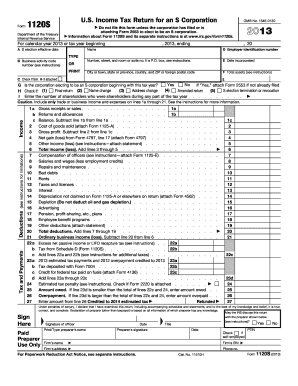

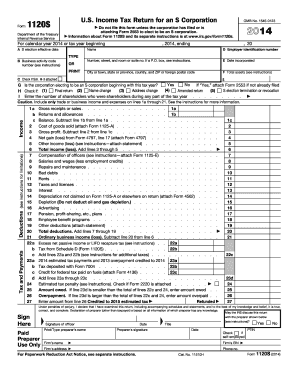

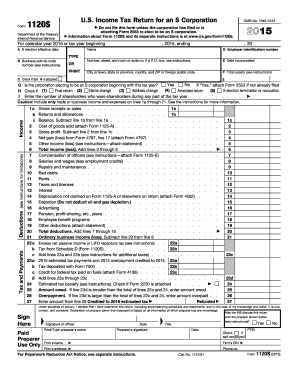

IRS 1120S - Schedule K-1 2013 free printable template

Instructions and Help about IRS 1120S - Schedule K-1

How to edit IRS 1120S - Schedule K-1

How to fill out IRS 1120S - Schedule K-1

About IRS 1120S - Schedule K-1 2013 previous version

What is IRS 1120S - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1120S - Schedule K-1

How can I manage my [SKS] directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign [SKS] and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit [SKS] from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your [SKS] into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I edit [SKS] on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute [SKS] from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is IRS 1120S - Schedule K-1?

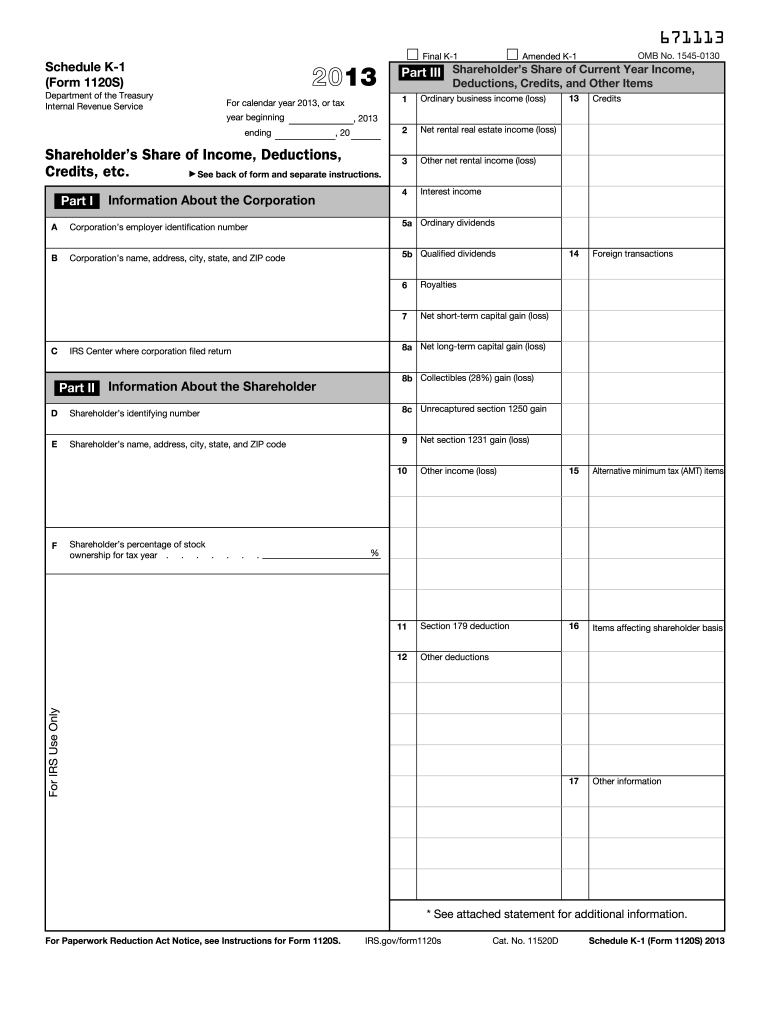

IRS 1120S - Schedule K-1 is a tax form used to report income, deductions, and credits from an S Corporation to its shareholders.

Who is required to file IRS 1120S - Schedule K-1?

An S Corporation is required to file IRS 1120S - Schedule K-1 for each shareholder to report their share of the corporation's income, deductions, and credits.

How to fill out IRS 1120S - Schedule K-1?

To fill out IRS 1120S - Schedule K-1, you need to gather information about the S Corporation's financial performance, including total income, deductions, and the individual contributions of each shareholder, and then complete the form with this information.

What is the purpose of IRS 1120S - Schedule K-1?

The purpose of IRS 1120S - Schedule K-1 is to inform shareholders of their individual shares of the S Corporation's taxable income, losses, and other tax-related items for their personal tax returns.

What information must be reported on IRS 1120S - Schedule K-1?

IRS 1120S - Schedule K-1 must report the shareholder's share of income, deductions, credits, and any other relevant financial information from the S Corporation.

See what our users say