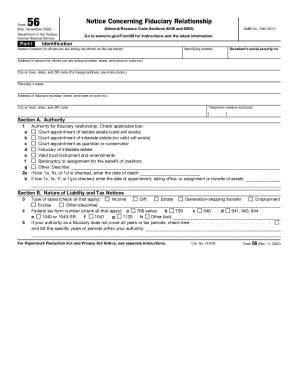

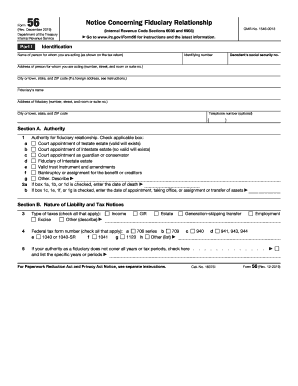

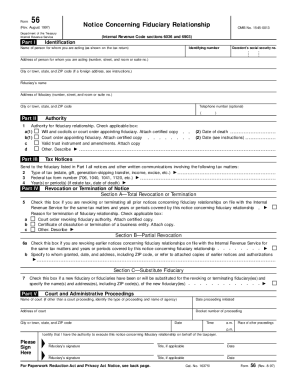

IRS 56 2007 free printable template

Show details

Cat. No. 16375I Rev. 12-2007 Form 56 Rev. 12-2007 Page Court and Administrative Proceedings Part V Name of court if other than a court proceeding identify the type of proceeding and name of agency Date proceeding initiated Address of court Docket number of proceeding Date Time a.m. Place of other proceedings p.m. Signature I certify that I have the authority to execute this notice concerning fiduciary relationship on behalf of the taxpayer. Notice Concerning Fiduciary Relationship Department...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 56

Edit your IRS 56 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 56 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 56 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS 56. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 56 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 56

How to fill out IRS 56

01

Obtain IRS Form 56 from the IRS website or your tax professional.

02

Provide your name and address in the designated fields at the top of the form.

03

Indicate the type of tax matters in which you are appointing someone as your representative.

04

Fill in the representative's information, including their name, address, and any applicable identification number.

05

Specify the effective date for the representation and any limitations on the authority granted.

06

Sign and date the form to validate your authorization.

07

Submit the completed Form 56 according to IRS instructions, either by mail or electronically, if applicable.

Who needs IRS 56?

01

Individuals who want to authorize someone else to act on their behalf in tax matters.

02

Persons who are involved in a tax-related issue and need representation.

03

Executors or administrators of estates handling tax matters.

Fill

form

: Try Risk Free

People Also Ask about

Who needs to file form 56?

An individual or entity that is willing to accept fiduciary responsibility for tax matters must file an IRS Form 56, Notice Concerning Fiduciary Relationship to be able to act as the taxpayer with the IRS.

Why do I need a form 56?

Purpose of Form Form 56 is used to notify the IRS of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under section 6036.

Is form 56 necessary?

If you are a guardian, trustee, administrator, or another person responsible for a decedent's estate, you are required to file Form 56. If there are multiple trustees for one estate, each trustee will be required to file IRS Form 56. A single Form 56 only establishes one relationship between a trustee and an estate.

What is the form 56?

You may use Form 56 to: Provide notification to the IRS of the creation or termination of a fiduciary relationship under section 6903. Give notice of qualification under section 6036.

What is the 56 F form used for?

Use Form 56-F to notify the IRS of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

Who is required to file form 56?

An individual or entity that is willing to accept fiduciary responsibility for tax matters must file an IRS Form 56, Notice Concerning Fiduciary Relationship to be able to act as the taxpayer with the IRS.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

Fill out your IRS 56 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 56 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.