Get the free 2014 Form 990 (Schedule R). Related Organizations and Unrelated Partnerships - irs

Show details

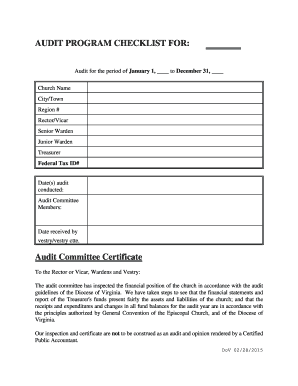

SCHEDULE R (Form 990) Department of the Treasury Internal Revenue Service Name of the organization Part I OMB No. 1545-0047 Related Organizations and Unrelated Partnerships 2012 Open to Public Inspection

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2014 form 990 schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2014 form 990 schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2014 form 990 schedule online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2014 form 990 schedule. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out 2014 form 990 schedule

How to fill out 2014 form 990 schedule:

01

Begin by obtaining a copy of the 2014 form 990 schedule. This can typically be found on the Internal Revenue Service (IRS) website or by contacting the appropriate tax authorities.

02

Review the instructions provided with the form to familiarize yourself with the requirements and guidelines for completing the schedule.

03

Gather all the necessary financial information and supporting documents, such as income statements, balance sheets, and expense records, that are relevant to the specific sections of the schedule.

04

Start by entering your organization's identifying information, including its name, address, and Employer Identification Number (EIN).

05

Follow the provided instructions to complete each section of the schedule accurately and thoroughly. This may include reporting revenue and expenses, providing specific details about certain activities or transactions, and disclosing any relevant organizational relationships or transactions.

06

Pay close attention to any checkboxes, explanations, or additional documentation required for specific lines or sections of the schedule. Failure to include this information may result in penalties or delays in processing your tax return.

07

Double-check all calculations and entries to ensure accuracy. It is recommended to use tax preparation software or consult a tax professional if you are unsure about any aspects of completing the schedule.

08

Once you have filled out the form, review it carefully for any errors or omissions. Make any necessary corrections or additions before submitting it to the appropriate tax authorities.

09

Retain a copy of the completed form for your records and submit the original as per the specified instructions provided with the form.

Who needs 2014 form 990 schedule:

01

Nonprofit organizations, including charities, foundations, and other tax-exempt organizations, are typically required to file the form 990 schedule as part of their annual tax filings.

02

The form 990 schedule provides additional information and details regarding the organization's financial activities, governance structure, and other relevant aspects of its operations.

03

In some cases, certain smaller organizations may be eligible to file a different form, such as the 990-EZ or 990-N, depending on their size and annual gross receipts. However, larger organizations or those with more complex financial activities will likely need to complete the form 990 schedule.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 990 schedule r?

Form 990 Schedule R is a form used by organizations to report related party transactions and certain transactions with disqualified persons.

Who is required to file form 990 schedule r?

Nonprofit organizations, including charities, foundations, and other tax-exempt organizations, that have engaged in related party transactions or transactions with disqualified persons are required to file Form 990 Schedule R.

How to fill out form 990 schedule r?

To fill out Form 990 Schedule R, organizations must provide detailed information about related party transactions and transactions with disqualified persons, including the nature and amount of the transactions, as well as any relationships between the parties involved.

What is the purpose of form 990 schedule r?

The purpose of Form 990 Schedule R is to provide transparency and accountability regarding transactions between the organization and related parties or disqualified persons, ensuring that the organization's resources are being used appropriately.

What information must be reported on form 990 schedule r?

Form 990 Schedule R requires organizations to report detailed information about related party transactions and transactions with disqualified persons, including the names of the parties involved, the nature of the transactions, and the amounts.

When is the deadline to file form 990 schedule r in 2023?

The deadline to file Form 990 Schedule R in 2023 is typically the 15th day of the fifth month after the end of the organization's fiscal year. However, it is recommended to consult the official IRS guidelines or a tax professional for the accurate deadline.

What is the penalty for the late filing of form 990 schedule r?

The penalty for the late filing of Form 990 Schedule R can vary depending on the size of the organization and the length of the delay. It is best to consult the official IRS guidelines or a tax professional for specific penalty information.

How do I modify my 2014 form 990 schedule in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your 2014 form 990 schedule as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I sign the 2014 form 990 schedule electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your 2014 form 990 schedule in seconds.

How do I edit 2014 form 990 schedule on an Android device?

You can edit, sign, and distribute 2014 form 990 schedule on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your 2014 form 990 schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.