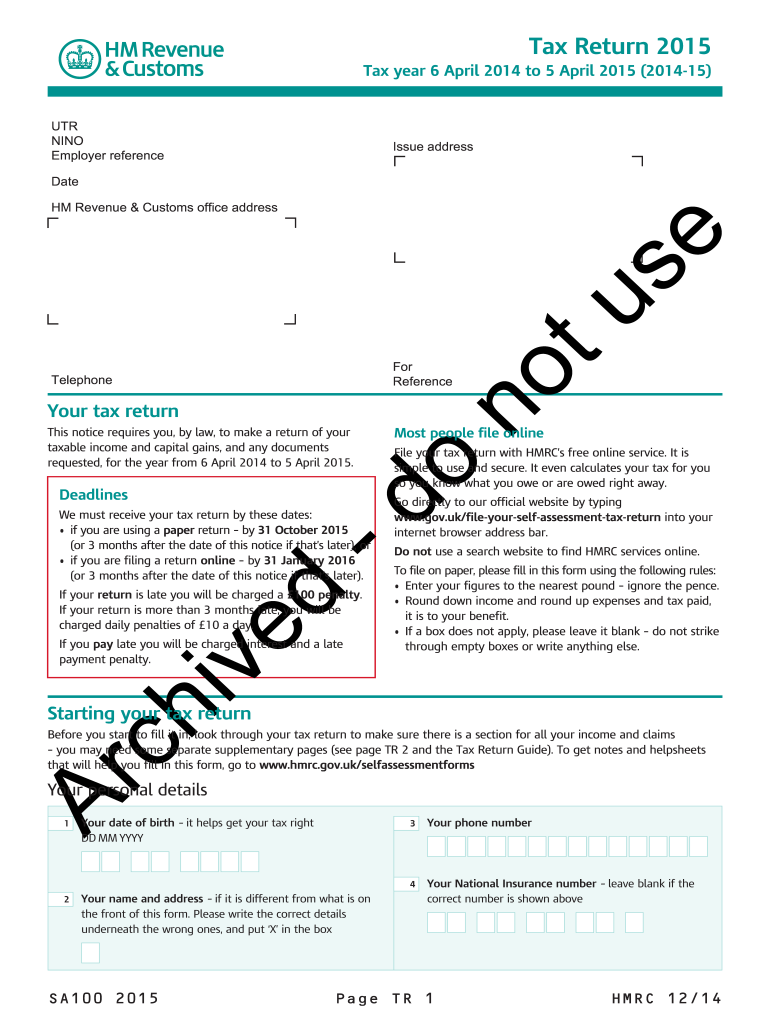

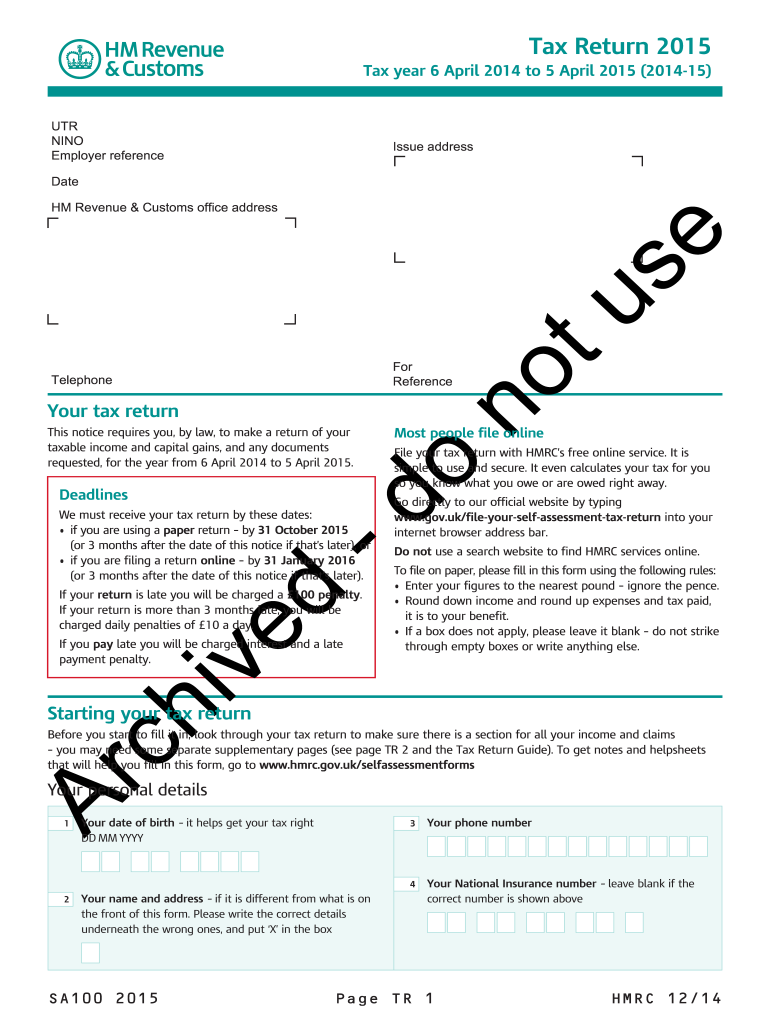

Get the free sa100 form

Get, Create, Make and Sign

How to edit sa100 form online

How to fill out sa100 form

How to fill out sa100 form?

Who needs sa100 form?

Video instructions and help with filling out and completing sa100 form

Instructions and Help about sa100 form

Watching a tax return being filled out is never going to be a YouTube sensation but the best way to judge something is to see it in action so in this video I'm going to step through a complete return and point out some key features of ABC along the way I'm going to start by using the next button and in fact I'm going to use that to set me through the entire process you may have noticed when I click that button the green box on this menu on the left which is a table of contents moves down to indicate the screen I'm now on as you can see the next entry in that menu is about you which has an icon on it which indicates that it is a subsection so when I click Next I step down into that section and can see where I am thanks to this indicator here now I've got to the beginning of the form itself I'm going to start by putting my name in for now I'm going to leave the UTC field empty let's say I haven't got it to hand, and I'm going to use the next button to move on as you can see the form alerts me to the fact that something's not right on the page in this case leaving a mandatory field blank, and it prompts me either to return to the screen, so I can fix it or to leave and come back later sometimes you don't have the appropriate information to hand, and it's not convenient to have to get it at that moment in time as we'll see later the format let me submit until I've fixed any errors, and we'll make it easy to come back and make the required change here I'm going to add an email address and I immediately get an error message if I forget to add the calm, so I fix that on this screen we see an example of ABC only showing parts of the form I need if I tick this box to say that my address has changed I get the address fields if I antic they go away again the next button has now brought us to what makes up your tax return section which is where this idea of the form adapting to my needs is particularly important for example if I take this first question to say that I need to complete employment pages you will see that the associated sub action appears in the table of contents if you're one of those people who don't like clutter and just wants to focus on the job in hand you can click on this button in the top right to hide the table of contents you can always bring it back by clicking again even if the table of contents is hidden the pages you need will still be being added behind the scenes, and you can use the next button to step through them all, so I'm going to keep it hidden and do just that for this return I'm not going to be self-employed or in partnership or have a UK property or have foreign income, but I will have trust income I don't need the other forms now we have reached the start of the SI 100 form itself, and I'm going to start by declaring some taxed UK interest you will see that instantly a running total of the tax calculation is displayed at the top at this moment I'm due a rebate as I progress through the form that total would be updated...

Fill sa100 2015 : Try Risk Free

People Also Ask about sa100 form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your sa100 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.