Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is usda refinance fact?

The USDA (United States Department of Agriculture) offers a unique refinancing program known as the USDA Refinance, also referred to as the USDA Streamline Refinance or USDA-to-USDA refinance. This program allows borrowers with existing USDA home loans to refinance their mortgages without going through a full appraisal or credit check process. The main purpose of the USDA Refinance program is to help borrowers in rural areas take advantage of reduced interest rates and lower their monthly mortgage payments. It is a simplified process to help eligible borrowers save money on their loans.

Who is required to file usda refinance fact?

The USDA Refinance Fact Sheet is required to be filed by the lender when they refinance a USDA loan.

How to fill out usda refinance fact?

To fill out the USDA refinance fact, follow these steps:

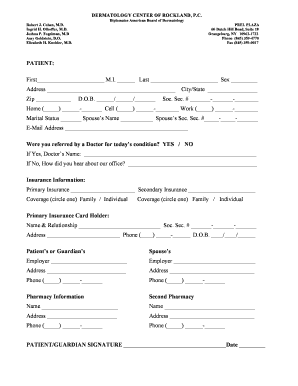

1. Begin by entering the date at the top of the form.

2. Fill in the borrower's name and social security number in the designated fields.

3. Provide the property address on the form, including street, city, state, and zip code.

4. Indicate the home phone number, mobile phone number, and email address of the borrower.

5. If applicable, provide the co-borrower's name, social security number, and contact information.

6. Specify the loan purposes by checking the appropriate box (e.g., refinance, purchase, construction).

7. Enter the new loan amount and the existing loan amount in the corresponding fields.

8. Include the interest rate on the existing and new loans.

9. Indicate the term of the new loan (number of months).

10. Provide the estimated value of the property.

11. On the "Household Members" section, list the names of all household members.

12. Indicate whether any of the household members are full-time students or disabled individuals.

13. Sign and date the form at the bottom to certify the accuracy of the information provided.

14. Finally, submit the completed USDA refinance fact form through the appropriate channels or to the relevant USDA office.

What is the purpose of usda refinance fact?

The USDA Refinance Fact aims to provide information and educate individuals about the USDA Refinance Program. This program, officially known as the USDA Streamline-Assist Refinance, allows homeowners with existing USDA mortgages to refinance their loans with reduced documentation and without an appraisal. The fact sheet ensures that borrowers are aware of the program's eligibility criteria, benefits, and requirements. It assists homeowners in understanding when and how they can take advantage of the USDA Refinance Program to potentially obtain lower interest rates or more favorable loan terms.

What information must be reported on usda refinance fact?

The USDA Refinance Fact Sheet is a document that provides information about the refinancing program offered by the United States Department of Agriculture (USDA). The specific information that must be reported on the fact sheet includes:

1. Program Overview: This section should provide a summary of the USDA's refinancing program and its purpose. It should outline eligibility requirements and any limitations or restrictions.

2. Interest Rates: The fact sheet should display the current interest rates for the USDA refinance program. This may also include information about adjustable rate mortgages or other rate options.

3. Loan Terms: The fact sheet should list the available loan terms for the USDA refinance program, including the repayment period (typically 15 or 30 years) and any specific conditions or requirements.

4. Eligibility Criteria: This section should outline the specific eligibility criteria for borrowers to qualify for the USDA refinance program. It should include information about income limits, credit requirements, and property eligibility.

5. Application Process: The fact sheet should explain the steps involved in applying for the USDA refinance program. It may provide information on required documentation, how to find a participating lender, and the timeline for approval and closing.

6. Benefits and Advantages: This section should highlight the benefits and advantages of the USDA refinance program. This may include features such as lower interest rates, reduced monthly payments, and the ability to finance closing costs.

7. Risks and Considerations: The fact sheet should also provide a balanced view by mentioning any potential risks or considerations associated with the USDA refinance program. This may include information about fees, prepayment penalties, and potential impacts on credit scores.

8. Contact Information: The fact sheet should include contact information for the USDA or relevant agency that can provide further assistance or answer any questions about the refinance program.

Please note that the exact content and format of the USDA Refinance Fact Sheet may vary, but it should generally cover these key areas to provide relevant information to borrowers.

What is the penalty for the late filing of usda refinance fact?

There is no specific penalty for the late filing of USDA refinance fact. However, it is important to file the necessary documents on time to avoid any delays or complications in the refinancing process. It is recommended to consult with a USDA-approved lender or the USDA Rural Development office for specific guidelines and requirements pertaining to refinance filings.

How can I send usda refinance fact to be eSigned by others?

When you're ready to share your refinance fact form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I execute refinance sheet form online?

pdfFiller has made filling out and eSigning usda refinance sheet form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How can I fill out fill refinance fact on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your usda refinance fact sheet form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.