WI Form CV-424 2011 free printable template

Show details

STATE OF WISCONSIN, CIRCUIT COURT, COUNTYEarnings Garnishment Debtor's AnswerCreditor:

Debtor:

and Case No. Garnishee:To the garnishee/employer:

1. My earnings are completely exempt from earnings

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI Form CV-424

Edit your WI Form CV-424 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI Form CV-424 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI Form CV-424 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit WI Form CV-424. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI Form CV-424 Form Versions

Version

Form Popularity

Fillable & printabley

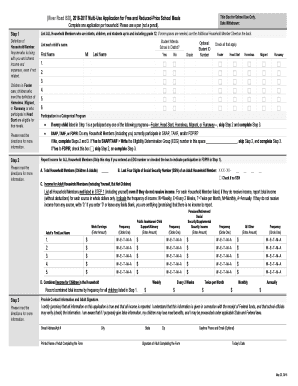

How to fill out WI Form CV-424

How to fill out WI Form CV-424

01

Obtain the WI Form CV-424 from the appropriate state website or local office.

02

Review the instructions provided on the form carefully.

03

Fill in your personal information including your name, address, and contact details.

04

Provide relevant case information or identifiers as required on the form.

05

Carefully answer all questions asked on the form, ensuring accuracy.

06

Sign and date the form at the designated area.

07

Make a copy of the completed form for your records before submission.

08

Submit the form to the designated authority either by mail or in person as instructed.

Who needs WI Form CV-424?

01

Individuals filing for a court case or legal proceeding in Wisconsin.

02

Attorneys representing clients in need of the form.

03

Parties seeking to record specific information with the court system.

Fill

form

: Try Risk Free

People Also Ask about

How long does a garnishment last in VA?

A garnishment is good for 30, 60, 90 or 180 days, at the choice of the judgment-creditor. The garnished money is under the control of the court until the garnishment period is over.

How do I get out of a garnishment in Ohio?

Request a Court-Appointed Trustee Under Ohio law, you may be able to avoid wage garnishment if you enter into a trusteeship. Trusteeships can stop wage garnishment and prevent creditors from harassing you for payment. A trusteeship requires that you pay a percentage of your earnings to your court-appointed trustee.

How do I stop a wage garnishment after it starts in Ohio?

With your demand letter or notice, you will get a form titled “Payment to Avoid Garnishment.” Complete the form and return it to the creditor within 15 days and you can make periodic payments without having to go through the formal garnishment process.

What is an order of garnishment in Ohio?

This order of garnishment of personal earnings is a continuous order that generally requires you to withhold a specified amount, calculated each pay period at the statutory percentage, of the judgment debtor's personal disposable earnings during each pay period, as determined in ance with the "INTERIM REPORT AND

How do I write an objection letter for wage garnishment?

The written objection should include: the case number (a unique set of numbers or letters specific to your case) your name, address, and phone number. a detailed explanation of your reasons for challenging the garnishment. a request for a hearing if the court has not already set a hearing date.

How do I respond to a garnishment summons in Virginia?

In Virginia, you have 21 days to file an answer, or respond to the lawsuit, if it's filed in a circuit court. If the suit is filed in a district court, you need to show up at the time on your summons prepared to prove your case. If you fail to answer or appear as directed, a default judgment may be entered against you.

What is the answer of garnishee in Ohio?

A garnishee is liable to the judgment creditor for all money, property, and credits, other than personal earnings, of the judgment debtor in the garnishee's possession or under the garnishee's control or for all personal earnings due from the garnishee to the judgment debtor, whichever is applicable, at the time the

What are the garnishment rules in Ohio?

The total amount garnished cannot be more than 25% of the employee's monthly disposable earnings. Exemptions from garnishment, including, but not limited to, worker's compensation, unemployment compensation, disability payments, OWF payments, or child support or spousal support, and most pensions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify WI Form CV-424 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including WI Form CV-424. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an eSignature for the WI Form CV-424 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your WI Form CV-424 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out the WI Form CV-424 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign WI Form CV-424 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is WI Form CV-424?

WI Form CV-424 is a tax form used in Wisconsin for reporting certain business-related transactions and income.

Who is required to file WI Form CV-424?

Businesses operating in Wisconsin that meet specific income thresholds or engage in certain activities related to sales and use tax are required to file WI Form CV-424.

How to fill out WI Form CV-424?

To fill out WI Form CV-424, follow the instructions provided on the form, including entering relevant business information, reporting income, and detailing any deductions or credits.

What is the purpose of WI Form CV-424?

The purpose of WI Form CV-424 is to assist Wisconsin taxpayers in reporting their business income and calculating their potential tax liabilities accurately.

What information must be reported on WI Form CV-424?

Information that must be reported on WI Form CV-424 includes business identification details, reported income, applicable deductions, and any sales tax obligations.

Fill out your WI Form CV-424 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI Form CV-424 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.