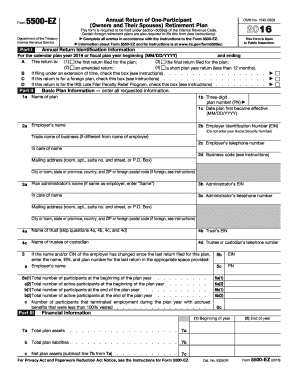

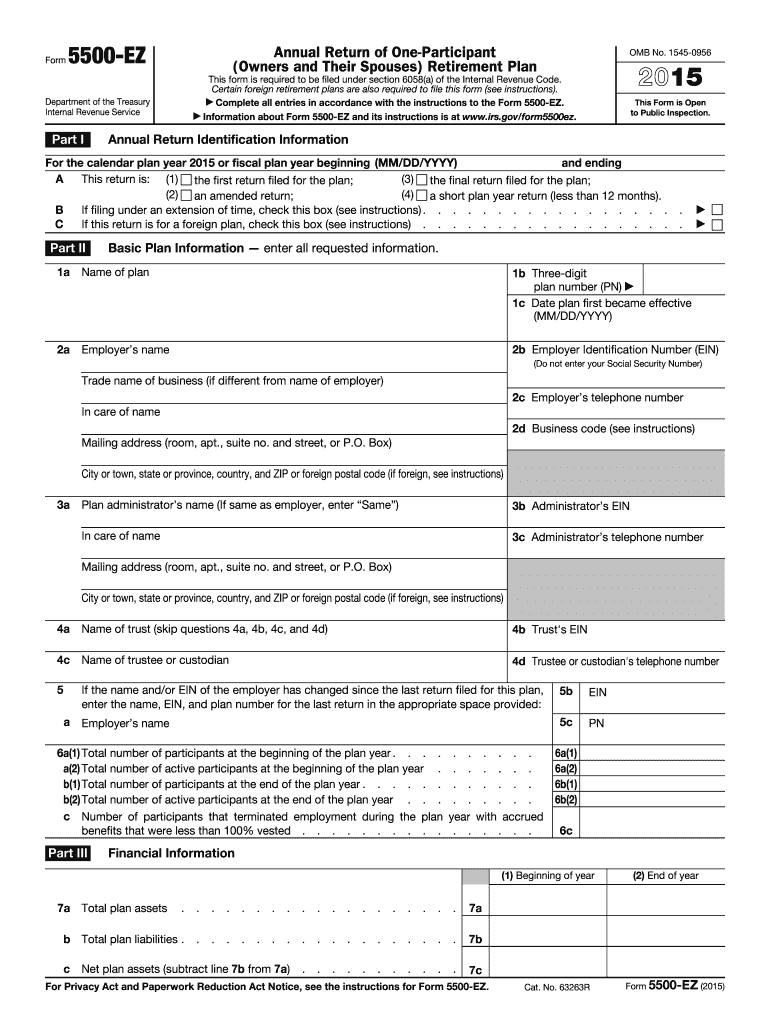

IRS 5500-EZ 2015 free printable template

Instructions and Help about IRS 5500-EZ

How to edit IRS 5500-EZ

How to fill out IRS 5500-EZ

About IRS 5500-EZ 2015 previous version

What is IRS 5500-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 5500-EZ

What should I do if I realize I made a mistake after filing the IRS 5500-EZ?

If you discover an error after submitting your IRS 5500-EZ, you can file an amended return to correct it. Ensure that you highlight the changes made to avoid confusion. It's advisable to keep a copy of the amended form for your records, as well as any correspondence with the IRS regarding the correction.

How can I track the status of my filed IRS 5500-EZ?

To verify the status of your IRS 5500-EZ, you can use the IRS online tools designed for tracking submissions. Additionally, you should keep an eye on confirmation emails or notices sent by the IRS to ensure that your form has been processed. If you face any issues, contact the IRS for more information.

What should I do if my submission of IRS 5500-EZ is rejected?

In case your IRS 5500-EZ is rejected, the IRS will provide a reason, often in the form of a notice. Review the rejection code, rectify the identified issue, and re-submit your form as soon as possible. Make sure to document the changes made to ensure a smooth re-filing process.

Are electronic signatures acceptable for IRS 5500-EZ submissions?

Yes, electronic signatures are accepted for the IRS 5500-EZ. Ensure that your e-signature complies with IRS guidelines to avoid any issues. It’s essential to maintain records that verify your authorization if signing on behalf of someone else.

What common errors should I be aware of when submitting the IRS 5500-EZ?

Common mistakes when filing the IRS 5500-EZ include incorrect participant counts, forgetting to sign the form, and failing to include required attachments. To avoid these issues, double-check your entries against the IRS guidelines before submission, ensuring all necessary fields are completed accurately.

See what our users say