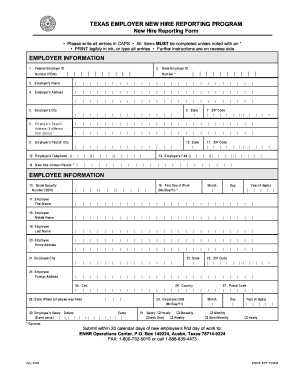

Get the free texas employer new hire reporting form

Show details

WHAT IS NEW HIRE REPORTING? New Hire Reporting is mandated by federal law under the Personal Responsibility and Work. Opportunity Reconciliation Act ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your texas employer new hire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas employer new hire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas employer new hire reporting form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit texas employer new hire reporting form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

How to fill out texas employer new hire

How to fill out Texas employer new hire:

01

Obtain the necessary forms from the Texas Workforce Commission or download them from their website.

02

Fill out the employer information section, providing your company's name, address, and federal employer identification number.

03

Provide the employee's personal information, such as their full name, social security number, and date of birth.

04

Complete the employment details section, including the employee's start date, pay rate, and job title.

05

Fill out the employee's tax withholding information, including their federal and state withholding allowances.

06

Sign and date the form, attesting that the information provided is complete and accurate.

Who needs Texas employer new hire:

01

Employers in Texas who hire new employees are required by law to fill out the Texas employer new hire form.

02

This includes businesses of all sizes, including corporations, partnerships, and sole proprietorships.

03

The form must be completed for each new employee and submitted to the Texas Workforce Commission within 20 days of the employee's start date.

Fill form : Try Risk Free

People Also Ask about texas employer new hire reporting form

What forms are needed for new hires?

What forms are required for a new employee in Texas?

Do I report new hires in Texas?

What 2 forms is an employee required to complete when they begin a new job?

What forms do you need when hiring a new employee?

What forms do employers give new employees?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is texas employer new hire?

Texas Employer New Hire Reporting Program is a required program in Texas where employers are mandated to report information on all newly hired employees within a certain time frame. This program helps in the enforcement of child support orders and assists with locating parents who owe child support.

Through this program, employers are required to report information such as the employee's name, address, social security number, and date of hire. The reporting must be done within 20 days of the employee's start date. This information is then used by the Texas Attorney General's Office to locate parents who owe child support and to establish and enforce child support orders.

By participating in the Texas Employer New Hire Reporting Program, employers play a crucial role in ensuring that child support obligations are met and that children receive the financial support they need.

Who is required to file texas employer new hire?

According to the Texas Workforce Commission, all Texas employers are required by law to report newly hired employees to the Texas Employer New Hire Reporting Program.

What is the purpose of texas employer new hire?

The purpose of Texas Employer New Hire is to collect and report information about newly hired employees to the Texas Attorney General's Office. This statewide program helps employers fulfill their legal obligation of reporting newly hired employees and assists in the enforcement of child support and other court-ordered obligations. The program aims to ensure that parents receive the necessary financial support for their children by helping locate noncustodial parents and deducting child support from their wages.

What information must be reported on texas employer new hire?

When reporting a new hire in Texas, employers are required to provide the following information:

1. Employer Identification Number (EIN): The unique identifier assigned to the employer by the Internal Revenue Service (IRS).

2. Employer's name and address: Legal name and physical address of the employer.

3. Employee's name and address: Full legal name and mailing address of the newly hired employee.

4. Social Security Number (SSN): The employee's Social Security Number, which is mandatory for reporting.

5. Date of hire: The date when the employee began working for the employer.

6. Employer's State Unemployment Insurance (SUI) account number: The employer's account number with the Texas Workforce Commission's Unemployment Insurance Division.

7. Employee's date of birth: The employee's date of birth is optional but recommended for accurate recordkeeping.

8. Employee's gender: The employee's gender is optional but recommended for accurate recordkeeping.

It's important to note that employers must report this information within 20 days of the employee's hire date or the date they resumed working after a separation of employment. The reporting is usually done through the Texas New Hire Reporting Program or the Texas Employer New Hire Reporting System.

What is the penalty for the late filing of texas employer new hire?

The penalty for late filing of the Texas Employer New Hire report can vary depending on the specific circumstances and the number of days beyond the deadline. However, according to the Texas Workforce Commission (TWC), employers who fail to file within 20 calendar days from the date of hire or rehire may be subject to a penalty of $25 for each new hire that was not timely reported.

Additionally, if the TWC finds that an employer has knowingly and willfully failed to comply with the reporting requirements, they may also impose a penalty of up to $500 for each unreported employee. These penalties can vary and are subject to change, so it is important to consult the official TWC guidelines or seek legal advice for the most up-to-date and accurate information.

How do I edit texas employer new hire reporting form in Chrome?

Install the pdfFiller Google Chrome Extension to edit texas employer new hire reporting form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the texas employer new hire reporting form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your texas employer new hire reporting form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit texas employer new hire reporting form on an Android device?

You can edit, sign, and distribute texas employer new hire reporting form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your texas employer new hire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.