Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

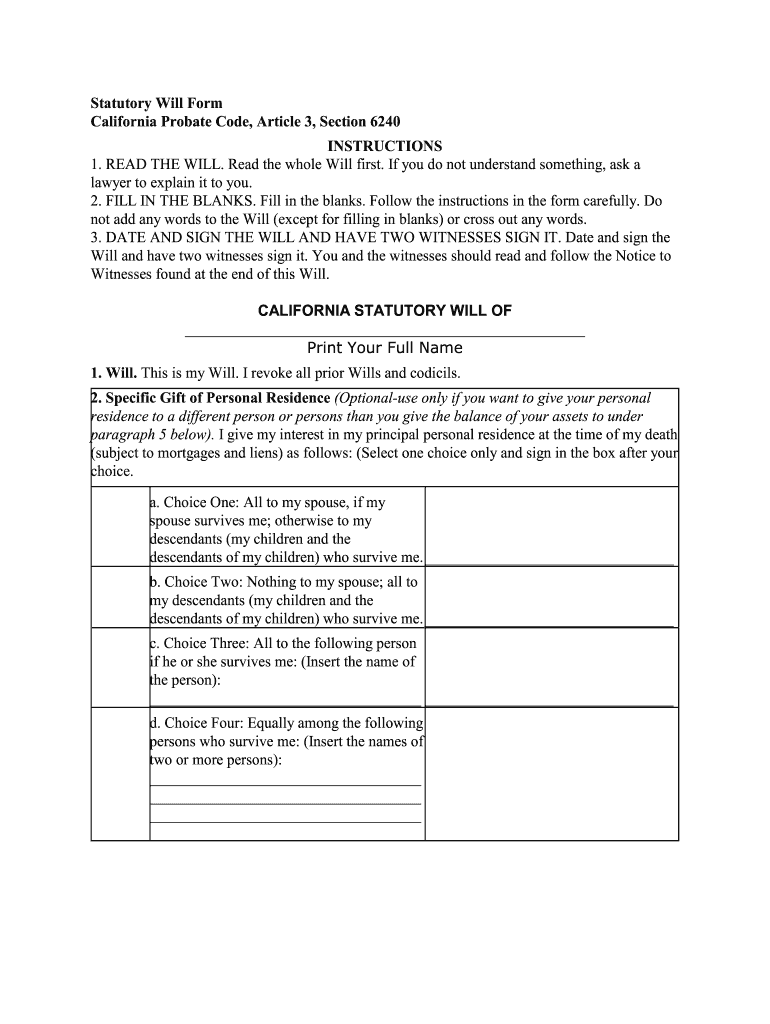

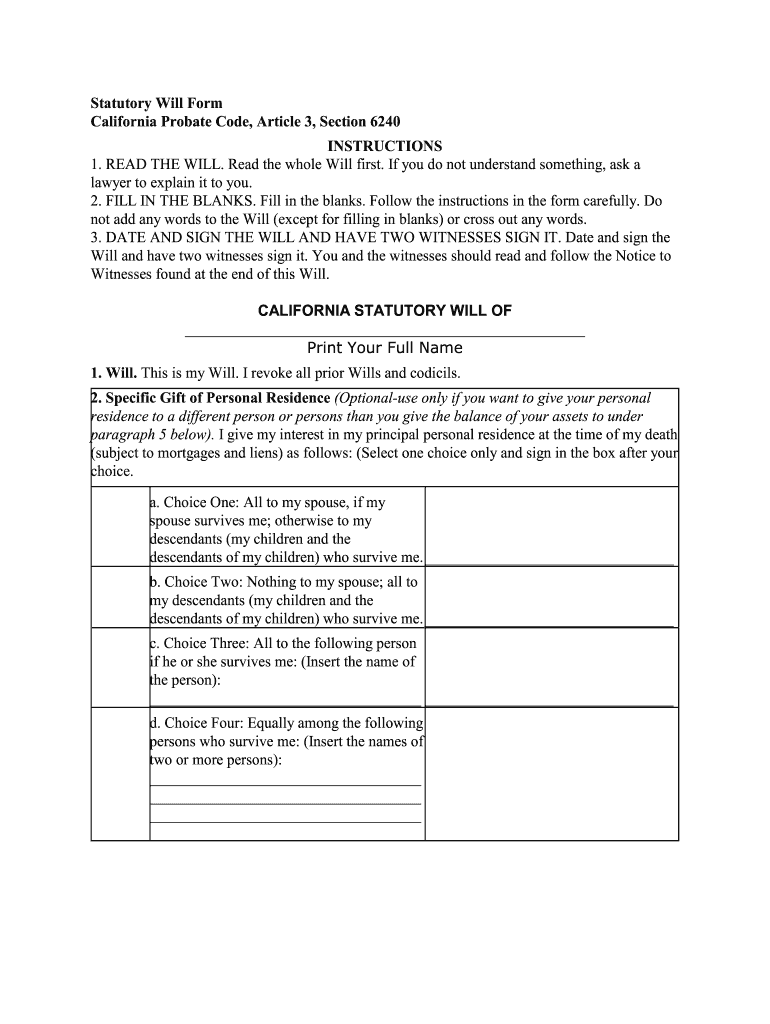

What is california probate code section?

The California Probate Code is a comprehensive set of laws that governs matters related to probate and estate administration in the state of California. It is divided into several sections, each addressing a specific topic within the probate process.

Here are some commonly referenced sections of the California Probate Code:

- Section 13006: Defines the order of priority for appointment as the personal representative (executor) of a decedent's estate when there is no valid will.

- Section 13050: Establishes the small estate affidavit procedure for estates with a gross value of $166,250 or less.

- Section 13100: Outlines the process of collecting a decedent's personal property valued at $166,250 or less without the need for formal probate administration.

- Section 13101: Expands the simplified procedure for collecting a decedent's property to include estates valued at $166,250 or less, excluding liens and encumbrances.

- Section 13500: Defines the process of petitioning for the appointment of a conservator to manage the personal and financial affairs of an incapacitated adult.

- Section 16061: Imposes a duty on the trustee of a revocable living trust to provide a notice of trust administration to specified beneficiaries within a specified timeframe.

- Section 17200: Provides a mechanism for interested persons to petition the court concerning any matter relating to a trust, including its validity, interpretation, or administration.

- Section 21350: Establishes rules regarding gifts and inheritances made to caregivers, fiduciaries, and individuals with a close relationship to the decedent, known as the "caregiver/fiduciary presumption."

- Section 8500: Pertains to the administration of charitable trusts and the duty of the Attorney General to enforce charitable purposes.

Please note that the California Probate Code is subject to change, and it is advisable to consult the most recent version of the code or seek legal counsel for specific legal questions or concerns.

Who is required to file california probate code section?

California Probate Code Section 13006 requires a personal representative or executor of an estate to file a probate petition with the court. This typically applies when someone passes away and their estate needs to go through the probate process in California.

How to fill out california probate code section?

To fill out California Probate Code section, you would need to follow these steps:

1. Start by downloading or obtaining a copy of the California Probate Code, which is available online or can be obtained from legal libraries or bookstores.

2. Identify the specific section you need to fill out. The California Probate Code is divided into various sections, each covering different aspects of probate and estate administration. Find the relevant section that you need to work on.

3. Read and understand the specific section you are dealing with. It is important to carefully review the section's language, requirements, and any relevant instructions or definitions. Familiarize yourself with the purpose and scope of the section.

4. Gather all the necessary information needed to fill out the section. Depending on the section, you may need various documents, such as legal forms, financial records, asset inventories, or beneficiary information. Make sure you have everything ready before proceeding with the filling process.

5. Carefully complete the required form or document associated with the section. Pay attention to any specific instructions, formatting requirements, or mandatory information requested. Provide accurate and complete information, ensuring that all fields are filled out correctly.

6. Review the filled-out section and the associated document for accuracy and completeness. Double-check all the information provided, ensuring there are no errors or omissions. Make sure the section is appropriately filled out according to the instructions and requirements of the California Probate Code.

7. If necessary, seek legal advice or assistance. The probate process can be complex, and it is always wise to consult an attorney or a legal professional if you have any doubts or concerns regarding the filling-out process. They can provide guidance, review your completed section, and offer appropriate advice based on your specific situation.

8. Once you are confident that the section is accurately completed, sign and date the document as required. Keep a copy for your records and file the original according to the relevant procedures and timelines outlined in the California Probate Code.

Remember, the process of filling out a specific section of the California Probate Code may vary depending on the section and the circumstances surrounding your case. It is important to thoroughly read and understand each section, gather the necessary information, and follow any specific instructions or requirements outlined in the code.

What is the purpose of california probate code section?

The purpose of the California probate code section is to establish laws and procedures for the administration of estates and the distribution of assets after the death of a person. It provides guidelines on how to handle probate matters, including the appointment of personal representatives or executors, determination of heirship, inventory and appraisal of estate assets, payment of debts and taxes, and distribution of the remaining property to beneficiaries. The code aims to ensure a fair and efficient process for settling the affairs of deceased individuals and protecting the rights of all parties involved.

What information must be reported on california probate code section?

California Probate Code Section requires the following information to be reported in a probate case:

1. The decedent's name, date of death, and place of residence.

2. The names and addresses of all known heirs, beneficiaries, and interested parties.

3. A description and estimated value of all property owned by the decedent at the time of death, including real estate, personal property, bank accounts, stocks and bonds, and any other assets.

4. Any debts or liabilities of the decedent, including outstanding loans, mortgages, and unpaid taxes.

5. The names and addresses of any creditors or claimants against the estate.

6. A statement of the proposed distribution of the estate assets among the heirs or beneficiaries.

7. The appointment and qualifications of the executor or administrator of the estate.

8. Any other relevant information necessary to administer the estate, such as the need to sell or distribute specific assets, resolve disputes, or pay any outstanding debts.

It is important to note that the specific reporting requirements may vary depending on the circumstances of each individual probate case.

What is the penalty for the late filing of california probate code section?

The penalty for the late filing of California Probate Code Section can vary depending on the specific circumstances and the actions taken by the court. However, generally, the court has the authority to impose a variety of penalties for late filing, including:

1. Denial of certain claims or petitions: The court may refuse to consider or accept a late-filed claim or petition.

2. Reduction or denial of compensation: The court can reduce or deny compensation to the personal representative or attorney for the estate due to the late filing.

3. Additional court supervision and oversight: The court may increase its level of supervision and require more frequent reporting or appearances by the personal representative.

4. Imposition of fines: The court has the discretion to impose fines or penalties on the personal representative for the late filing.

5. Removal of personal representative: In cases of persistent or severe delay, the court may remove the personal representative and appoint a successor.

It is important to consult with an attorney who specializes in probate matters to understand the specific penalties that may apply in your situation.

How do I execute california probate code section 6240 online?

pdfFiller has made it simple to fill out and eSign california probate code section 6240 form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make edits in california probate code 6240 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing california probate code 6240 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out california probate code section 6240 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign california probate code 6240 form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.