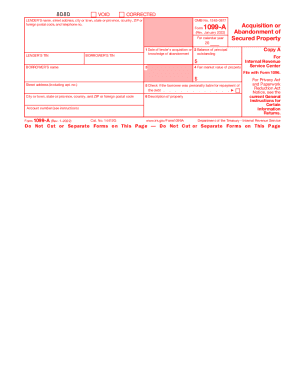

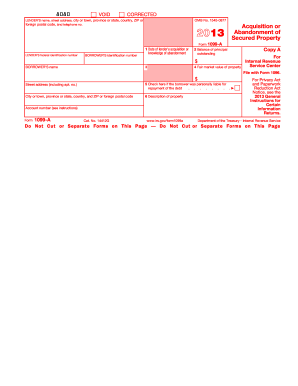

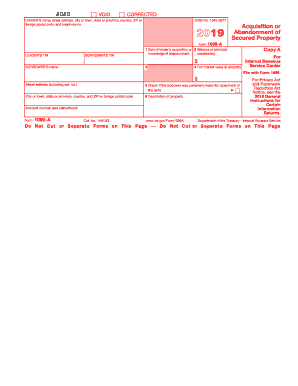

Who needs a 1099-A form?

1099-A form is the United States Internal Revenue Service form that is officially called the Acquisition or Abandonment of Secured Property. It is to be filled out by lenders involved in lending trade or business and who have acquired an interest in property that was security for a loan or who have reason to know that such property has been abandoned.

What is the form 1099-A for?

By filing the Acquisition or Abandonment of Secured Property form, lenders are to inform all their borrowers of reportable income or loss due to an acquisition or loss. For the borrower, gain or loss is calculated based on the difference between the borrower’s adjusted basis in the property and the amount of debt canceled in exchange for the property or sale proceeds. If the borrower has abandoned the property, they may have income as the result of an indebtedness discharge in the amount of the unpaid balance of the canceled debt. The tax consequences of such an action are determined by whether the borrower was personally liable for the debt. Losses on acquisitions or abandonment of property held for personal use are not deductible.

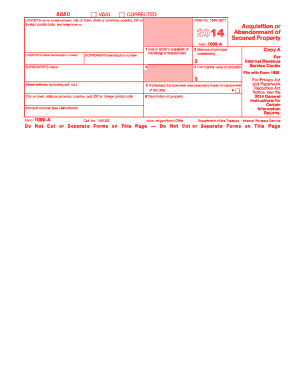

When is form 1099-A due?

The lender (or the bank) must deliver the borrower's copy of the 2016 Form 1099-A by the end of January 2017. And the Department of Revenue Service form must be submitted the last day of February, which is February 28th in 2017.

Is the 1099-A form accompanied by any other documents?

When sending the form to the borrower there is no need to accompany it with any other forms, but when filing with the IRS, form 1096 must be attached.

How do I fill out form 1099-A?

On all copies (there are three of them), the lender must provide the following information:

Their business name and address;

FIN (Federal Identification number);

Name and identification number of the borrower;

-

The borrower’s address;

-

Account number;

-

Date of the acquisition or abandonment;

-

Principal outstanding balance;

-

The property market value;

-

The property description.