Get the free employee earnings form

Show details

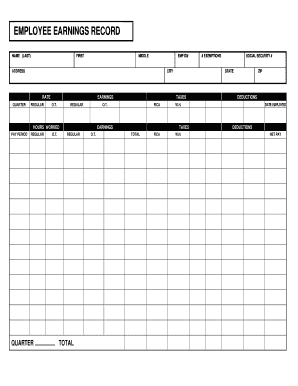

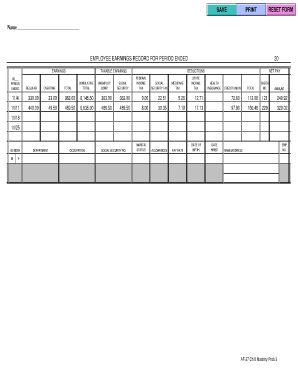

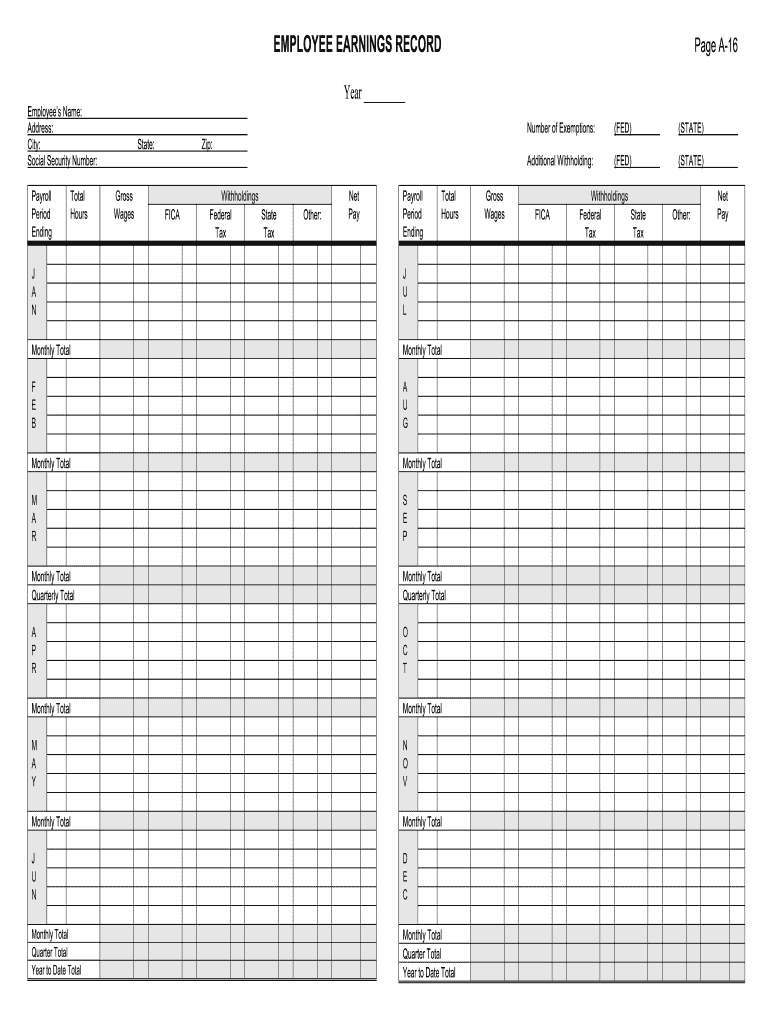

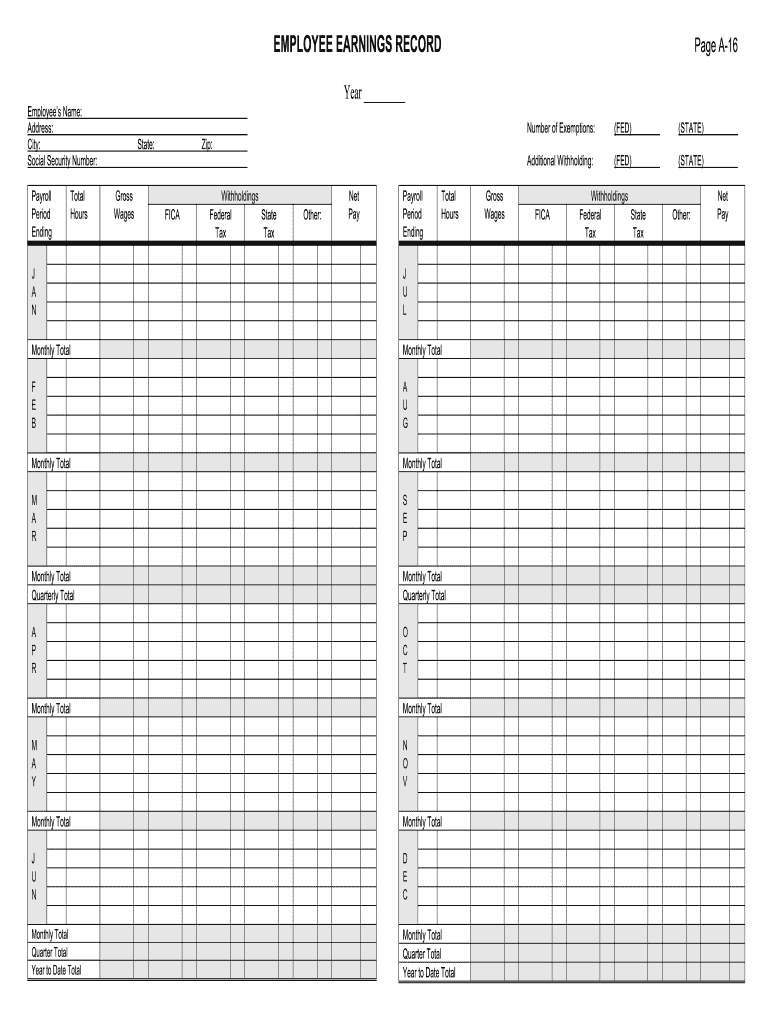

EMPLOYEE EARNINGS RECORD Page A16Year Employees Name: Address: City: Social Security Number: Payroll Period EndingTotal Housemate:Gross WagesNumber of Exemptions:(FED)(STATE)Additional Withholding:(FED)(STATE)Zip:FICAWithholdings

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your employee earnings form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee earnings form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employee earnings form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit oregon school employee form 385 e printable. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out employee earnings form

How to fill out employee earnings form:

01

Start by gathering all necessary information such as the employee's name, address, social security number, and employment start and end dates.

02

Next, identify the employee's gross earnings for the pay period. This includes regular wages, overtime, bonuses, commissions, and any other forms of compensation.

03

Deduct any pre-tax deductions the employee may have such as healthcare premiums, retirement contributions, or flexible spending account contributions.

04

Calculate the employee's taxable income by subtracting pre-tax deductions from gross earnings.

05

Determine and subtract federal income tax withholdings based on the employee's tax status and the IRS withholding tables.

06

Subtract any state income tax withholdings, if applicable.

07

Deduct any other withholding amounts such as Social Security and Medicare taxes.

08

Calculate the employee's net earnings by subtracting all deductions from the taxable income.

09

Once the payroll calculations are complete, fill out the employee earnings form with all the figures and breakdowns for each category.

10

Finally, provide a copy of the completed form to the employee and keep a record of it for your own records.

Who needs employee earnings form:

01

Employers who have employees working for them and need to maintain accurate records of their earnings.

02

Human resources departments that handle payroll and need to keep track of employee compensation.

03

Employees themselves who may need the form for tax filing purposes or to provide proof of income for future loans or rentals.

Fill printable employee earnings record form : Try Risk Free

People Also Ask about employee earnings form

Should an employee fill out a w9?

What is a w9 form for employees?

What's the difference between a W-4 and a W-2 form?

What is a W-2 earnings form?

Who is required to fill out a w9?

What is the difference between 1099 and W-2?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

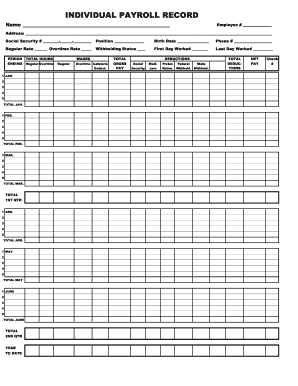

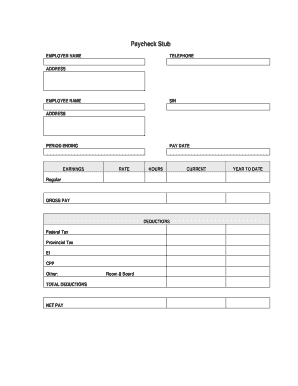

What is employee earnings form?

An employee earnings form, also known as a pay stub or paycheck stub, is a document that provides detailed information about an employee's earnings and deductions for a specific pay period. It typically includes information such as the employee's gross wages, tax withholdings, deductions for benefits like health insurance or retirement plans, and net pay (the amount the employee actually receives after all deductions). The form may also include additional information such as the employee's name, employee identification number, pay period dates, and the employer's name and address. The employee earnings form is typically provided alongside the employee's paycheck as a record of their earnings and deductions for that specific pay period.

Who is required to file employee earnings form?

Employers are required to file employee earnings forms.

How to fill out employee earnings form?

To fill out an employee earnings form, follow these steps:

1. Begin by downloading or obtaining the employee earnings form from your employer or the relevant government agency.

2. Read the instructions and guidelines provided with the form carefully to understand the information required and any specific formatting or documentation requirements.

3. Start by providing your personal information such as your full name, social security number, employee identification number, and contact details. Ensure that all the information you provide is accurate and up to date.

4. Enter the relevant pay period for which you are reporting your earnings. It could be weekly, bi-weekly, monthly, or any other period as determined by your employer or the form requirements.

5. Record your total earnings for the pay period. This usually includes your regular salary or wages, any overtime pay, bonuses, commissions, tips, or any other income you received during that period.

6. If your earnings are subject to any deductions, taxes, or contributions, indicate these amounts accurately in the appropriate fields on the form. Common deductions may include income tax, social security tax, Medicare tax, state or local taxes, health insurance premiums, retirement account contributions, or any other voluntary or mandatory deductions applicable to you. Use the provided spaces or additional sections if needed.

7. Summarize your net earnings after deductions by subtracting the total deductions from your total earnings. This will represent your take-home pay or net income for the given pay period.

8. Carefully review the completed form to ensure all the information is accurate and complete.

9. Sign and date the form. Depending on the requirements, you may need to obtain a supervisor's or employer's signature as well.

10. Submit the completed employee earnings form to the relevant department or individual as instructed, whether it is your employer, an accounting department, or a government agency.

Remember, it is important to provide accurate and truthful information on the form to avoid any legal or financial consequences. If you have any doubts or questions about filling out the form, seek assistance from your employer or a professional accountant.

What is the purpose of employee earnings form?

The purpose of an employee earnings form is to provide a summary of an employee's earnings and deductions over a specific period of time, typically a pay period or year. This form is used by employers to record and report employee compensation information accurately and comply with legal and tax requirements. It includes details such as gross earnings, net income, taxes withheld, contributions to benefits and retirement plans, and any other deductions made from the employee's paycheck. The employee earnings form is crucial for employees to understand their earnings, withholdings, and deductions, and for employers to maintain accurate financial records and issue necessary tax and wage statements.

When is the deadline to file employee earnings form in 2023?

The deadline to file employee earnings form (such as W-2 Form in the United States) for the year 2023 is typically on January 31st, 2024. However, it's always advisable to consult the specific tax agency or jurisdiction for the most accurate and up-to-date deadline information.

What is the penalty for the late filing of employee earnings form?

The penalty for late filing of employee earnings form may vary depending on the country and specific regulations. In the United States, for example, employers who fail to file the Form W-2 (Wage and Tax Statement) by the deadline are subject to penalties ranging from $50 to $540 per form, depending on the length of the delay. The penalty amount increases if the failure is due to intentional disregard. It's important to consult with the relevant tax authorities or a professional for accurate and up-to-date information on penalties in your jurisdiction.

How do I edit employee earnings form straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing oregon school employee form 385 e printable right away.

How do I fill out school employee form 385 e oregon using my mobile device?

Use the pdfFiller mobile app to complete and sign state earnings record on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit employees earning record template on an iOS device?

Create, edit, and share employee earning record form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your employee earnings form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

School Employee Form 385 E Oregon is not the form you're looking for?Search for another form here.

Keywords relevant to employee earnings record form pdf

Related to online earnings

If you believe that this page should be taken down, please follow our DMCA take down process

here

.