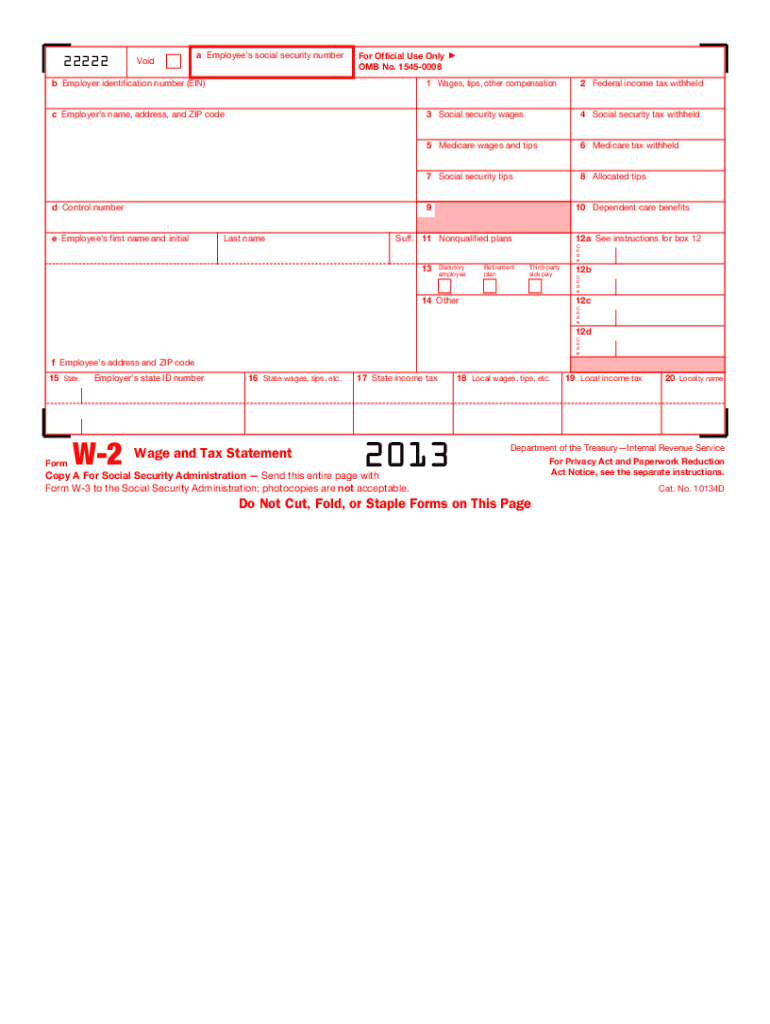

IRS W-2 2013 free printable template

Instructions and Help about IRS W-2

How to edit IRS W-2

How to fill out IRS W-2

About IRS W-2 2013 previous version

What is IRS W-2?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-2

What should I do if I realize there's an error on my IRS W-2 after submitting it?

If you discover an error on your IRS W-2 after submission, you should file a corrected W-2, also known as a W-2c. This form should include the accurate information, and it's essential to also notify the IRS and any relevant parties. Additionally, keep records of the correction process for your files.

How can I verify if the IRS has received my W-2?

To confirm that the IRS has received your W-2, you should check your account on the IRS website or contact their customer service. If you e-filed, you may receive confirmation of receipt. Keep an eye out for any notices that indicate processing issues.

What are the potential consequences if my W-2 submission gets rejected?

If your W-2 submission is rejected, you may face delays in processing your tax return, which could affect your refund timeline. The IRS typically sends a notice outlining the rejection reasons, allowing you to correct the form and resubmit it for approval.

Are there any specific privacy concerns I should consider when filing my IRS W-2 electronically?

When e-filing your IRS W-2, ensure you're using secure software that complies with IRS standards for data protection. Be wary of phishing scams and verify that your information is submitted through secure channels to protect your personal data.

What should I consider if I am filing a W-2 on behalf of another person?

If you are filing a W-2 on someone else's behalf, ensure you have the proper authorization, such as a power of attorney (POA). Understand the specific requirements for the taxpayer, and consider any implications for both parties regarding tax liability and privacy.

See what our users say