GA DoR IA-81 2012 free printable template

Show details

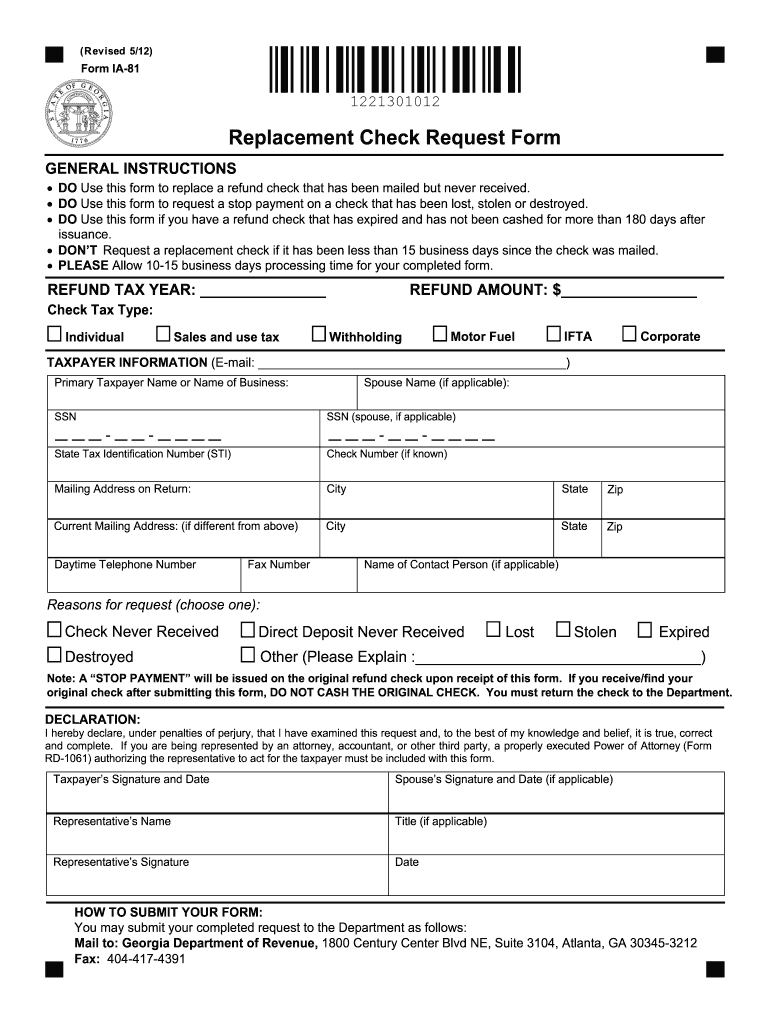

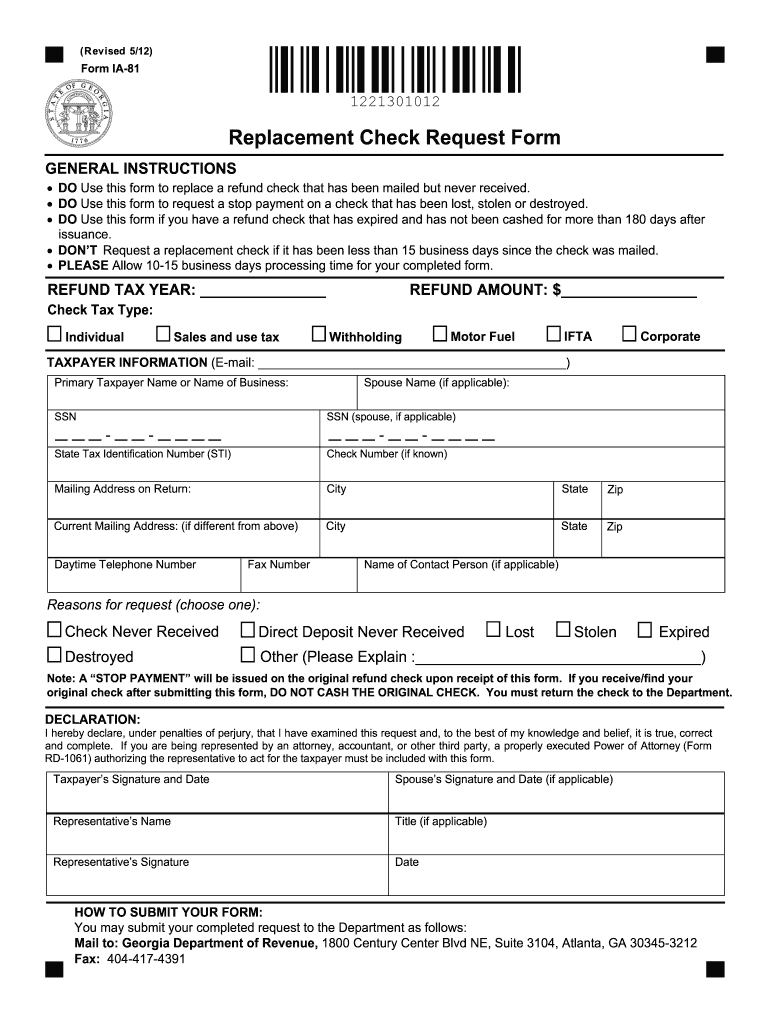

Replacement Check Request Form. GENERAL INSTRUCTIONS. • DO Use this form to replace a refund check that has been mailed but never received.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA DoR IA-81

Edit your GA DoR IA-81 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA DoR IA-81 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA DoR IA-81 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GA DoR IA-81

How to fill out GA DoR IA-81

01

Obtain the GA DoR IA-81 form from the appropriate state department website or office.

02

Carefully read the instructions provided on the form.

03

Fill out your personal details at the top of the form including your name, address, and contact information.

04

Provide the specific information requested in the form, such as income details and tax identification numbers.

05

Review the eligibility criteria listed on the form to ensure you meet the requirements.

06

Complete any additional sections relevant to your situation, such as deductions or credits.

07

Double-check all entries for accuracy and completeness.

08

Sign and date the form at the designated area.

09

Submit the completed form to the appropriate state department office, either by mail or electronically if available.

Who needs GA DoR IA-81?

01

Individuals applying for certain tax-related benefits or exemptions in the state of Georgia.

02

Taxpayers who need to report specific information for state income tax purposes.

03

Residents seeking to claim deductions or credits related to Georgia state taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is the form for lost IRS check?

Form 3911 is completed by the taxpayer to provide the Service with information needed to trace the nonreceipt or loss of the already issued refund check.

How can I get maximum tax refund?

6 Ways to Get a Bigger Tax Refund Try itemizing your deductions. Double check your filing status. Make a retirement contribution. Claim tax credits. Contribute to your health savings account. Work with a tax professional.

Can you file taxes with no income but have a dependent?

Can you file taxes with no income but have a child or dependent? If you have no income but have a child/dependent, you can still file your taxes. This may allow you to get a refund if the tax credits you're eligible for are more than your income.

How to get a $10,000 tax refund?

Individuals who are eligible for the Earned Income Tax Credit (EITC) and the California Earned Income Tax Credit (CalEITC) may be able to receive a refund of more than $10,000. “If you are low-to-moderate income and worked, you may be eligible for the Federal and State of California Earned Income Tax Credits (EITC).

How much does the IRS take out of $10,000?

If you make $10,000 a year living in the region of California, USA, you will be taxed $875. That means that your net pay will be $9,125 per year, or $760 per month.

How do I get my IRS refund check reissued?

What you need to do Call us at 800-829-0115 to request a replacement check. If you have the expired check, please destroy it. When you receive the new check, remember to cash it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is GA DoR IA-81?

GA DoR IA-81 is a tax form used by the Georgia Department of Revenue for reporting income tax information related to specific tax obligations.

Who is required to file GA DoR IA-81?

Individuals or entities that have certain taxable activities or income subject to Georgia state income tax are required to file GA DoR IA-81.

How to fill out GA DoR IA-81?

To fill out GA DoR IA-81, you need to provide your personal or entity information, report your income, deductions, and credits, and ensure all sections are completed accurately before submitting.

What is the purpose of GA DoR IA-81?

The purpose of GA DoR IA-81 is to gather information from taxpayers to assess their state income tax liability and ensure compliance with Georgia tax laws.

What information must be reported on GA DoR IA-81?

GA DoR IA-81 requires reporting personal identification information, total income earned, applicable deductions, tax credits claimed, and any other relevant financial data pertinent to income tax.

Fill out your GA DoR IA-81 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA DoR IA-81 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.