Get the free Liquor Return-Sample

Show details

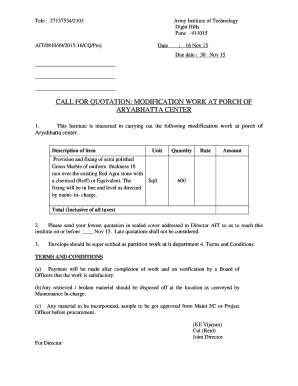

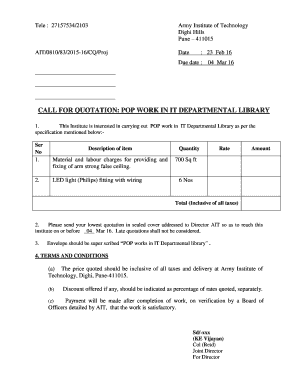

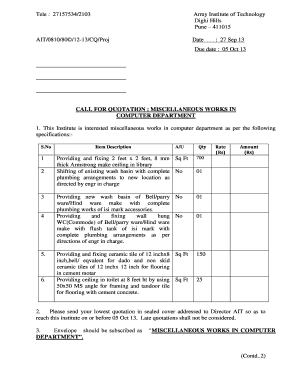

“In k County Department of Revenue. FOR THE ... Tax Due by beverage type (For each column multiply Line 6 by :-- I. (900me ... COOK COUNTY COLLECTOR.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your liquor return-sample form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your liquor return-sample form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing liquor return-sample online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit liquor return-sample. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out liquor return-sample

How to fill out liquor return-sample:

01

Obtain the necessary forms: Start by contacting the appropriate authority or organization to obtain the liquor return-sample forms. These forms typically include sections for providing information about your business and details about the liquor sales.

02

Gather the required information: Before filling out the liquor return-sample, make sure you have all the necessary information handy. This may include details about the types and volumes of liquor sold, sales dates, pricing information, and any taxes or fees applicable to your jurisdiction.

03

Complete the business information section: Begin by filling out the business information section of the liquor return-sample form. This typically includes your business name, address, contact details, and any license or permit numbers associated with your liquor sales.

04

Provide the liquor sales details: Proceed to the section where you are required to provide information about the liquor sales. This may involve entering the specific liquors sold, quantities, sales dates, and any relevant pricing information. Pay close attention to the form's instructions to ensure accurate and complete reporting.

05

Calculate taxes or fees: If applicable, calculate the taxes or fees associated with your liquor sales based on the provided guidelines. This may involve applying specific tax rates or calculating percentages based on the sale amounts. Double-check your calculations to avoid any errors.

06

Review and submit: Once you have filled out all the necessary sections and verified the accuracy of the information provided, review the completed liquor return-sample form. Ensure that all fields are correctly filled and there are no missing details. Finally, submit the form as instructed, either through mail, online submission, or in-person delivery.

Who needs liquor return-sample?

01

Liquor retailers: Liquor return-samples are typically required from businesses that sell liquor, such as liquor stores, bars, restaurants, and distributors. These businesses need to accurately report their liquor sales and related information to comply with regulatory requirements.

02

Government authorities: The liquor return-sample forms are usually requested by government authorities responsible for overseeing liquor sales and enforcing regulations. They use these forms to keep track of sales data, ensure compliance with tax laws, and monitor the liquor industry's overall operations.

03

Accountants or bookkeepers: Businesses often rely on accountants or bookkeepers to assist them in filling out and submitting liquor return-sample forms. These professionals help ensure accurate reporting and adherence to the necessary guidelines, saving businesses time and ensuring compliance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is liquor return-sample?

Liquor return-sample is a form used to report information related to liquor sales and inventory.

Who is required to file liquor return-sample?

Businesses that sell liquor are required to file liquor return-sample.

How to fill out liquor return-sample?

Liquor return-sample can be filled out manually or electronically, depending on the requirements of the governing authority.

What is the purpose of liquor return-sample?

The purpose of liquor return-sample is to track liquor sales, inventory, and ensure compliance with regulations.

What information must be reported on liquor return-sample?

Information such as total liquor sales, inventory levels, and any discrepancies must be reported on liquor return-sample.

When is the deadline to file liquor return-sample in 2023?

The deadline to file liquor return-sample in 2023 is typically determined by the governing authority and may vary depending on the jurisdiction.

What is the penalty for the late filing of liquor return-sample?

The penalty for the late filing of liquor return-sample may include fines, interest charges, and potential suspension of liquor license.

How can I send liquor return-sample to be eSigned by others?

When you're ready to share your liquor return-sample, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit liquor return-sample on an Android device?

You can edit, sign, and distribute liquor return-sample on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I complete liquor return-sample on an Android device?

Use the pdfFiller mobile app and complete your liquor return-sample and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your liquor return-sample online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.