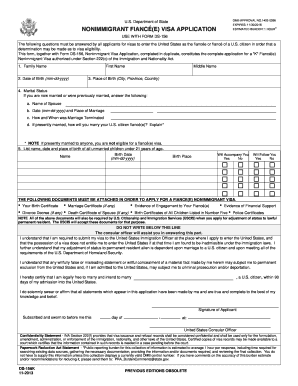

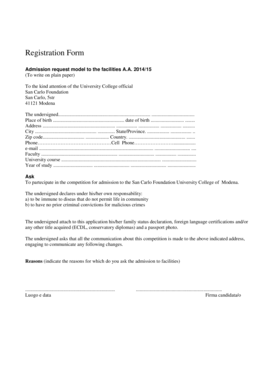

DS-156K 2011 free printable template

Show details

This form, together with Form DS-156, Nonimmigrant Visa Application, completed in duplicate, constitutes the complete ... NOTE If presently married to anyone, you are not eligible for a fiancé (e)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ds 156k form 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ds 156k form 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ds 156k form online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 156k form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

DS-156K Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ds 156k form 2011

How to fill out 156k:

01

Start by gathering all relevant information such as financial statements, income records, and any other necessary documents.

02

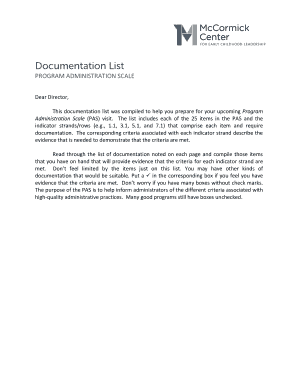

Carefully review the form 156k and make sure you understand all the instructions and requirements.

03

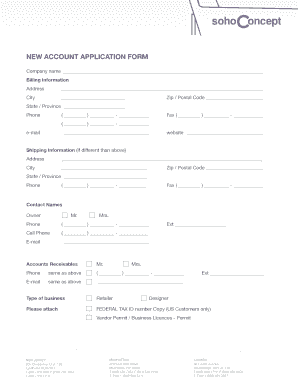

Begin filling out the form by providing your personal information accurately. This may include your name, address, social security number, and other identifying details.

04

Follow the instructions on the form to report your financial information. This may include details about your income, assets, liabilities, and expenses.

05

Take your time to ensure accuracy and double-check all the provided information. Mistakes or omissions could lead to delays or complications in the process.

Who needs 156k:

01

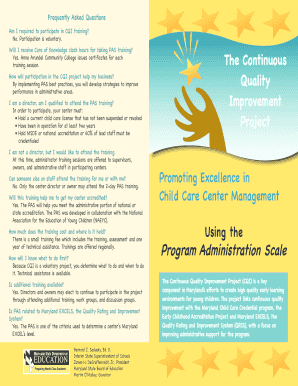

Individuals who have reached the age of 65 and are eligible for Social Security benefits may need to fill out form 156k. This form is used for reporting income earned after the individual reached full retirement age.

02

Those who have received a lump sum payment, such as an inheritance or a legal settlement, may need to fill out form 156k to report this income accurately.

03

Individuals who have participated in certain retirement or pension plans that distribute payments in a lump sum may also be required to fill out form 156k. This allows the accurate reporting of such payments for tax and financial purposes.

It is important to note that the specific situations and requirements for needing form 156k may vary, so it is always recommended to consult with a financial advisor or tax professional for personalized guidance.

Video instructions and help with filling out and completing ds 156k form

Instructions and Help about ds 156k form 2011

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 156k?

156k refers to a specific tax form or document that must be filed with the appropriate tax authority.

Who is required to file 156k?

Businesses or individuals meeting certain criteria or thresholds may be required to file 156k.

How to fill out 156k?

156k can be filled out manually or electronically following the instructions provided by the tax authority.

What is the purpose of 156k?

The purpose of 156k is to report specific financial or tax information to the relevant authorities.

What information must be reported on 156k?

156k typically requires reporting of income, expenses, deductions, and other relevant financial data.

When is the deadline to file 156k in 2023?

The deadline to file 156k in 2023 is typically April 15th, but it is always recommended to check with the relevant tax authority for any updates or changes.

What is the penalty for the late filing of 156k?

The penalty for late filing of 156k may include fines, interest charges, or other repercussions depending on the specific tax authority and circumstances.

How can I send ds 156k form to be eSigned by others?

When you're ready to share your 156k form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit pneus 10z156k michelin x works z 156k prix in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your ds 156k, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my ds 156k form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your 156k form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your ds 156k form 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pneus 10Z156K Michelin X Works Z 156k Prix is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.