Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

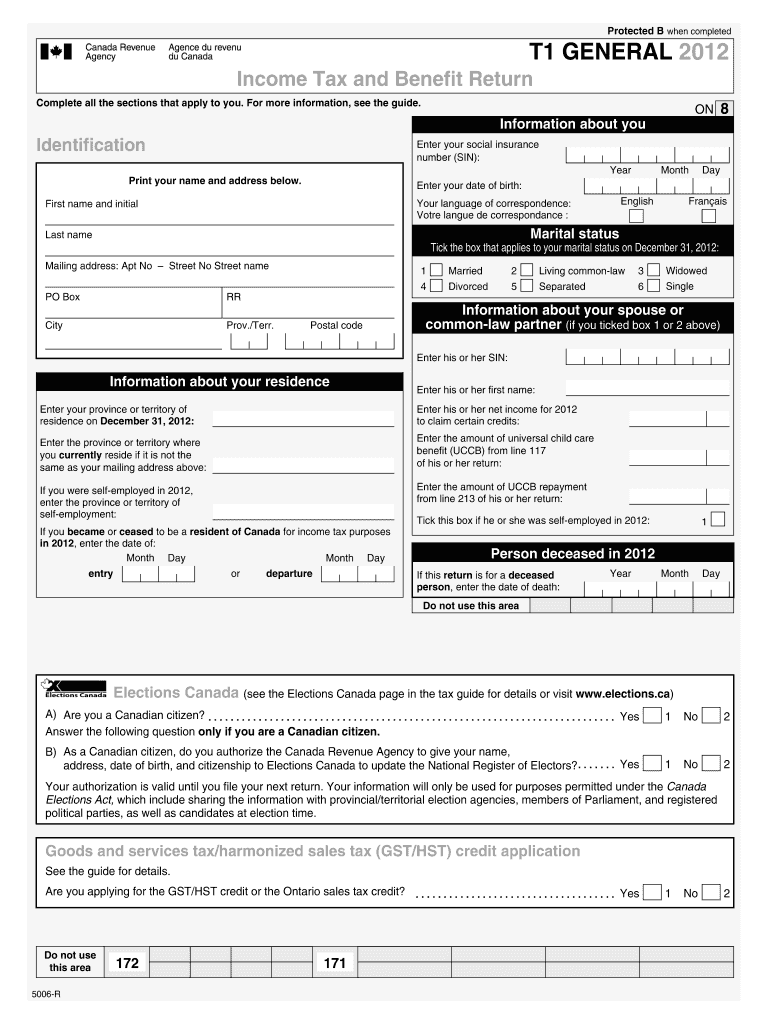

The T1 General form is the tax return form used by individuals in Canada to report their income and calculate the amount of income tax they owe or the refund they are entitled to. It is used to report various types of income, deductions, credits, and other information relevant to the determination of an individual's tax liability. The T1 General form is filed annually and is typically due by April 30th for most individuals.

Who is required to file t1 general form?

In Canada, individuals who are residents for tax purposes are required to file the T1 General form. This form is used to report income, deductions, and tax credits. Some specific situations that require the filing of the T1 General form include:

1. Individuals with taxable income exceeding the basic personal amount.

2. Those who owe taxes for the year or have a balance owing from a previous year.

3. Individuals who are claiming certain refundable or non-refundable tax credits.

4. Individuals who have disposed of taxable Canadian property during the year.

5. Self-employed individuals who need to report business income and expenses.

6. Individuals who received income from other sources such as rental properties, investments, or foreign employment.

It is important to note that even if an individual's income is below the taxable threshold or they are not required to file, they may still choose to file a T1 General form in order to claim certain benefits or credits like the goods and services tax/harmonized sales tax (GST/HST) credit or the Canada child benefit (CCB).

How to fill out t1 general form?

Filling out a T1 General form for income tax purposes in Canada requires attention to detail and accurate information. Here are the steps to fill out the form correctly:

1. Identify the correct tax year: Ensure you are filling out the form for the correct tax year, which typically runs from January 1 to December 31.

2. Personal information: Fill in your name, social insurance number (SIN), and address on the top section of the form. Provide up-to-date contact information, including phone number and email.

3. Marital status: Indicate your marital status as of December 31 of the tax year you are filing for.

4. Identification: Fill in the section requesting your date of birth, your spouse's date of birth (if applicable), and your SIN.

5. Residency status: Indicate your residency status, whether you are a resident, non-resident, or deemed resident for tax purposes.

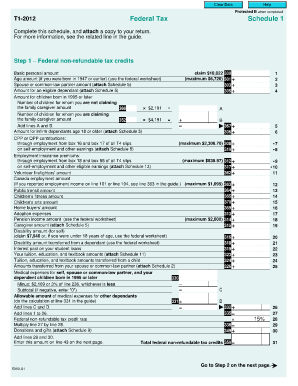

6. Income details: Provide information on your employment income, business income, rental income, investment income, pension income, and any other sources of income. Use the relevant schedules and forms provided by the Canada Revenue Agency (CRA) to report specific types of income.

7. Deductions and credits: Claim deductions and credits you are eligible for, such as medical expenses, charitable donations, tuition fees, and others. Again, use the relevant schedules and forms as required.

8. Total taxpayer and spouse amounts: Calculate the total amounts entered in the income and deductions sections for both you and your spouse. Combine them to determine the total taxpayer and spouse amounts.

9. Net income: Calculate your net income by subtracting deductions from total income. Follow the instructions and guidance provided on the form to ensure accurate calculations.

10. Tax payable or refund: Calculate the amount of tax payable or refundable by referring to the tax tables provided by the CRA. Consider any applicable credits or previous year amounts owed.

11. Sign and date: Finally, sign and date the T1 General form. If you have a spouse or common-law partner, they should also sign if applicable.

Remember to keep copies of all supporting documents, such as T-slips, receipts, and statements. It may be advisable to consult a tax professional or use tax software to ensure accuracy and maximize eligible deductions and credits.

What is the purpose of t1 general form?

The T1 General form is the main income tax form that Canadian individuals use to report their income, deductions, and credits for a particular tax year. It is used to calculate the amount of income tax owed or the refund due to the individual. The form includes various sections for reporting employment income, investment income, business income, and various deductions and credits that the taxpayer may be eligible for. The T1 General form is submitted to the Canada Revenue Agency (CRA) to fulfill the individual's tax obligations.

What information must be reported on t1 general form?

The T1 General form is used by individuals in Canada to file their personal income tax return. It is important to report various types of information on this form, including:

1. Personal information: This includes your name, address, social insurance number, and date of birth.

2. Income: You must report all sources of income earned during the tax year, such as employment income, self-employment income, rental income, investment income, and any other sources of income.

3. Deductions and credits: You should report all applicable deductions and tax credits to which you are entitled, such as RRSP contributions, childcare expenses, medical expenses, charitable donations, and tuition fees paid.

4. Employment details: If you are an employee, you will need to provide your employer's name and address, as well as details about your income earned, deductions, and any other employment-related information.

5. Tax installment payments: If you made any income tax installments during the tax year, you must report the amounts paid.

6. Capital gains and losses: If you disposed of any capital property during the tax year, such as stocks or real estate, you must report any capital gains or losses realized.

7. RRSP contributions: If you made contributions to a registered retirement savings plan (RRSP) during the tax year, you should report the amounts contributed.

8. Provincial or territorial information: You may need to report additional information specific to your province or territory of residence, such as tax credits or benefits.

It is important to carefully review the instructions provided with the T1 General form or consult with a tax professional to ensure you accurately report all required information.

When is the deadline to file t1 general form in 2023?

The deadline to file the T1 General form in Canada for the tax year 2022 (reflecting the income earned in 2022) will be April 30, 2023. This is the standard deadline for most individuals. However, if you or your spouse or common-law partner operate a business, the deadline may be extended to June 15, 2023.

What is the penalty for the late filing of t1 general form?

The penalty for late filing of a T1 General form (income tax return) in Canada depends on various factors such as the amount of taxes owed, the number of days late, and whether there have been previous late filings. Generally, the penalty for late filing is a percentage of the unpaid tax owing.

For the first offense, the late-filing penalty is 5% of the balance owing, plus an additional 1% for each month (up to a maximum of 12 months) that the return is late. If the filing is late for multiple years, the penalties compound.

Additionally, if a taxpayer has a history of repeated late filing, the penalties can increase. The penalty for repeated late filing within a three-year period is 10% of the balance owing, plus an additional 2% for each month (up to a maximum of 20 months) that the return is late.

It's important to note that interest charges also apply to any outstanding balance owing. It is always advisable to file the T1 General form on time to avoid penalties and interest charges.

How can I send 2012 t1 general form for eSignature?

When you're ready to share your 2012 t1 general form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit 2012 t1 general form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign 2012 t1 general form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I fill out 2012 t1 general form on an Android device?

Use the pdfFiller mobile app and complete your 2012 t1 general form and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.