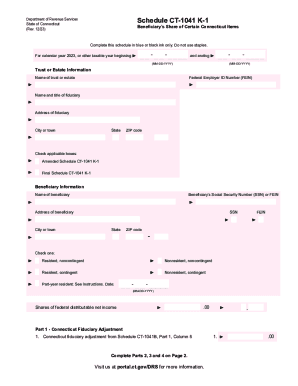

CT DRS Schedule CT-1041 K-1 2013 free printable template

Get, Create, Make and Sign

Editing form ct 1041 k online

CT DRS Schedule CT-1041 K-1 Form Versions

How to fill out form ct 1041 k

How to fill out form ct 1041 k:

Who needs form ct 1041 k:

Instructions and Help about form ct 1041 k

Hi there this is aardvark tax TV I'm Sean benefice an enrolled agent and customer service representative here at aardvark tax today we're going to talk about flow through entities and the schedule k-1 this video is part of a complete continuing education course available at our website w off tags comm in most cases when a single person or married couple owned a business they use the Schedule C to report their income but when a taxpayer partners to do business with someone else or much other someone else's or requires liability protection there's no longer an easy way to report the income that new entity generates to facilitate tax computation for these multi taxpayer conglomerates the IRS recognizes several kinds of entities for tax purposes these entities include things like partnerships corporations and trusts a partnership is an arrangement where two or more taxpayers do business together and split the proceeds each person contributes money property labor or skill and expects to share in the profit and losses of the business some states require entity registration for partnerships which allows for limits of liability, but the IRS does not require these kinds of things for partnerships the IRS does require however that partnerships fill out a separate 1165 tax return in addition to the 1040 tax returns that the partners individually provide partners in a partnership are not employees and should not receive w-2s or be on payroll instead all income that is generated to the partner through the partnerships flow to the individuals tax return through a storm call to schedule k-1 we'll talk more about k ones in a moment if your partner in a partnership you're going to have to pay self-employment tax like you would with a Schedule C a corporation is a separate legal entity that has been incorporated at the state level through a registration process established by law incorporated entities have legal rights and liabilities that are distinct from employees and shareholders and may conduct businesses either profit seeking businesses or as a not for profit seeking business in addition to legal personality the richest corporations tend to have limited liability be owned by shareholders who can transfer their shares to others and are controlled by a board of directors who are normally elected or appointed by the shareholders there are two kinds of corporations the traditional c corporation and the more recent S corporation both corporations register at the state level and receive benefits such as limited liability but the way the corporations are taxed are different C corporations are taxed separately from their owners receive income from the C Corp in the form of dividends most major companies and many smaller companies are treated as C corporations for US federal tax income purposes there is a downside to being a C Corp from a tax perspective income for a C Corp is taxed at the corporate level than again at the individual level for owners when they...

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form ct 1041 k online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.