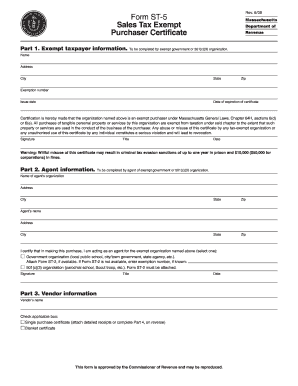

Who needs a form ST-5?

Form ST-5 was designed for taxpayers in the State of Massachusetts. It is not requested from all taxpayers. Only exempt organizations that have a Certificate of Exemption from the Commissioner of Revenue need to file this application in order to purchase items without applicable sales taxes.

What is form ST-5 for?

Form ST-5 stands for a Sales Tax Exempt Purchaser Certificate. An agent representing an exempt organization must provide this certificate to a goods or service provider to inform him that no sales tax should be withheld from this purchase.

Is it accompanied by other forms?

A goods or service provider may request a copy of the certificate as evidence that the organization is entitled to an exemption. An organization may request this type of certificate by filing form ST-2 with Massachusetts Department of Revenue.

When is form ST-5 due?

The Sales Tax Exempt Purchaser Certificate must be presented upon making a purchase.

How do I fill out a form ST-5?

Part I must be completed by the exempt organization. Its representative has to provide the name and address of the purchaser, its exemption number, issue date and expiration date of the certificate.

Part II is for an agent acting on behalf of the exempt organization when making a purchase. The agent has a right to fill out Part I, if he knows the exemption number.

Part III is for vendor information.

In Part IV there must be a list of the items to be purchased with brief descriptions. There is more information and guidelines for this form at the bottom of Page 2.

Where do I send it?

Provide the completed form ST-5 to the seller. He can give the descriptions for soon-to-be-purchased items.