Get the free btr application form

Show details

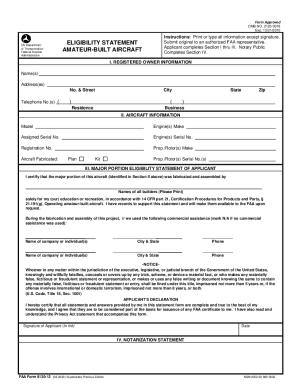

Sep 7, 2012 ... The FAA recommends using a fillable FAA Form 8130-6, which is available ... What Sections Should Be Completed on FAA Form 8130-6.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your btr application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your btr application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit btr application form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit btr certificate application form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out btr application form

How to fill out the BTR application form:

01

Start by obtaining the BTR application form from the designated authority or website.

02

carefully read and understand all the instructions provided on the form.

03

Fill in your personal information accurately, including your full name, address, contact details, and any other required information.

04

Provide all the necessary supporting documentation, such as identification documents, proof of residence, and any relevant licenses or permits.

05

Complete the sections or fields related to the nature of your business or activity for which you are applying for the BTR.

06

Double-check all the information you have provided to ensure it is accurate and complete.

07

Sign and date the form before submitting it to the designated authority or mailing it to the designated address if required.

Who needs the BTR application form:

01

Individuals who are starting or operating a business in a specific jurisdiction may be required to fill out a BTR application form.

02

Entrepreneurs who are engaged in certain activities or professions, such as operating a restaurant, providing professional services, or selling goods, may also need to complete this form.

03

Anyone who is applying for a Business Tax Receipt (BTR) to comply with local regulations and obtain the necessary permits and licenses will need to fill out this application form.

Video instructions and help with filling out and completing btr application form

Instructions and Help about application for btr certificate form

Fill how to apply btr online : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

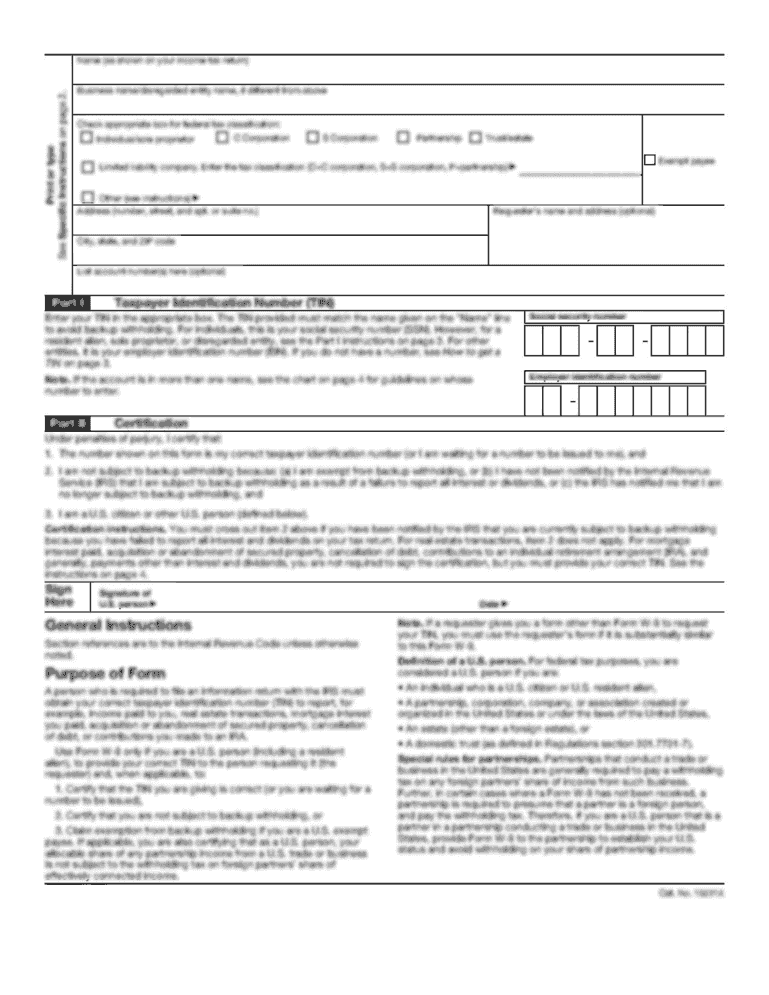

What is btr application form?

BTR application form refers to the application form used to apply for the BTR (Build to Rent) scheme. BTR is a type of housing development where multiple properties are built specifically for rental purposes. The application form typically asks for information such as personal details, financial information, references, and any specific requirements for the rental property. The form is used to assess the eligibility of applicants for the BTR scheme and to ensure that they meet the necessary criteria to become tenants in the development.

Who is required to file btr application form?

The term "BTR" does not specifically correspond to a universally recognized acronym or term in relation to application forms. Could you please provide more context or clarify the acronym or term you are referring to?

How to fill out btr application form?

To fill out a BTR (Business Tax Registration) application form, follow these steps:

1. Obtain the application form: Visit your local tax office or regulatory agency's website to download or request a hard copy of the BTR application form. Ensure you have the latest version of the form.

2. Read the instructions: Carefully read through the instructions provided with the application form. Understanding the requirements and specific sections will help you complete the form accurately.

3. Gather required information: Collect all the necessary information and documents required for the application, such as your business name, contact details, tax identification number, business address, nature of the business, etc.

4. Complete the form: Fill in each section of the form accurately. Provide all the required information, leaving no blank spaces unless instructed otherwise. Review the form before proceeding to the next step to ensure completeness.

5. Provide supporting documents: Attach any required supporting documents along with the application form. This may include a copy of your business license, lease agreement, identification documents, and tax-related information.

6. Review and double-check: Carefully review the completed form and supporting documents for any errors or omissions. Make sure all information is accurate and consistent. Proofread the application form before submission.

7. Submit the application: Depending on the requirements, you may need to submit the completed application form and supporting documents in person, mail them, or use an online submission portal. Follow the instructions to ensure proper submission.

8. Pay the fees: If there are any registration or application fees, make sure to pay them according to the specified process. Keep a record of your payment for future reference.

9. Confirmation and follow-up: After submission, wait for confirmation of receipt and processing of your application. If needed, follow up with the tax office to ensure that your application is being processed.

It is advisable to consult with a tax professional or contact the relevant tax authorities if you have any specific questions or need clarification while filling out the BTR application form.

What is the purpose of btr application form?

The purpose of a BTR (Built-To-Rent) application form is to collect necessary information from prospective tenants who are interested in renting a property within a built-to-rent development or community. The application form aids in the screening process and helps property managers or landlords gather information to evaluate the eligibility of applicants. The form typically includes personal information, employment details, rental history, references, and other relevant information required to assess the applicant's suitability as a tenant.

What information must be reported on btr application form?

The specific information that must be reported on a BTR (Business Tax Registration) application form can vary depending on the jurisdiction and the specific requirements of the government entity issuing the form. However, here are some common information that is typically required:

1. Business Name: The legal name of the business entity, which may include the trade name or DBA (Doing Business As) if applicable.

2. Business Address: The physical location where the business operates from, including the street address, city, state, and zip code.

3. Mailing Address: If different from the business address, the mailing address where official correspondence, licenses, or permits should be sent.

4. Contact Information: The phone number, email address, and any other relevant contact information for the business.

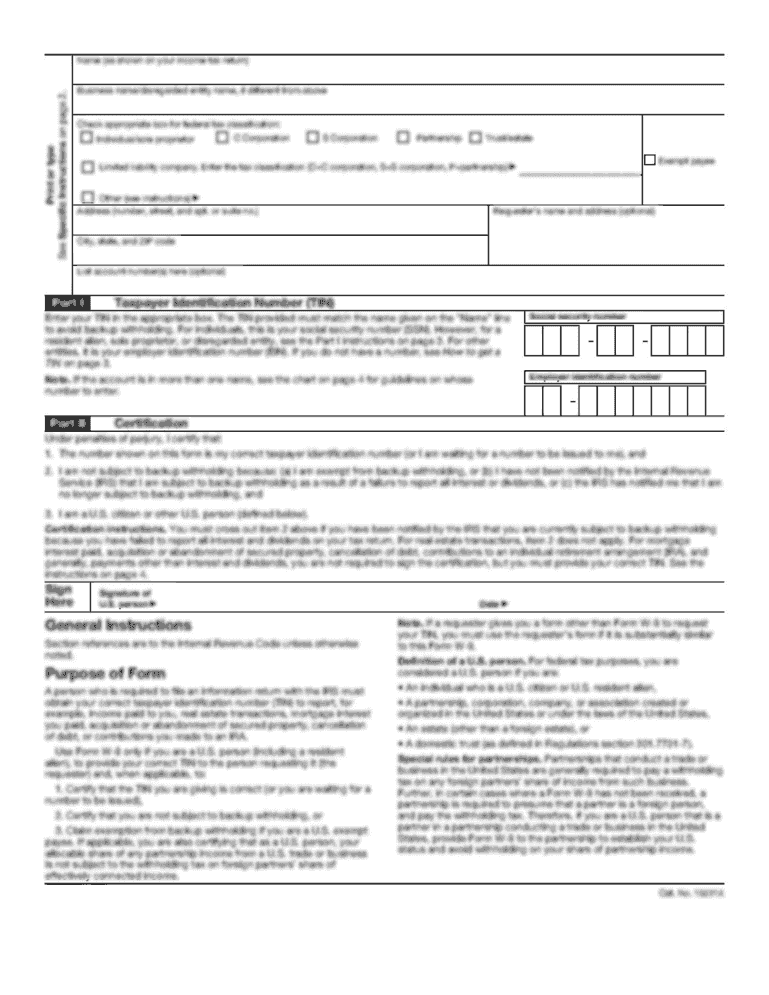

5. Owner/Principal Information: The name, address, contact details, and social security number or Tax Identification Number (TIN) of the business owner(s) or principal(s).

6. Business Structure: Information about the legal structure of the business, such as whether it is a sole proprietorship, partnership, corporation, or LLC (Limited Liability Company).

7. Nature of Business: A description of the type of business activities conducted, the industry sector, or the specific goods/services offered.

8. Employment Information: Details about the number of employees, including full-time and part-time positions.

9. Tax Identification Number: The federal employer identification number (EIN) or other tax identification numbers associated with the business.

10. Business Start Date: The date when the business officially started operations.

11. Additional Licenses/Permits: Any additional permits, licenses, or certifications required for the specific industry or business activity.

12. Signature: The signature or electronic acceptance to certify the accuracy of the information provided and compliance with applicable laws and regulations.

It is important to note that requirements may vary, and it is recommended to consult the specific BTR application form provided by the local government entity or tax agency to ensure accurate and complete reporting.

What is the penalty for the late filing of btr application form?

The penalties for the late filing of BTR (Business Tax Registration) application forms can vary depending on local regulations and governments. Generally, late filing can result in the imposition of fines or penalties. The specific amount may depend on factors such as the duration of the delay and the local tax laws. It is recommended to check with the appropriate local government agency or tax authority to determine the exact penalties for late filing in your specific jurisdiction.

How can I modify btr application form without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including btr certificate application form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find btr online application form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific btr form and other forms. Find the template you want and tweak it with powerful editing tools.

How can I edit btr form download on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing btr certificate download form, you need to install and log in to the app.

Fill out your btr application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Btr Online Application Form is not the form you're looking for?Search for another form here.

Keywords relevant to btr application form

Related to btr full form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.