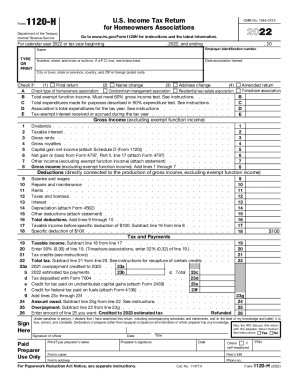

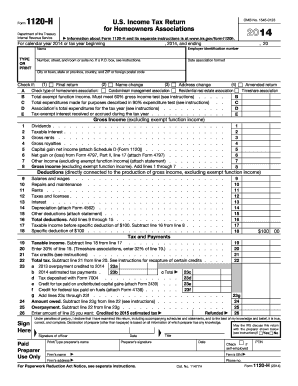

Who needs an IRS 1120-H form ?

IRS 1120-H 2016 is the U.S. Income Tax Return completed by Homeowners’ Associations that aren't engaged in any money-earning activities.

What is the IRS 1120-H form for?

Just like all the corporations in the USA, homeowners associations must complete an income-based tax return.

This is a standard form 1120. However, the associations that do not work for profit and, as a rule, don't owe anything to the government, may fill out form 1120-H. It is much shorter than the original 1120 form and, most important, it can earn tax benefits for the association. In other words, homeowners associations file form 1120-H to claim their eligibility for tax exemption.

Is form 1120-H accompanied by other forms?

When filing form 1120-H, don't forget to attach form 4136 and all the schedules arranged in alphabetical order. Additional forms that accompany form 1120-H should be arranged in numerical order.

To clarify the list of attachments, read the instructions provided by the IRS on their website.

When is form 1120-H due?

Generally homeowners’ associations, must fill out the form by the 15th day of the third month after the end of the taxable year. If this day falls on weekend or official holiday, the due date is moved to the next business day.

How do I fill out form 1120-H?

Form 1120-H requires filing one page consisting of multiple parts. Including the name of the homeowners’ association, its contact information, EIN, gross income, deductions, etc. There are only some people who are authorized to sign form 1120-H. They are the president, vice, president, and chief accounting officer of the organization.

Where do I send form 1120-H?

The homeowners’ association must send form 1120-H electronically to the IRS website.