Get the free 2012 Form 593 - Real Estate Withholding Tax Statement. 2012 California Form 593 - ft...

Show details

Amount from Form 593-E, Real Estate. Withholding Computation of Estimated Gain or Loss, line 17 on Form 593, line 5. Installment Sales: The Installment ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

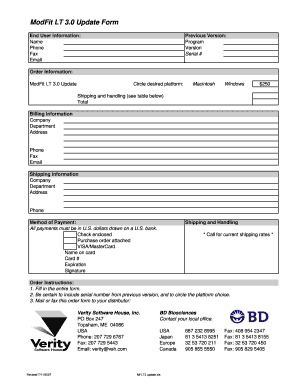

Edit your 2012 form 593 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 form 593 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012 form 593 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2012 form 593. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

How to fill out 2012 form 593

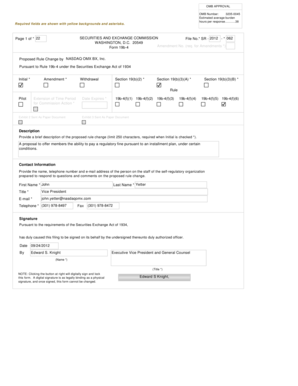

How to fill out 2012 form 593:

01

Start by gathering all the necessary information and documents. You will need details about the property involved in the transaction, including its address and the date of sale or transfer.

02

Begin filling out the form by entering your personal information in Section A. This includes your name, Social Security Number or Individual Tax Identification Number, and contact information.

03

Move on to Section B, where you will provide information about the property. Fill in the property address, county, and the type of transaction (sale or transfer).

04

In Section C, you will need to report the gross sales price or total transferor's value for the property. This represents the total amount paid or the fair market value of the property at the time of transfer.

05

Next, in Section D, you can report any allowable deductions that might apply to your situation. These deductions can help reduce the taxable amount and may include items such as outstanding debt or liens on the property.

06

Proceed to Section E, where you will calculate the taxable amount by subtracting the allowable deductions (if any) from the gross sales price. This will give you the net taxable amount.

07

In Section F, indicate whether the property was your principal residence at the time of transfer. If it was, you may be eligible for certain exclusions or adjustments.

08

Finally, complete Section G by signing and dating the form. Make sure to provide your phone number and the best time to reach you in case the tax authorities have any questions.

Who needs 2012 form 593:

01

Individuals who have sold or transferred real property in California during the year 2012.

02

Those who have purchased real property in California during 2012 and are required to report the transfer tax.

03

Taxpayers who are subject to California withholding on the sale or transfer of real property and need to report it on form 593.

Keep in mind that it is essential to consult with a tax professional or refer to the specific instructions provided with the form to ensure accuracy and compliance with the applicable regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 593 - real?

Form 593 - real is used for reporting real estate transactions to the California Franchise Tax Board.

Who is required to file form 593 - real?

Individuals or entities that are involved in real estate transactions in California are required to file form 593 - real.

How to fill out form 593 - real?

Form 593 - real can be filled out by providing the required information such as the buyer's and seller's details, property information, and transaction details.

What is the purpose of form 593 - real?

The purpose of form 593 - real is to report real estate transactions and ensure compliance with California tax laws.

What information must be reported on form 593 - real?

Information such as buyer's and seller's details, property information, sale price, and any applicable withholding amounts must be reported on form 593 - real.

When is the deadline to file form 593 - real in 2023?

The deadline to file form 593 - real in 2023 is typically January 31st of the following year.

What is the penalty for the late filing of form 593 - real?

The penalty for late filing of form 593 - real can vary, but it may result in fines or other consequences imposed by the California Franchise Tax Board.

How can I manage my 2012 form 593 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your 2012 form 593 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send 2012 form 593 for eSignature?

To distribute your 2012 form 593, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the 2012 form 593 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your 2012 form 593 in seconds.

Fill out your 2012 form 593 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.