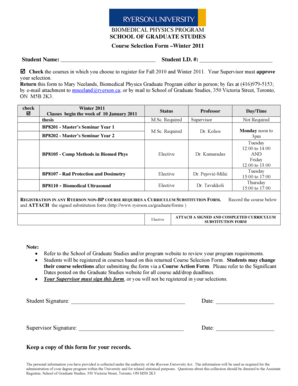

Get the free adp paystub generator form

Get, Create, Make and Sign

How to edit adp paystub generator online

How to fill out adp paystub generator form

How to fill out adp pay stub template:

Who needs adp pay stub template?

Video instructions and help with filling out and completing adp paystub generator

Instructions and Help about adp check stub generator form

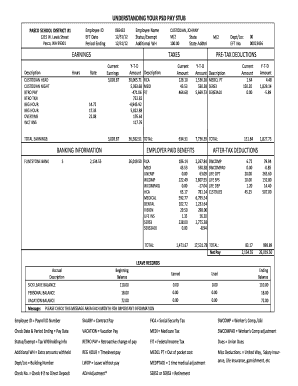

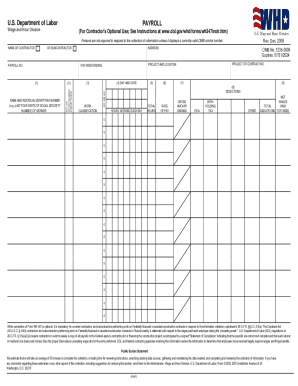

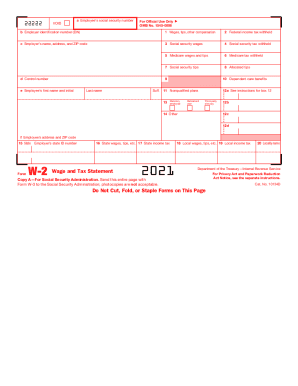

Hello this is Justin Brown from the pay stubs comm in this video I'll show you how to quickly and easily create a pay stub using our tool which automatically does all the calculations for you and generates a professional pay stub document the page is split into two important sections to the right we have the preview pane which updates automatically while inserting your information in the form, and you could click on the image to enlarge it the watermark will be removed from your final stub, and you'll be able to change the stub template in the next step you can always hover on any input for explanation start by selecting the state where the employee or contractor resides choose the correct status employee or contractor then insert the person's full name and last four digits of their social security number you can add optional information such as the person's address employee or contractor ID marital status number of dependents and exemptions continue by inserting the company name and optionally the address phone number and E I n number in the salary sections start by selecting whether the employee is paid on an hourly or fixed salary basis then choose the pay frequency for hourly employees enter their hourly rate for salaried employees enter their annual salary next you can add as many pay dates is needed and modify their dates each pay date will have its own separate pay stub in case of an hourly employee you must also specify the hours work for each pay date for hourly employees enter their schedule information whether they work on a varied or fixed schedule for salaried employees choose if you want to show the effective hourly rate on the stub check this box if the employee was hired during the current year and specify their hire date you can add additional additions and deductions such as bonuses overtime pay and tax refunds to add an addition fill out the description select which pay date it applies to and enter the current amount and the year-to-date amount note that taxes withheld will be zero for contractors last but not least you can replace the automatically generated check numbers for each pay date don't forget to enter your email address on which you will receive your generated pay stubs if you ever get stuck anywhere you can contact us via live chat or phone for instant support now that you're done filling the form press to submit information button to customize and finalize your stub on this page you have a selection of stub templates to choose from choose which template fits your needs once done you'll be able to validate your final stubs right under you can press the Edit information button to go back to the form page and edit any missing or incorrect information finally view your order details and select which payment method you'd like to use click the checkout button to complete your payment and download your pay stubs once you are on the download stub page you'll find on the left the download options available to you and on...

Fill paystub generator adp : Try Risk Free

People Also Ask about adp paystub generator

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

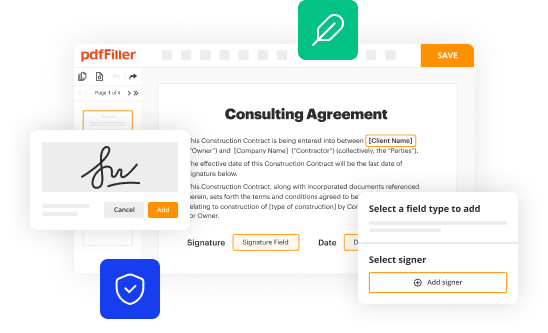

Fill out your adp paystub generator form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.