Get the free online california form 700 - fppc ca

Show details

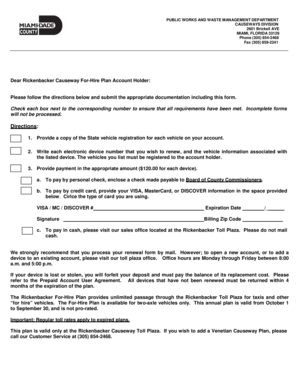

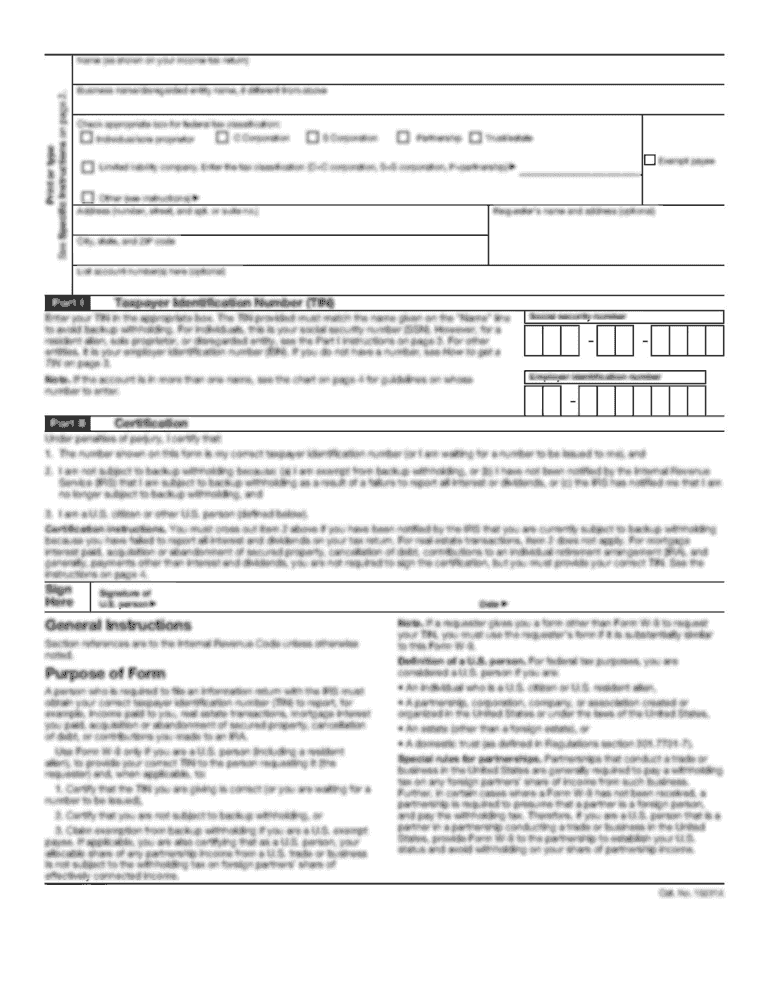

SCHEDULE C Income, Loans & Business Positions (Other than Gifts and Travel Payments) 1. INCOME RECEIVED NAME OF SOURCE OF INCOME 1. INCOME RECEIVED CALIFORNIA FORM Name 700 FAIR POLITICAL PRACTICES

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your online california form 700 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your online california form 700 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit online california form 700 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit online california form 700. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

How to fill out online california form 700

How to fill out online California Form 700:

01

Visit the California Fair Political Practices Commission (FPPC) website.

02

Locate the Form 700 section and click on the online filing option.

03

Create an account or log in if you already have one.

04

Provide the required personal information, such as your full name, contact information, and position or office you hold.

05

Fill out the various sections of the form accurately, including disclosing your sources of income, gifts, and investments.

06

Attach any necessary supporting documentation, such as schedules or attachments for additional details.

07

Review the form for completeness and accuracy before submitting it.

Who needs online California Form 700:

01

Public officials, government employees, and candidates for statewide office in California.

02

Appointed and elected officials at the local, county, and state levels.

03

Individuals who hold positions that involve decision-making authority or manage public funds.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is online california form 700?

The online California Form 700 is a document used to disclose and track a public official's financial interests as required by the Political Reform Act in the state of California. It is an electronic filing system that allows public officials to disclose their personal financial holdings, investments, business interests, and gifts received. The Form 700 helps ensure transparency and provides the public with information about potential conflicts of interest for public officials in California.

Who is required to file online california form 700?

California Form 700, also known as the Statement of Economic Interests, must be filed by public officials and designated employees in California who meet certain criteria or hold certain positions. This includes elected officers, top decision-makers, and certain employees of state, county, and city governments, as well as individuals appointed to various boards and commissions. The specific requirements may vary depending on the jurisdiction and the type of position held. It is recommended to consult the California Fair Political Practices Commission (FPPC) website or seek legal advice to determine if you are required to file Form 700.

How to fill out online california form 700?

Filling out the online California Form 700 requires following a few steps. Here is a general guide:

1. Access the Form: Visit the California Form 700 website (https://www.fppc.ca.gov/Form700.html) and click on the link to access the online filing system.

2. Create an Account: If you are a first-time user, you need to create an account by providing your name, email address, and other required information. Once completed, you will receive an email with login credentials.

3. Login: Use the login information received in the email to access the online filing system.

4. Start a New Filing: Click on the "Start a New Filing" button to begin filling out the form.

5. Personal Information: Provide your personal information, such as your name, address, position held, and agency/department information.

6. Reportable Interests: Declare any reportable interests you may have, including investments, income sources, business positions, and gifts received.

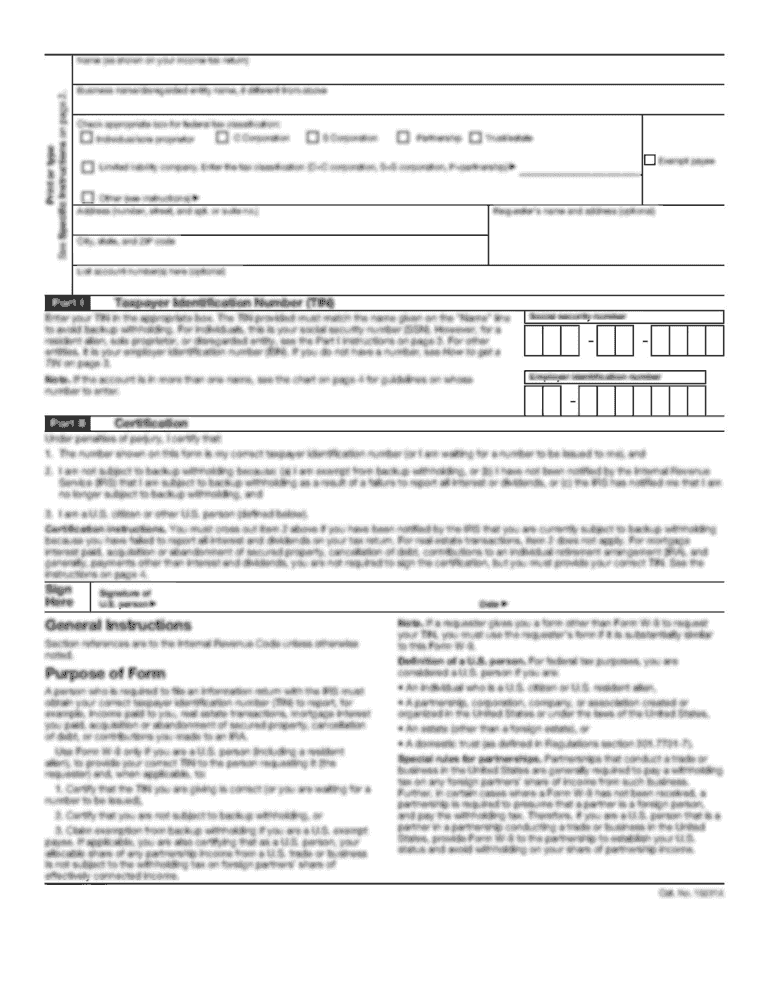

7. Schedule A: Complete Schedule A if you or your spouse or registered domestic partner earn reportable income. Provide details such as the source, type, and amount of income received.

8. Schedule B: Fill out Schedule B if you or your spouse or registered domestic partner hold financial interests, including investments, real estate, and business positions. Specify the types and value of these interests.

9. Schedule C: Complete Schedule C if you or your spouse or registered domestic partner receive gifts or honoraria, and specify the donor/source, description, and value of each gift.

10. Review and Submit: Review all the information provided, ensuring accuracy and completeness. Make any necessary edits. Once satisfied, sign and submit the form online.

11. Receipt Confirmation: After submitting, you will receive a confirmation indicating that your filing has been received.

Remember, the Form 700 may have additional requirements depending on your specific position or agency, so be sure to review any additional instructions or guidelines provided by your respective agency or the Fair Political Practices Commission (FPPC).

What is the purpose of online california form 700?

The purpose of California Form 700 is to disclose the financial interests and activities of designated public officials (DPOs) in the state of California. It is required under the California Political Reform Act and helps promote transparency and accountability in government. The form requires DPOs to disclose their personal financial holdings, investments, business positions, gifts received, and other relevant information that may present a conflict of interest in their public duties. By making this information publicly available online, it allows citizens to scrutinize and monitor the financial activities of their elected or appointed officials.

What is the penalty for the late filing of online california form 700?

The penalty for the late filing of the online California Form 700 varies depending on the circumstances. As of September 2021, the late filing penalties are as follows:

- For the first 30 days late: $10 per day, up to a maximum of $100.

- For 31 to 60 days late: $100 per day, up to a maximum of $2,000.

- For 61 days or more late: $100 per day, up to a maximum of $5,000.

It's important to note that these penalties are subject to change, and it's always best to consult the filing instructions provided by the California Fair Political Practices Commission (FPPC) or seek professional guidance to verify the current penalties and requirements.

Can I create an eSignature for the online california form 700 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your online california form 700 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the online california form 700 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign online california form 700. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit online california form 700 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign online california form 700 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your online california form 700 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.