Get the free 2009 1040NR Instructions12172009.qxp - State of Rhode Island ... - tax state ri

Show details

2009 INSTRUCTIONS FOR FILING RI-1040NR (FOR RHODE ISLAND NONRESIDENTS OR PART-YEAR RESIDENTS FILING FORM RI-1040NR) GENERAL INSTRUCTIONS Read the instructions carefully. For your convenience we have

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2009 1040nr instructions12172009qxp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2009 1040nr instructions12172009qxp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2009 1040nr instructions12172009qxp online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2009 1040nr instructions12172009qxp. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

How to fill out 2009 1040nr instructions12172009qxp

How to fill out 2009 1040nr instructions12172009qxp:

01

Start by carefully reading the instructions: The 2009 1040nr instructions12172009qxp document provides detailed guidance on how to complete the 2009 1040NR tax form. Make sure to familiarize yourself with the instructions before proceeding.

02

Gather the necessary documents: Collect all the required documents and forms, such as your passport, immigration papers, W-2 forms, 1099 forms, and any other relevant paperwork. These documents will be needed to accurately complete the 2009 1040NR form.

03

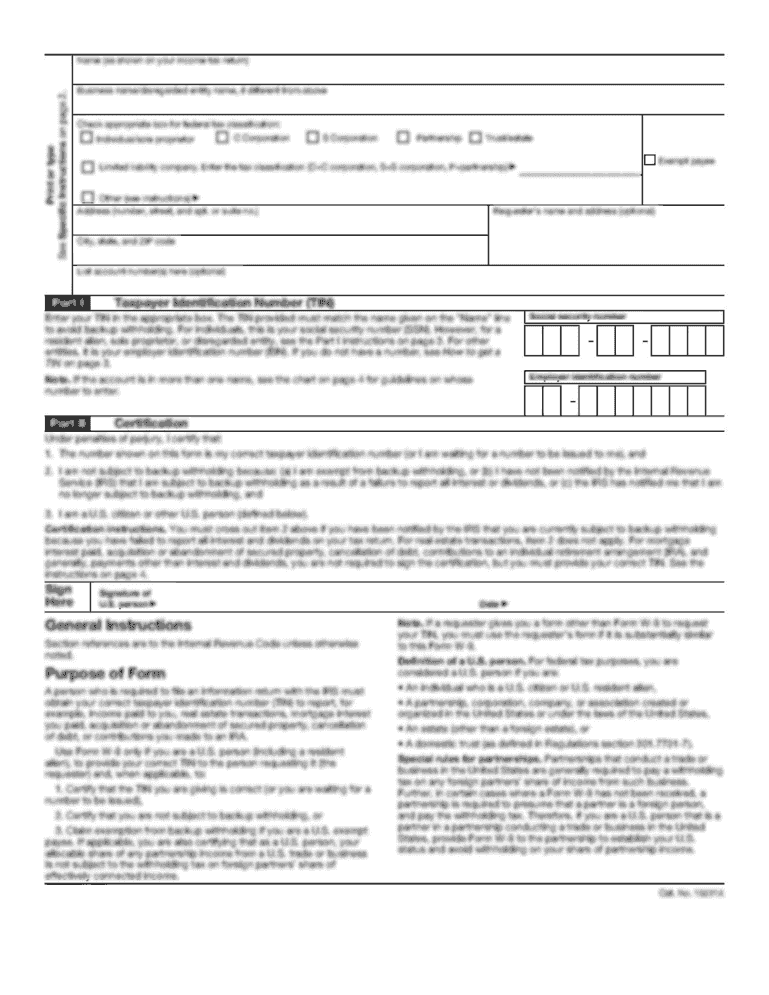

Fill in your personal information: Begin by providing your full name, address, and Social Security Number (or ITIN) in the designated spaces on the form. Double-check that the information is accurate and matches the information on your supporting documents.

04

Determine your filing status: Choose the appropriate filing status from the options provided on the form. The IRS provides guidelines to help you determine whether you qualify as single, married filing jointly, married filing separately, or head of household.

05

Report your income: Proceed to report your income from various sources, such as wages, dividends, interest, rental income, and any other applicable income. Follow the instructions provided on the form and attach any necessary schedules or forms that are required for specific types of income.

06

Claim deductions and credits: Determine if you qualify for any deductions or credits, such as educational expenses, mortgage interest deduction, or foreign tax credits. Carefully review the instructions and attach any required forms or schedules to support your claims.

07

Calculate your tax liability: Use the provided tax tables or the tax computation worksheet to calculate your tax liability. Follow the instructions to determine the amount you owe or any refund you may be entitled to.

08

Complete additional sections and schedules as necessary: Depending on your individual circumstances, you may need to complete additional sections or attach schedules to the 2009 1040NR form. This could include reporting self-employment income, capital gains, or foreign accounts.

09

Sign and date the form: Once you have completed all the necessary sections, make sure to sign and date the 2009 1040NR form. If you are filing jointly, both spouses must sign the form.

Who needs 2009 1040nr instructions12172009qxp:

01

Nonresident aliens: The 2009 1040nr instructions12172009qxp is specifically designed for nonresident aliens who need to file their tax returns for the year 2009. This form is not applicable to U.S. citizens or resident aliens.

02

Individuals with income in the United States: If you earned income from sources within the United States during the 2009 tax year and meet the nonresident alien criteria, you will need the 2009 1040nr instructions12172009qxp to accurately file your tax return.

03

Those who want to comply with tax obligations: Filing a tax return is an important legal obligation, and the 2009 1040nr instructions12172009qxp provides guidance to individuals who need to fulfill their tax responsibilities for the year 2009. It ensures that your tax return is completed correctly and in accordance with the IRS regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1040nr instructions12172009qxp - state?

1040nr instructions12172009qxp - state is a tax form used by non-resident aliens to report income earned in the United States.

Who is required to file 1040nr instructions12172009qxp - state?

Non-resident aliens who have earned income in the United States are required to file 1040nr instructions12172009qxp - state.

How to fill out 1040nr instructions12172009qxp - state?

To fill out 1040nr instructions12172009qxp - state, you will need to provide information about your income, deductions, and any taxes withheld.

What is the purpose of 1040nr instructions12172009qxp - state?

The purpose of 1040nr instructions12172009qxp - state is to report income earned in the United States by non-resident aliens and calculate any tax owed.

What information must be reported on 1040nr instructions12172009qxp - state?

On 1040nr instructions12172009qxp - state, you must report all income earned in the United States, including wages, salaries, tips, and any other sources of income.

When is the deadline to file 1040nr instructions12172009qxp - state in 2023?

The deadline to file 1040nr instructions12172009qxp - state in 2023 is April 15th.

What is the penalty for the late filing of 1040nr instructions12172009qxp - state?

The penalty for late filing of 1040nr instructions12172009qxp - state is usually a percentage of the unpaid tax amount, with a minimum penalty of $135.

Can I create an electronic signature for signing my 2009 1040nr instructions12172009qxp in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your 2009 1040nr instructions12172009qxp right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit 2009 1040nr instructions12172009qxp straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing 2009 1040nr instructions12172009qxp right away.

How do I fill out 2009 1040nr instructions12172009qxp using my mobile device?

Use the pdfFiller mobile app to fill out and sign 2009 1040nr instructions12172009qxp on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your 2009 1040nr instructions12172009qxp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.