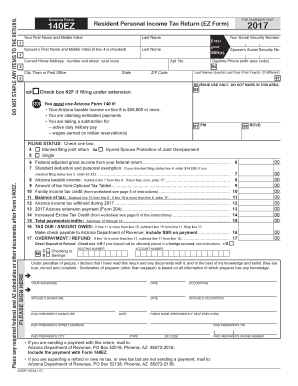

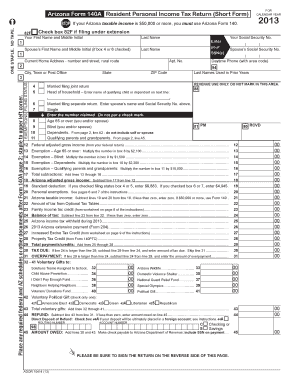

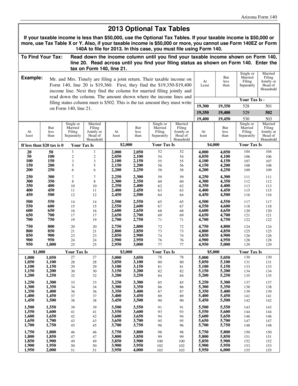

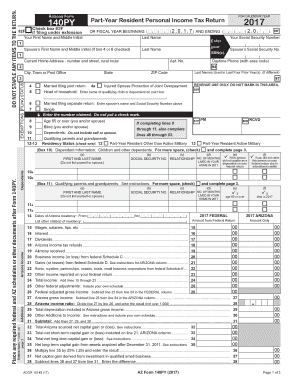

Get the free ARIZONA FORM 322 2013

Instructions and Help about arizona form

How to edit arizona form

How to fill out arizona form

Latest updates to arizona form

All You Need to Know About arizona form

What is arizona form?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about arizona form 322 2013

What should I do if I realize I made a mistake after submitting my arizona form 322 2013?

If you discover an error after submitting your arizona form 322 2013, you should submit an amended or corrected version of the form. This process usually involves providing an explanation of the changes made and submitting it to the same location as the original. It's essential to act promptly to avoid potential complications.

How can I check the status of my arizona form 322 2013 after submission?

To verify the receipt and processing status of your arizona form 322 2013, you can contact the relevant Arizona tax authority or use their online tracking system if available. Make sure to have your submission details ready for reference.

Are e-signatures acceptable when filing arizona form 322 2013?

Yes, e-signatures are generally accepted for most filings, including the arizona form 322 2013. However, it is recommended to review any specific instructions provided by the Arizona tax department regarding e-signature usage.

What should I do if I receive a notice after filing my arizona form 322 2013?

If you receive a notice or letter after filing your arizona form 322 2013, carefully read the correspondence for instructions. Prepare any required documentation and respond within the specified timeframe to address the issues raised.

What common errors should I avoid when submitting arizona form 322 2013?

Common errors when submitting arizona form 322 2013 include incorrect data entry and missing information. To avoid these, always double-check your entries against the guidelines, ensure that all necessary sections are completed, and verify that all supporting documents are included.