Nonprofit Organizations. Organizations in which no profit is made to the extent that the services they provide are not subject to income tax by the Internal Revenue Service.

Other Requirements

We may also grant an exemption if the organization demonstrates by careful analysis that it is not “primarily engaged in the ordinary and useful activities of a tax-exempt organization.” But that does not make the organization exempt.

There is no clear guideline for evaluating what qualifies as “the ordinary and useful activities of a tax-exempt organization.” But we do have a general rule for determining 501(c)(3) status: a major purpose of the organization's activities must be to advance social welfare. In general, social welfare includes the promotion of public health and safety and the preservation of the environment, and includes work directly related to a community's arts and cultural life.

The standard is not an absolute requirement, of course. However, if, for example, a social welfare organization engages in the distribution of literature, which is not primarily intended to advance public health or safety, it will not be likely considered social welfare and therefore not tax-exempt. However, this is not a blanket limitation. To be considered an “advancing of social welfare,” an organization must also include in its mission a significant proportion of its activities directly benefiting public health and safety. For tax purposes, this would mean that a social welfare organization seeking 501(c)(3) status must devote at least a large portion of its activities to efforts to prevent drug abuse, accidents, and other problems that are a direct result of the use of illegal drugs.

Organizations seeking to be exempt as a social welfare organization must meet the legal requirements of a 501.4(c)(3) organization. We consider these requirements to be satisfied when it can be shown that the organization serves the public interest and will not have a discriminatory impact on members of particular classes of people. In some cases, our requirements may be more rigorous than those required of other types of nonprofit organizations.

For example, to be considered a 501(c)(3) public charity, the organization must be devoted entirely to charitable purposes. However, it may provide certain tax-exempt activities for which it does not qualify as a public charity. For example, it may hold a benefit concert, in which ticket sales help offset its expenses.

Get the free FBR Matching Gifts Program Guidelines

Show details

Programs pursuing a purely doctrinal program. Ineligible Organizations. Organizations that do not have a valid 501(c)(3) public charity status or section 170(c) ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your fbr matching gifts program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fbr matching gifts program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

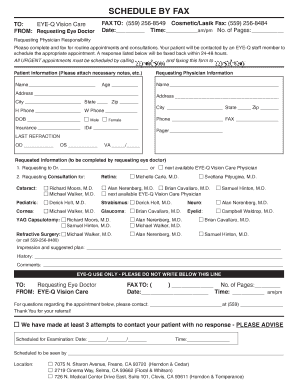

How to edit fbr matching gifts program online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fbr matching gifts program. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fbr matching gifts program?

The fbr matching gifts program is a program that allows employees to have their charitable contributions matched by their employer, typically on a dollar-for-dollar basis.

Who is required to file fbr matching gifts program?

Employers who have implemented a matching gifts program for their employees are required to file the fbr matching gifts program.

How to fill out fbr matching gifts program?

To fill out the fbr matching gifts program, employers need to gather information about the employee's charitable contributions and the corresponding matching amounts. This information is then reported on the required forms.

What is the purpose of fbr matching gifts program?

The purpose of the fbr matching gifts program is to encourage and support employee charitable giving by providing an incentive for employees to donate to eligible charities.

What information must be reported on fbr matching gifts program?

The fbr matching gifts program requires employers to report information about the employee's charitable contributions, the corresponding matching amounts, and any relevant documentation.

When is the deadline to file fbr matching gifts program in 2023?

The deadline to file the fbr matching gifts program in 2023 is typically April 15th, but it's recommended to consult the official guidelines or a tax professional for the exact deadline.

What is the penalty for the late filing of fbr matching gifts program?

The penalty for the late filing of the fbr matching gifts program can vary depending on the jurisdiction and specific circumstances. It's advisable to check the official guidelines or consult a tax professional for accurate information.

Where do I find fbr matching gifts program?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the fbr matching gifts program. Open it immediately and start altering it with sophisticated capabilities.

How do I edit fbr matching gifts program on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign fbr matching gifts program. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I edit fbr matching gifts program on an Android device?

You can make any changes to PDF files, like fbr matching gifts program, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your fbr matching gifts program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.