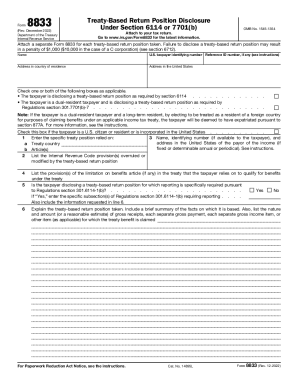

IRS 8833 2013 free printable template

Instructions and Help about IRS 8833

How to edit IRS 8833

How to fill out IRS 8833

About IRS 8 previous version

What is IRS 8833?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8833

What should I do if I made a mistake on my filed irs form 8833 2013?

If you realize that you have made an error on your filed irs form 8833 2013, you have the option to file an amended return. Use the appropriate process for correcting mistakes by submitting a revised form and clearly indicating the changes made. Ensure you keep records of both the original and the amended form to maintain accurate documentation.

How can I verify if my irs form 8833 2013 was received?

To verify the receipt of your irs form 8833 2013, you can check the IRS online portal for any updates on your submission status. Additionally, you might receive a confirmation notice by mail or through email if you've e-filed. If you encounter issues or rejections, review the specific error codes provided by the IRS.

What should I do if I receive an audit notice after filing the irs form 8833 2013?

Receiving an audit notice after filing the irs form 8833 2013 requires careful handling. First, ensure you gather all related documentation to support your filing. Review the notice thoroughly to understand the specific items being audited, and consider consulting a tax professional to guide you through the response process and help present your case effectively.

What are common technical issues with e-filing irs form 8833 2013?

Common technical issues with e-filing irs form 8833 2013 may include browser incompatibility, problems with the tax software, or incomplete data entries triggering rejections. Ensure your software is up to date and compatible with IRS requirements. If you encounter issues, refer to the help resources offered by your e-filing provider for troubleshooting steps.

What records should I retain after submitting my irs form 8833 2013?

After submitting your irs form 8833 2013, it is essential to retain a copy of the form along with any supporting documents for at least three years. This ensures you have the necessary information on hand in case of future inquiries or audits by the IRS regarding your submission.