A common requirement of many states is that tax-exempt vehicles be listed on a state's vehicle registration. Many states request that tax-exempt vehicles be registered with the state. See the links below for the requirements for each state. Click on the state name in the menu to read the requirements for that state.

Click on the state name in the menu to read the requirements for that state. Check with your state department of revenue if this is not the case for your state. To learn how your state makes use of this form, download the checklist from the page to the right. If you do not own a vehicle with an identifying number listed above, you should not include it on these reports in either state. If there are other exemptions or restrictions, we need this information to verify those. You can still submit the forms in the other states that allow exemptions, but will have to include the exemptions on the report. We do not need the exemptions for: Tax exemptions from a federal tax code (e.g. 501(c)) (see exemptions section below)

) (see exemptions section below) Tax deductions, such as for charitable contributions

Payments that only relate to certain types of travel, such as student assistance, Social Security payments and military allowances

Payments for meals, lodging, tickets and parking for which you receive reimbursement or benefit from the IRS, or the individual or employer

You may be required to include the following exemptions on the return if you do not have the corresponding exemption from your state: Medical Care / Deduction

Housing or Medical Expenses / Reducibility You MUST also file the forms on paper in the correct place. If your filing status is married filing separately, separate returns are preferred, but this is not required. The forms should be filed in the name of the owner and not an executor. They must be filed on the first page and completed completely. We will need all the information that is contained in the form to verify your income for federal tax purposes. We do not need any additional information. For complete instructions for using the forms on the right page, click here.

WA FT-441-004 2014-2024 free printable template

Show details

Click here to START or CLEAR, then hit the TAB buttoning/IRP Individual Trip Report

Use this form to report mileage and fuel information for each trip. Keep completed reports for your records and

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ifta individual get form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ifta individual get form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ifta individual get online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form irp report form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Fill form ifta trip form : Try Risk Free

People Also Ask about ifta individual get

How do I get my IFTA stickers in NC?

How do I get an IFTA in Texas?

What is the IFTA 100 MN form?

How do I get my IFTA in Minnesota?

How do I get a PA IFTA sticker?

What is the meaning of IFTA?

How much does it cost to get an IFTA in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ifta individual get?

IFTA stands for International Fuel Tax Agreement, which is an agreement between the United States and Canada to simplify the reporting of fuel taxes by interstate motor carriers. It is a tax collection and distribution mechanism used by individual motor carriers to pay fuel taxes based on the distance traveled in each participating jurisdiction. The IFTA individual gets a quarterly fuel tax report that shows the amount of fuel purchased and the distance traveled in each jurisdiction, allowing them to calculate the amount of tax owed or refund due.

Who is required to file ifta individual get?

IFTA, or the International Fuel Tax Agreement, is a program that ensures equitable distribution of fuel taxes paid by interstate motor carriers. It is a tax reporting system used by motor carriers operating in multiple jurisdictions within the United States and Canada.

Under the IFTA requirements, individual motor carriers who operate qualified motor vehicles (commercial vehicles exceeding 26,000 pounds gross vehicle weight or having three or more axles) must file quarterly fuel tax reports. These reports summarize the fuel use by jurisdiction and calculate the amount of fuel tax owed or refunded.

So, it is the individual motor carriers who are required to file IFTA reports, not individuals in general.

How to fill out ifta individual get?

To fill out the IFTA Individual Get, follow these steps:

1. Begin by gathering all the necessary information and documents required for the IFTA Individual Get, including your personal and vehicle information, such as name, address, social security number, vehicle identification number (VIN), and license plate number.

2. Visit the official website of the International Fuel Tax Association (IFTA) or the respective governing agency in your jurisdiction to obtain the proper form. The specific form may vary depending on your location.

3. Start by entering your personal information in the designated spaces on the form, including your full name, address, phone number, and social security number.

4. Move on to the vehicle information section of the form. Provide the details of the vehicle(s) you operate, including the VIN, license plate number, make, model, and year.

5. Fill in the mileage information for each jurisdiction you operated in during the reporting period. This includes both the miles traveled and the taxable miles, which are typically calculated by subtracting the distance traveled in non-jurisdictional areas (e.g., out-of-state or non-taxable miles) from the total miles driven.

6. Calculate the fuel consumption for each jurisdiction based on the fuel receipts you have for the reporting period. This usually involves recording the total number of gallons purchased and the total number of miles driven in each jurisdiction.

7. Convert the fuel consumption to gallons per mile to determine the fuel efficiency for each jurisdiction. This is typically done by dividing the total gallons purchased by the total miles driven.

8. Finally, double-check all the information you have entered on the form for accuracy. Ensure that all the necessary fields are completed and that all calculations are correct.

9. Sign and date the form, certifying that all the information provided is accurate and complete.

10. Keep a copy of the completed IFTA Individual Get form for your records, and submit the original form to the appropriate IFTA office or governing agency as instructed. It is important to file the form by the designated deadline to avoid any penalties or fines.

Note: The steps listed here provide a general overview of the process, but it's crucial to consult the specific instructions and guidelines provided by your jurisdiction's IFTA office or governing agency to ensure compliance with their particular requirements.

What is the purpose of ifta individual get?

The purpose of IFTA (International Fuel Tax Agreement) individual get is to allow individual drivers and owners of commercial vehicles to report and pay their fuel taxes in a convenient and streamlined manner. IFTA is an agreement among U.S. states and Canadian provinces that simplifies the reporting and distribution of fuel tax payments for motor carriers operating in multiple jurisdictions. By using IFTA, individual drivers and owners can avoid the need to file separate fuel tax returns in each state or province they operate, saving time and effort.

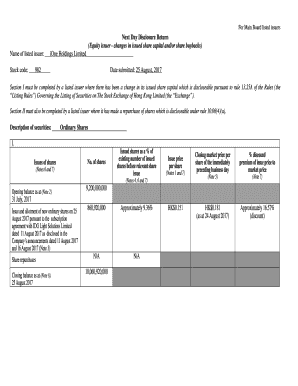

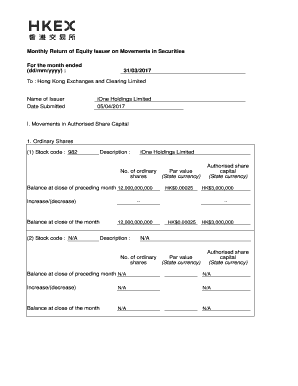

What information must be reported on ifta individual get?

When reporting for the International Fuel Tax Agreement (IFTA), the following information must be provided:

1. Distance Traveled: The total distance traveled in each member jurisdiction, which includes both taxable and nontaxable miles.

2. Fuel Consumption: The total amount of fuel consumed in each member jurisdiction, reported in gallons or liters.

3. Miles Per Gallon (or Liters): The average fuel mileage of the vehicle in each member jurisdiction, calculated by dividing the distance traveled by the fuel consumed.

4. Tax Paid Fuel Purchases: The total amount of fuel purchased in each member jurisdiction on which fuel taxes have been paid. This includes both taxable and nontaxable fuel.

5. Tax Exempt Fuel Purchases: The total amount of fuel purchased in each member jurisdiction that is exempt from fuel taxes. This includes fuel used for non-taxable purposes such as government use or off-road use.

6. Total Miles: The total distance traveled by the vehicle in all member jurisdictions during the reporting period.

7. Total Gallons/Liters: The total amount of fuel consumed by the vehicle in all member jurisdictions during the reporting period.

8. Taxes Payable: The amount of fuel tax owed to each member jurisdiction based on the fuel consumed and the tax rates of that jurisdiction.

It is important to note that the exact requirements for reporting may vary by jurisdiction, and it is advisable to consult the specific reporting guidelines provided by each member jurisdiction's tax authority.

When is the deadline to file ifta individual get in 2023?

The deadline to file IFTA (International Fuel Tax Agreement) reports for individuals in 2023 would depend on the specific jurisdiction and the rules set by the International Fuel Tax Association (IFTA). Each jurisdiction may have its own due date for filing IFTA reports. It is recommended to check with your local jurisdiction's tax department or IFTA official website for the exact deadline in 2023.

What is the penalty for the late filing of ifta individual get?

The penalty for the late filing of IFTA (International Fuel Tax Agreement) varies depending on the jurisdiction. Each state or province has its own regulations regarding IFTA reporting and penalties. Generally, a late filing penalty will result in a monetary fine based on a percentage of the taxes due. Additionally, interest may be charged on any unpaid amounts. It's important to consult specific state or province regulations for accurate and up-to-date information on IFTA penalties.

How do I edit ifta individual get on an iOS device?

Create, modify, and share form irp report form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete ifta trip report on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your wa form trip template by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Can I edit form ifta irp on an Android device?

With the pdfFiller Android app, you can edit, sign, and share wa form trip on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your ifta individual get form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ifta Trip Report is not the form you're looking for?Search for another form here.

Keywords relevant to ifta trip form

Related to washington form ifta irp

If you believe that this page should be taken down, please follow our DMCA take down process

here

.