Get the free tds challan 281 excel format

Show details

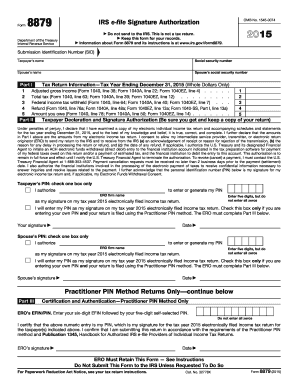

*Important : Please see notes overleaf before filling up the Chillán NO./ ITS 281 T.D.S./TCS TAX CHILLÁN Single Copy (to be sent to the ZOO) THOUSANDS Date: Pin

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your tds challan 281 excel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tds challan 281 excel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tds challan 281 excel format online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tds challan 281 fillable pdf form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out tds challan 281 excel

How to fill out tds challan 281 excel:

01

Open Microsoft Excel on your computer.

02

Create a new spreadsheet or open an existing one.

03

In the first row, enter the relevant details such as your name, address, and Permanent Account Number (PAN).

04

In the next row, enter the details of the deductee such as their name, address, and PAN.

05

Enter the relevant financial year and assessment year in the next row.

06

Fill in the details of the tax deducted such as the section under which the deduction is made, the nature of payment, and the amount deducted.

07

Calculate the total amount of tax deducted and fill it in the designated cell.

08

Double-check all the information entered to ensure accuracy and completeness.

09

Save the Excel file with an appropriate name and in a preferred location.

Who needs tds challan 281 excel?

01

Individuals or entities who are required to deduct tax at source on various payments made, such as salaries, rent, or contractor payments, need TDS challan 281 excel.

02

Employers or businesses that are responsible for deducting tax from the salary of their employees need TDS challan 281 excel.

03

Contractors or service providers receiving payments from clients who deduct TDS on such payments need TDS challan 281 excel.

Fill tds challan format : Try Risk Free

What is form 281?

ITNS 281 – This Challan is used for depositing Tax Deducted at Source (TDS) or Tax Collected at Source (TCS). Challan No. ITNS 282 – This is to be used in case of payment of Gift Tax, Wealth Tax, Expenditure Tax, Estate Duty, Securities Transaction Tax and Other Direct Taxes.

People Also Ask about tds challan 281 excel format

How to fill challan 281 offline?

How can I download TDS paid challan 281?

How can I file TDS challan online?

How to fill Challan 281 offline?

How can I download TDS challan copy?

How to download TDS challan in Excel format?

How to fill challan 280 offline?

How can I create TDS and TCS challan online?

How do I create TDS details in Excel?

What is the difference between challan 280 and 281?

Can we make TDS payment offline?

How to pay TDS 281 online?

How to generate challan 281?

How to create a challan in Excel?

How can I generate TDS challan 281?

How can I pay TDS challan offline?

How can I pay TDS directly?

How to pay TDS online step by step?

What is Form 281 challan?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tds challan 281 excel?

TDS Challan 281 is an excel based form used for making payment of Tax Deducted at Source (TDS). It is an excel file available on the official website of the Income Tax Department. The challan is used to deposit TDS with the government. It is to be filled in triplicate copies, the first copy being the depositor's copy, the second copy being the bank's copy and the third copy being the Income Tax Department copy.

Who is required to file tds challan 281 excel?

Any person or business who is liable to deduct tax at source (TDS) on payments made to a third party is required to file Form No. Challan 281. This includes individuals, companies, trusts, society, and partnership firms, etc.

How to fill out tds challan 281 excel?

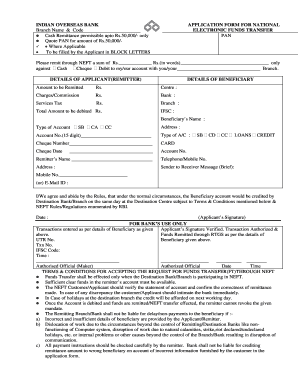

1. Download the TDS Challan 281 Excel template from the TIN website.

2. Enter the details of the TDS assessee in the appropriate fields.

3. Select the type of tax and fill in the amount to be paid in the relevant fields.

4. Enter the details of the bank where the payment is to be made.

5. Enter the assessee’s PAN number in the appropriate field.

6. Enter the Tax Deductor’s PAN and TAN details.

7. Enter the details of the deductor in the relevant fields.

8. Enter the details of the deductee in the relevant fields.

9. Enter the details of the tax collected at source in the relevant fields.

10. Click on ‘Generate Challan’ to generate the Challan 281.

11. Take a printout of the Challan 281 and sign it.

12. Submit the Challan 281 to the bank along with the necessary amount.

What is the purpose of tds challan 281 excel?

TDS Challan 281 excel is an Excel sheet for payment of taxes deducted at source (TDS) under the Income Tax Act. It provides taxpayers with an easy way to make payments, calculate tax deductions, and keep track of their tax payments. It also helps businesses to comply with tax regulations and accurately report TDS to the Income Tax Department.

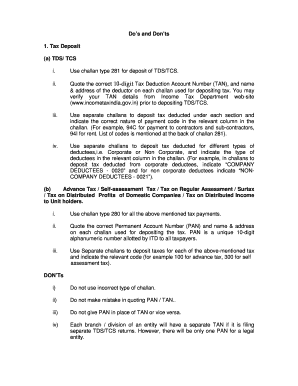

What information must be reported on tds challan 281 excel?

The information that must be reported on a TDS Challan 281 Excel includes:

• Name and address of the deductor

• PAN of the deductor

• TAN of the deductor

• Address of the office or branch of the deductor

• Major Head Code

• Nature of Payment

• Amount of Tax Deducted at Source (TDS)

• Amount of Tax Collected at Source (TCS)

• Amount of Tax Paid

• Date of Deposit

• Bank Branch Code

• Bank Challan Serial Number

• Challan Identification Number (CIN)

• Mode of Payment

When is the deadline to file tds challan 281 excel in 2023?

The deadline to file TDS challan 281 excel in 2023 is 31st March 2023.

What is the penalty for the late filing of tds challan 281 excel?

The penalty for the late filing of TDS challan 281 excel is a fine of up to ₹10,000. Additionally, the defaulter may also be subject to a penalty of 1% per month of the total amount of tax due.

How can I edit tds challan 281 excel format from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including tds challan 281 fillable pdf form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I sign the tds challan 281 pdf editable electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your challan excel format in minutes.

Can I create an electronic signature for signing my challan 281 in excel in Gmail?

Create your eSignature using pdfFiller and then eSign your itns 281 pdf form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your tds challan 281 excel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tds Challan 281 Pdf Editable is not the form you're looking for?Search for another form here.

Keywords relevant to tds challan 281 excel form

Related to tds challan excel format

If you believe that this page should be taken down, please follow our DMCA take down process

here

.