax obligations.

Who is required to file IN Form 102?

Entities such as companies, firms, and organizations that are involved in specific financial activities are required to file IN Form 102 as part of their statutory compliance.

How to fill out IN Form 102?

To fill out IN Form 102, individuals or organizations need to provide their identity details, financial transaction details, and any relevant compliance information as prescribed by the regulatory authority.

What is the purpose of IN Form 102?

The purpose of IN Form 102 is to facilitate transparency in financial transactions and ensure that entities comply with the legal and regulatory frameworks governing their operations.

What information must be reported on IN Form 102?

IN Form 102 requires reporting of details such as names of the parties involved, nature of the transactions, amounts, dates, and other pertinent financial information relevant to the transactions.

Fill out your IN Form 102 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN Form 102 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.