CT DRS AU-524 1999 free printable template

Show details

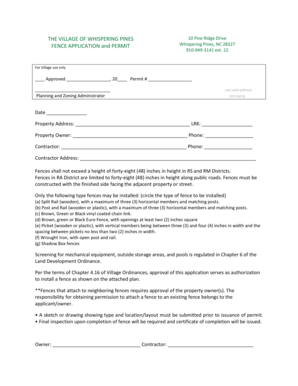

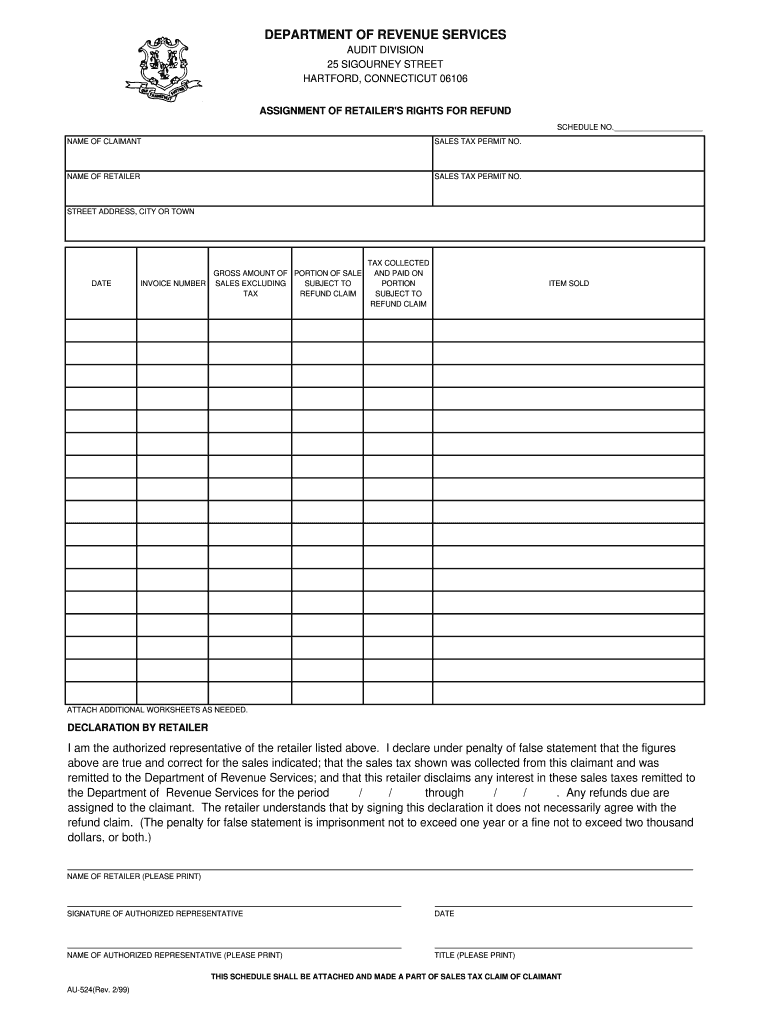

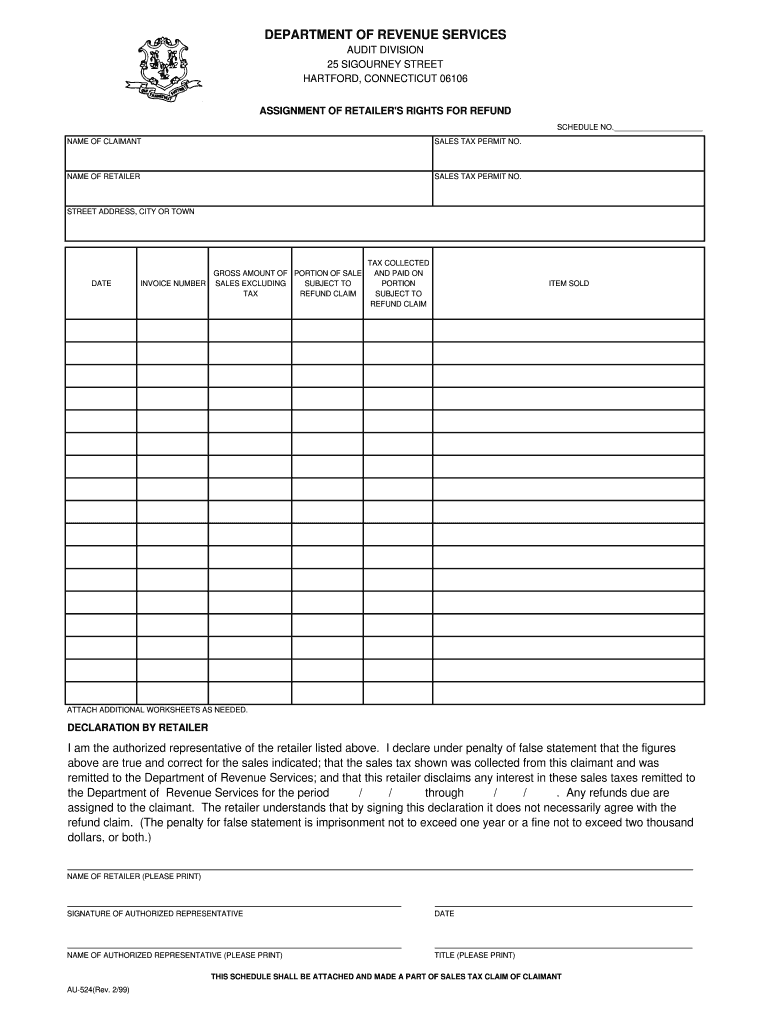

SIGNATURE OF AUTHORIZED REPRESENTATIVE NAME OF AUTHORIZED REPRESENTATIVE PLEASE PRINT TITLE PLEASE PRINT THIS SCHEDULE SHALL BE ATTACHED AND MADE A PART OF SALES TAX CLAIM OF CLAIMANT AU-524 Rev. 2/99. DEPARTMENT OF REVENUE SERVICES AUDIT DIVISION 25 SIGOURNEY STREET HARTFORD CONNECTICUT 06106 ASSIGNMENT OF RETAILER S RIGHTS FOR REFUND SCHEDULE NO. NAME OF CLAIMANT SALES TAX PERMIT NO. NAME OF RETAILER STREET ADDRESS CITY OR TOWN DATE GROSS AMOUNT OF PORTION OF SALE INVOICE NUMBER SALES...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your au 524 1999 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your au 524 1999 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing au 524 1999 form online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit au 524 1999 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

CT DRS AU-524 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out au 524 1999 form

How to fill out au 524 1999 form:

01

Begin by obtaining a copy of the au 524 1999 form. It can usually be found on the official website of the relevant authority or department.

02

Gather all the necessary information and documents required to complete the form. This may include personal details, financial information, and any supporting documentation that may be requested.

03

Carefully read through the instructions provided with the form. Familiarize yourself with the sections and requirements to ensure all information is accurately provided.

04

Start filling out the form by entering your personal information, such as your name, address, contact details, and any other relevant identification information.

05

Proceed to fill out the specific sections of the form as instructed. This may involve entering details about your income, employment history, tax-related information, or any other details that the form requests.

06

When providing information, ensure that you are truthful and accurate. Double-check the information you are entering to avoid any errors or discrepancies.

07

If there are any sections or questions that you are unsure of, seek clarification from the relevant authority or consult with a professional, such as a tax consultant or legal advisor.

08

Once you have completed filling out all the required sections, review the form carefully. Make sure all fields are filled out, and there are no mistakes or missing information.

09

Sign and date the form in the designated area, as required. If multiple signatures are required, ensure all parties involved sign the form appropriately.

10

Make a copy of the completed form for your records before submitting it. Follow the instructions provided with the form to submit it to the appropriate department or authority.

Who needs au 524 1999 form?

01

Individuals who need to report their financial or tax-related information to the relevant authority or department.

02

Businesses or organizations that are required to provide financial statements or disclosures as per the regulations or guidelines specified by the authority.

03

Individuals or entities involved in specific transactions, such as real estate transactions or financial transactions, as mandated by the authority.

04

Anyone who is required by law or regulation to submit the au 524 1999 form for a specific purpose, such as claiming tax benefits, reporting income, or fulfilling a legal obligation.

05

It is important to note that the exact requirements for who needs the au 524 1999 form may vary depending on the jurisdiction and the specific rules and regulations in place. It is advisable to consult with the relevant authority or seek professional advice to determine if this form is required for your specific situation.

Fill form : Try Risk Free

People Also Ask about au 524 1999 form

What items are exempt from CT sales tax?

How do I renew my CT sales and use tax permit?

What is exempt from CT sales tax?

What grocery items are taxable in CT?

What is subject to sales tax in CT?

What is the statute of limitations on CT sales tax refund?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is au 524 form?

The au 524 form is a tax form used to report information related to foreign bank and financial accounts.

Who is required to file au 524 form?

Any U.S. person who has a financial interest in or signature authority over foreign financial accounts that exceed certain thresholds is required to file the au 524 form.

How to fill out au 524 form?

The au 524 form can be filled out online or by mail, and requires detailed information about each foreign financial account.

What is the purpose of au 524 form?

The purpose of the au 524 form is to report foreign financial accounts to the IRS in order to combat tax evasion.

What information must be reported on au 524 form?

The au 524 form requires information such as the name of the foreign financial institution, the account number, and the maximum value of the account during the reporting period.

When is the deadline to file au 524 form in 2023?

The deadline to file the au 524 form in 2023 is April 15th.

What is the penalty for the late filing of au 524 form?

The penalty for the late filing of the au 524 form can be up to $10,000 per violation.

How can I get au 524 1999 form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific au 524 1999 form and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for the au 524 1999 form in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your au 524 1999 form in seconds.

How can I edit au 524 1999 form on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing au 524 1999 form right away.

Fill out your au 524 1999 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.