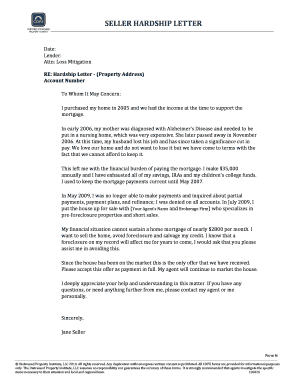

Get the free sample hardship letter for loss of income form

Get, Create, Make and Sign

Editing sample hardship letter for loss of income online

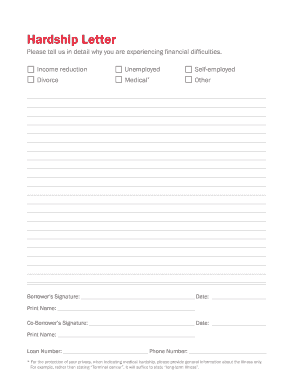

How to fill out sample hardship letter for

Point by point, here is how to fill out a sample financial hardship letter:

Who needs a sample financial hardship letter?

Video instructions and help with filling out and completing sample hardship letter for loss of income

Instructions and Help about hardship letter form

Hi this is Becky de grace, and I'm really excited to show you this collection of hardship letters all of these 32 letters were professionally written by me and approved by lenders, so I've been writing letters for a couple of years now, and I always follow up with folks that are writing for and the folks who respond that they got approved by their lender all those letters go in a certain file and what I did was I went through that that pretty big file and chose 32 letters that I thought would give you a perfect cross sample of not only linters but also hardship situations a variety of first mortgages second mortgages home equity lines of credit all sorts of different things and also the various types of letters loan modification hardship letters short sale hardship letters deed-in-lieu and then also a new thing I'm seeing lately which is requests for reduction of repayment plans, so this collection contains a great variety and what I want to do in this video is show you how to actually navigate it I just got this file from my assistant who put this all together, and it's just amazing what she was able to do to help you navigate this so if you order this you will get this you'll get this file it's a PDF file and the way what happens when you open it is that over on the left side, or it could be on the right side depending on your version of a PDF reader you will have some kind of navigation so as you can see here I'm on the cover page and then here if I click there I go to the copyright information there's a little page on about this report and then how to use this book, and then we just go on and so there's hardship let our tips now notice here that on the left there's an arrow and if I push that arrow that will expand and show me the different options that I look at so let's say that I'm looking for a short sale that's what I need to write for my lender I can click on that and that will show me that over here's the short sale hardship letter tips and I can read that and then in the next section if we go down here there's a section 1 on loan modification hardship letters and all of these letters are listed here if I click this arrow that will all collapse up and in section 2 there's short sale having a hard time saying that short sale hardship letters and I can expand that, and then I can see the different kinds so the way you read this is that this says this is a first mortgage the reason that the person is requesting the March the short sale is because the tenants are not paying and that the person is caring for a family member if I were to click on that and something about investments if I were to click on this I can see the letter over here and what I want to show you is at the very top of the letter there's a little table that we've put together for each letter, so the type of this letter is a short sale it's a first mortgage the tenants aren't paying the rent and this person is caring for a family member, so they can't make the payments...

Fill sample hardship letter for mortgage assistance : Try Risk Free

People Also Ask about sample hardship letter for loss of income

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your sample hardship letter for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.