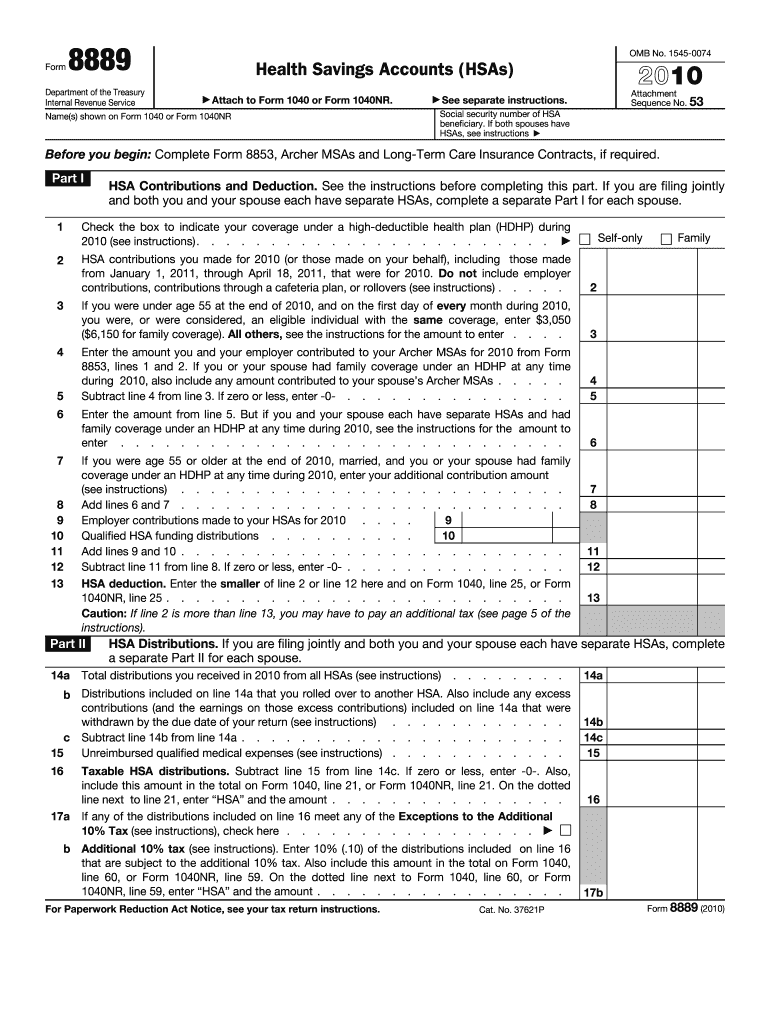

IRS 8889 2010 free printable template

Instructions and Help about IRS 8889

How to edit IRS 8889

How to fill out IRS 8889

About IRS 8 previous version

What is IRS 8889?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

What are the penalties for not issuing the form?

FAQ about IRS 8889

What should I do if I realize I made a mistake after submitting my 8889 form 2010?

If you find an error post-submission, you can file an amended 8889 form 2010 to correct the information. It is important to clearly indicate that you are making a correction, as this helps avoid confusion with the IRS. Keep a copy of the amended form and any correspondence related to the correction for your records.

How can I verify the status of my submitted 8889 form 2010?

To check the status of your 8889 form 2010, you can use the IRS's online tools for tracking your submission. Additionally, if you e-filed, you may receive automatic notifications regarding the processing of your form. Be aware of common e-file rejection codes to preemptively resolve any issues.

Are there any special considerations for nonresidents filing the 8889 form 2010?

Nonresidents may face specific rules when filing the 8889 form 2010, particularly concerning eligibility and reporting requirements. It's essential to review IRS guidelines for foreign payees and consider seeking professional tax advice to ensure compliance with all applicable regulations.

What should I do if my 8889 form 2010 submission is rejected?

If your submission of the 8889 form 2010 is rejected, carefully review the rejection notice for specific reasons. You can correct the errors and resubmit the form as soon as possible. Ensure you follow any additional instructions provided by the IRS to facilitate successful processing.

How long should I retain records related to my 8889 form 2010?

You should keep records related to your 8889 form 2010 for at least three years from the date you filed it or the date it was due, whichever is later. This retention period is crucial for ensuring you can provide documentation if required for audits or inquiries by the IRS.

See what our users say