MD DNR B-240 2014-2024 free printable template

Show details

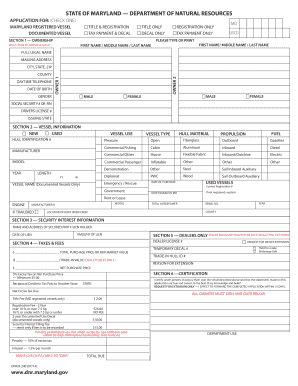

See reverse Penalty 10 of excise tax Interest 1. 5 per month MAKE CHECK PAYABLE TO DNR DNR B-240 07/14 www. STATE OF MARYLAND DEPARTMENT OF NATURAL RESOURCES APPLICATION FOR CHECK ONE MARYLAND REGISTERED VESSEL DOCUMENTED VESSEL TITLE REGISTRATION TAX PAYMENT DECAL TITLE ONLY DECAL ONLY SECTION 1 OWNERSHIP REGISTRATION ONLY TAX PAYMENT ONLY PLEASE TYPE OR PRINT FIRST NAME / MIDDLE NAME / LAST NAME Attach sheet for additional owners MD USCG FULL LEGAL NAME MAILING ADDRESS CITY STATE ZIP...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your dnr b240 2014-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dnr b240 2014-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dnr b240 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit maryland form b240. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

MD DNR B-240 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out dnr b240 2014-2024 form

How to Fill Out Maryland Form B240:

01

Gather all necessary information: Before beginning to fill out Maryland Form B240, make sure you have all the required information. This includes your personal details such as your full name, address, Social Security number, and date of birth, as well as any relevant financial information.

02

Review the instructions: Take the time to carefully read and understand the instructions provided with Maryland Form B240. This will help ensure that you accurately complete the form and provide all the necessary information.

03

Fill out Section A: Start by filling out Section A of Maryland Form B240. This section requests your personal information, including your name, address, and Social Security number. Be sure to provide accurate and up-to-date information.

04

Provide the required details: In Section B of the form, you will need to provide details about your income and deductions. This includes information about your wages, tips, and other income, as well as any deductions or adjustments you may qualify for. Carefully follow the instructions and accurately report this information.

05

Complete Section C: Section C of Maryland Form B240 requires information regarding your exemptions. Determine the number of exemptions you are claiming based on your personal circumstances and enter this information in the appropriate fields.

06

Review your form: Once you have completed all the necessary sections of Maryland Form B240, take the time to review your form. Double-check for any errors or omissions and make sure all the information is accurate and complete.

07

Sign and date the form: Finally, sign and date the completed Maryland Form B240. Failure to sign the form may result in processing delays or the rejection of your application.

Who Needs Maryland Form B240:

01

Maryland residents: Maryland Form B240 is required for all Maryland residents who need to file their state income taxes. It is used to report your income, deductions, exemptions, and other relevant information for tax assessment purposes.

02

Individuals with Maryland income: If you earned income from sources within the state of Maryland, you will need to fill out Maryland Form B240. This applies to both residents and non-residents who generated income from Maryland sources.

03

Those who meet the filing requirements: Maryland Form B240 is necessary for individuals who meet the state's filing requirements. These requirements may vary depending on your filing status, age, and income level. It is recommended to consult the instructions or a tax professional to determine if you are required to file this form.

Fill vessel maryland registered : Try Risk Free

People Also Ask about dnr b240

What are the requirements for boat registration numbers in Maryland?

What must have a Maryland certificate of vessel number to operate on Maryland public waters?

What vessels are required to be registered in Maryland?

What is required to operate a boat in Maryland?

How do I get a title for a boat without a title in Maryland?

What must be done before a boat can be issued a Maryland vessel number?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out maryland form b240?

Maryland Form B240, Application for a Certificate of Title, is an application for a vehicle title that must be completed in full and signed by all owners listed on the title. It requires information such as vehicle information, owner information, lienholder information, and a $50.00 fee for the title. The form also requires proof of identity, such as a valid driver's license or other government-issued ID. It must be submitted to the Motor Vehicle Administration in person or by mail.

What is the purpose of maryland form b240?

Maryland Form B240 is a state income tax form for Maryland residents. It is used to report income, deductions, and credits to calculate tax liability.

What information must be reported on maryland form b240?

Form B240 is a filing form for the Maryland Department of Assessments and Taxation. This form must be completed in order for a business entity to register with the Maryland Department of Assessments and Taxation. Information required on Form B240 includes the business name, entity type, address, registered agent information, owner information, purpose of the business, and other related information.

When is the deadline to file maryland form b240 in 2023?

The due date for filing Maryland Form B240 in 2023 is April 15, 2023.

What is the penalty for the late filing of maryland form b240?

The penalty for the late filing of Maryland Form B240 is a penalty of 5% of the amount due for each month or partial month that the return is late, up to a maximum of 25% of the amount due.

What is maryland form b240?

Maryland Form B240 is a tax form used by residents of Maryland to claim a credit for taxes paid to other states. The form is used to determine the amount of credit that can be applied to the Maryland state tax liability for income that was earned in another state and subject to taxation there as well. This credit helps prevent double taxation for individuals who earn income in multiple states.

Who is required to file maryland form b240?

Maryland Form B240 is used for the Business Personal Property Return, which is required to be filed by all businesses operating in Maryland that own personal property used in their business. This includes individuals, partnerships, corporations, limited liability companies (LLCs), and other business entities.

How can I manage my dnr b240 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your maryland form b240 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I fill out the dnr 240 md form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign dnr form b 240. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete dnr b 240 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your dnr 240 md form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your dnr b240 2014-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dnr 240 Md Form is not the form you're looking for?Search for another form here.

Keywords relevant to dnr b 240 maryland form

Related to b 240 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.