AZ CSE-1129A 2015 free printable template

Show details

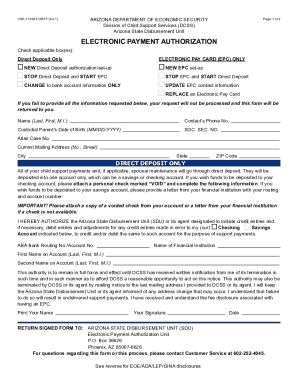

CSE-1129A FO RPF (4-15) ARIZONA DEPARTMENT OF ECONOMIC SECURITY Division of Child Support Services Arizona State Disbursement Unit ELECTRONIC PAYMENT AUTHORIZATION Check applicable box(BS): DIRECT

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ CSE-1129A

Edit your AZ CSE-1129A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ CSE-1129A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AZ CSE-1129A online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AZ CSE-1129A. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ CSE-1129A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ CSE-1129A

How to fill out AZ CSE-1129A

01

Start by downloading the AZ CSE-1129A form from the official website.

02

Read the instructions provided with the form carefully.

03

Fill in your personal information in the designated fields, including your full name, address, and contact details.

04

Provide any required identification numbers or social security numbers as prompted.

05

Detail the specific information or services you are requesting on the form.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form as instructed, either by mail, online, or in person based on the submission guidelines.

Who needs AZ CSE-1129A?

01

Individuals applying for certain state services in Arizona.

02

Residents seeking assistance or benefits that require formal application.

03

Anyone needing to provide information for state-related services or inquiries.

Fill

form

: Try Risk Free

People Also Ask about

What is Arizona form 210?

Use Form 210 to notify the Arizona Department of Revenue of a fiduciary relationship for a decedent's estate. A fiduciary for a decedent's estate may be any of the following: • an executor, • an administrator, • a personal representative, or • a person in possession of property of a decedent.

What is an Arizona form 140?

Form 140 - Resident Personal Income Tax Form -- Calculating Personal income tax return filed by resident taxpayers. You may file Form 140 only if you (and your spouse, if married filing a joint return) are full year residents of Arizona.

What is Arizona form 343?

343. Renewable Energy Production Tax Credit.

What is the Arizona State Solar tax credit 2023?

The state tax credit is valued at 25% of the total system cost, up to a maximum of $1,000 in total. Those who are eligible may claim the credit for up to five tax years, but the amount of the credit cannot exceed $1,000 total.

What is AZ form 343?

Arizona individuals, corporations, S corporations and partners in a partnership can claim a renewable energy production tax credit using a form 343. This document can be obtained from the website of the Arizona Department of Revenue.

What is Arizona form 323?

Arizona State income tax forms 301, 323, and 348 are used for claiming the Original and PLUS/Overflow Tuition Tax Credits. Form 335 is used in claiming the Corporate Tax Credit. You can retrieve Arizona tax forms from the Arizona Department of Revenue's website or click on the below links.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete AZ CSE-1129A online?

pdfFiller makes it easy to finish and sign AZ CSE-1129A online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit AZ CSE-1129A online?

With pdfFiller, the editing process is straightforward. Open your AZ CSE-1129A in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit AZ CSE-1129A on an iOS device?

Create, modify, and share AZ CSE-1129A using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is AZ CSE-1129A?

AZ CSE-1129A is a form used by the Arizona Department of Economic Security to report child support information and related data.

Who is required to file AZ CSE-1129A?

Individuals who are involved in child support cases, including custodial and non-custodial parents, are required to file AZ CSE-1129A.

How to fill out AZ CSE-1129A?

To fill out AZ CSE-1129A, gather all necessary information about income, expenses, and child support obligations, then complete each section of the form accurately before submitting it to the appropriate Arizona authority.

What is the purpose of AZ CSE-1129A?

The purpose of AZ CSE-1129A is to collect and report information regarding child support payments, ensuring compliance with child support orders and facilitating the proper management of cases.

What information must be reported on AZ CSE-1129A?

The information that must be reported on AZ CSE-1129A includes personal identification details, income information, expenses, and the specifics of any child support agreements or obligations.

Fill out your AZ CSE-1129A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ CSE-1129a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.