Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

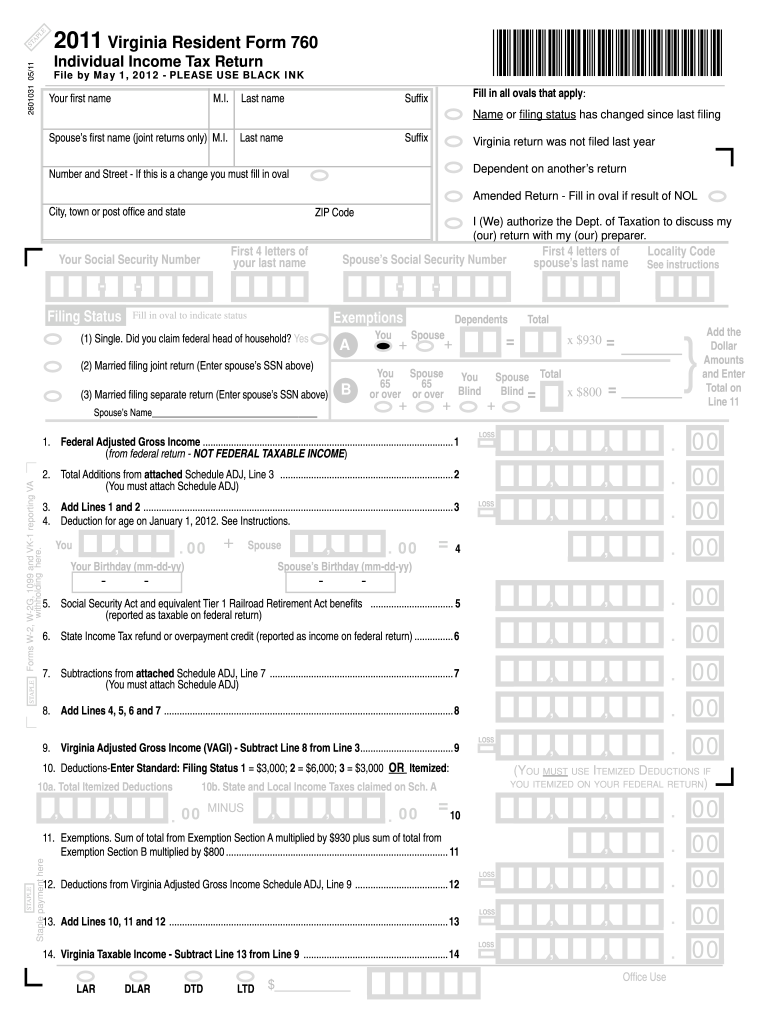

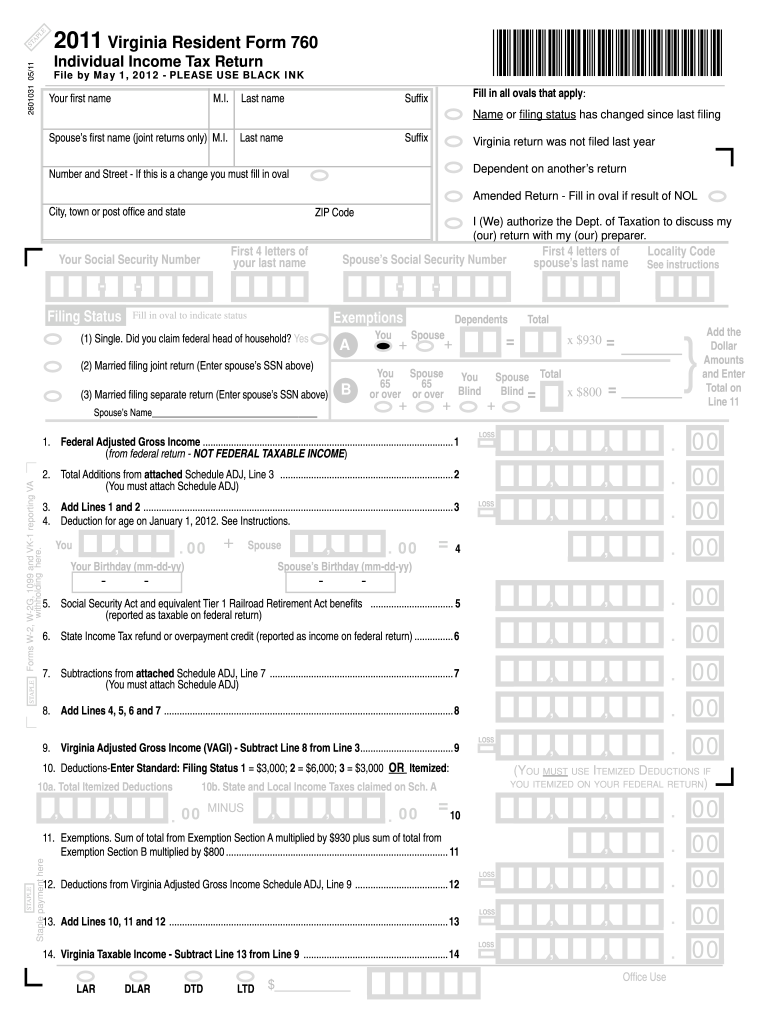

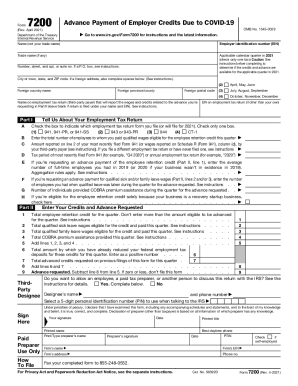

VA Form 760 is a tax form used by veterans and their dependents to file their state income tax return with the Commonwealth of Virginia. It is specific to Virginia residents and must be filed annually by May 1st. The form includes sections for reporting income, deductions, credits, and calculating the final tax liability or refund.

Who is required to file va form 760?

Individuals who are residents of Virginia for the entire tax year, or individuals who are not residents of Virginia but have income from Virginia sources, are required to file VA Form 760.

How to fill out va form 760?

To fill out VA Form 760, the Individual Income Tax Return, follow these steps:

1. Collect necessary documentation: Gather all relevant documents such as W-2 forms, 1099 forms, and any other documents related to your income, deductions, and credits.

2. Personal information: Provide your personal information at the top of the form, including your name, Social Security Number, mailing address, and the applicable tax year.

3. Filing status: Indicate your filing status (Single, Married Filing Jointly, Head of Household, etc.) in the appropriate box. If filing jointly, include your spouse's information as well.

4. Exemptions: Enter the number of exemptions you are claiming in the appropriate box.

5. Income: Report your income from various sources in the corresponding sections of the form. Provide details, such as wages, salaries, self-employment income, interest, dividends, and any other relevant sources of income.

6. Deductions: Deduct allowable expenses in the appropriate sections. This may include items such as mortgage interest, medical expenses, charitable contributions, and student loan interest.

7. Tax credits: If eligible, claim tax credits for which you qualify to reduce your overall tax liability. Examples of common credits include child tax credit, earned income credit, and education credits.

8. Calculate tax: Use the provided tables and instructions to calculate your tax liability based on your income and deductions.

9. Withholdings and payments: Report any federal tax withheld and payments you have made throughout the year, such as estimated tax payments or amounts carried over from the previous year.

10. Signature: Sign and date the form at the bottom to certify that the information provided is accurate and complete.

11. Attachments: If required, attach any necessary schedules or additional forms supporting your income, deductions, or credits.

12. Keep a copy: Make a copy of the completed form and all supporting documentation for your records.

Note: It's always advisable to consult with a tax professional, especially if you have complex tax situations or questions about certain deductions or credits.

What is the purpose of va form 760?

The purpose of VA Form 760 is to apply for supplemental income for disabled veterans and surviving spouses. It is used to determine the eligibility of veterans and their dependents in receiving monthly financial assistance through the Veterans Pension program. Additionally, it collects information regarding the veteran's income, assets, and medical expenses to assess their need for benefits.

What information must be reported on va form 760?

VA Form 760 is used for reporting real estate and business property. The following information must be reported on this form:

1. General Information: This includes the taxpayer's name, social security number, address, and contact information.

2. Property Information: Detailed information about the property being reported, such as the address, type of property (residential, commercial, etc.), and date acquired.

3. Ownership Information: Details about the ownership of the property, including the percentage of ownership if there are multiple owners.

4. Rental Revenue and Expenses: The form requires the reporting of gross rental revenue received during the tax year, as well as the associated expenses such as property taxes, insurance, repairs, and maintenance.

5. Business Property Information: If the property being reported is used for business purposes, additional information such as gross income from the business, business use percentage, and other related expenses must be provided.

6. Calculation of Net Rental or Business Income: The form requires the calculation of net rental or business income by deducting expenses from the gross revenue received.

7. Depreciation: If the property is depreciable, the form requires the reporting of the depreciation amount. This includes information about the date the property was placed in service, the depreciable basis, and the method used for depreciation.

8. Qualified Rehabilitation Expenditure: If there are any rehabilitation expenditures made on the property that qualify for tax credits, those amounts must be reported on the form.

9. Additional Information: In case there is any other relevant information about the property or any special circumstances related to the reporting, there is a section provided for additional explanations.

10. Certification and Signature: The taxpayer must certify that the information provided is accurate and complete by signing and dating the form.

It is important to note that the specific reporting requirements on VA Form 760 may vary depending on the state or jurisdiction in which the property is located. It is advisable to refer to the instructions accompanying the form for further details and any state-specific requirements.

When is the deadline to file va form 760 in 2023?

The deadline to file VA Form 760 in 2023 may vary depending on personal circumstances and specific situations. Generally, the deadline to file the form for individual income tax returns is April 15th each year. However, it's essential to check with the Virginia Department of Taxation or consult a tax professional for the most accurate and up-to-date information regarding deadlines and any possible extensions.

How do I make edits in 2011 va form 760 without leaving Chrome?

2011 va form 760 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit 2011 va form 760 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share 2011 va form 760 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How can I fill out 2011 va form 760 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your 2011 va form 760. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.