Get the free 1040 (1994) - Tax History Project

Show details

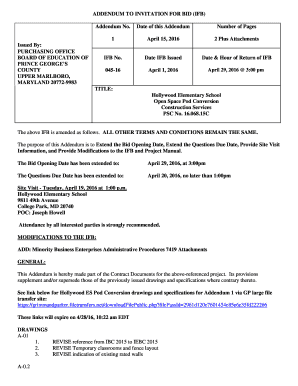

Form 1040 Department of the Treasury Internal Revenue Service U.S. Individual Income Tax Return (99) For the year Jan. 1 Dec. 31, 1994, or other tax year beginning Label L A B E L (See instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 1040 1994 - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1040 1994 - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1040 1994 - tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 1040 1994 - tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

How to fill out 1040 1994 - tax

How to fill out 1040 1994 - tax:

01

Gather all necessary documents, including W-2 forms, 1099 forms, and any other relevant financial information for the tax year 1994.

02

Start by filling out your personal information on the top section of the form, including your name, address, and social security number.

03

In the next section, provide information about your filing status. Choose the appropriate option from the available choices, which include single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

04

Indicate any exemptions you are claiming in the following section. This may include yourself, your spouse, and any dependents you have.

05

Calculate your total income for the tax year 1994. Include income from all sources, such as wages, dividends, interest, and self-employment income. Report each type of income in the corresponding sections of the form.

06

Deduct any adjustments to income that apply to you, such as contributions to an individual retirement account (IRA) or student loan interest paid.

07

Determine your taxable income by subtracting your total deductions from your total income. Use the tax tables or the tax rate schedules provided in the form's instructions to calculate your tax liability.

08

Claim any tax credits you qualify for, such as the earned income credit or the child tax credit. Fill out the applicable sections and follow the instructions to calculate the amount of credit you can claim.

09

Calculate your total tax liability by subtracting any applicable credits from your tax liability calculated in step 7.

10

Determine how much tax you have already paid for the tax year 1994, considering taxes withheld from your paycheck or any estimated tax payments made.

11

Compare the total tax liability calculated in step 9 with the total tax paid in step 10. If you have overpaid, you may be entitled to a refund. If you owe additional tax, you will need to pay the amount due.

12

Sign and date the form. If filing jointly, make sure your spouse also signs the form.

13

Make a copy of the filled-out 1040 1994 for your records before submitting it by mail or electronically, depending on the filing method allowed for that tax year.

Who needs 1040 1994 - tax:

01

Individuals who earned income or had income tax withheld during the tax year 1994 are required to file a tax return, using the appropriate form such as 1040.

02

Taxpayers who had self-employment income exceeding a certain threshold in 1994 may also need to file a tax return using the 1040 form.

03

Individuals who received Form 1099 reporting income, such as interest, dividends, or self-employment income, may be required to file a tax return using the 1040 form.

04

Taxpayers who qualify for certain tax credits or deductions in 1994, such as the earned income credit or the child tax credit, may need to file a 1040 form to claim these credits.

05

Married couples who opted for married filing separately instead of jointly for the tax year 1994 may need to file separate 1040 forms.

06

Individuals who owe taxes or expect a refund for the tax year 1994 should file a tax return using the appropriate form, including the 1040 form, to settle their tax obligations with the IRS.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1040 - tax history?

1040 - tax history is a form used by individuals to file their income tax returns with the Internal Revenue Service (IRS) in the United States.

Who is required to file 1040 - tax history?

Any individual whose income meets certain criteria set by the IRS is required to file 1040 - tax history. This includes both residents and non-residents of the United States.

How to fill out 1040 - tax history?

To fill out 1040 - tax history, you need to gather information about your income, deductions, and credits. Then, you can either fill out the form manually or use tax software or online platforms to complete and submit it.

What is the purpose of 1040 - tax history?

The purpose of 1040 - tax history is to report your income, claim deductions and credits, and calculate your tax liability or refund for the tax year.

What information must be reported on 1040 - tax history?

On 1040 - tax history, you must report your income from various sources, such as wages, self-employment, investments, and other taxable income. You also need to report your deductions, credits, and personal information.

When is the deadline to file 1040 - tax history in 2023?

The deadline to file 1040 - tax history in 2023 is typically April 15th, unless it falls on a weekend or holiday. However, it is always recommended to check with the IRS for any changes or extensions to the deadline.

What is the penalty for the late filing of 1040 - tax history?

The penalty for the late filing of 1040 - tax history is generally a percentage of the unpaid tax amount. The exact penalty amount can vary depending on the reason for the delay and the duration of the delay. It is recommended to file your taxes on time to avoid any penalties.

How do I modify my 1040 1994 - tax in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your 1040 1994 - tax along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send 1040 1994 - tax to be eSigned by others?

When you're ready to share your 1040 1994 - tax, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit 1040 1994 - tax on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share 1040 1994 - tax on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your 1040 1994 - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.