Get the free Federal Parent Locator and Federal Tax Refund/Administrative Offset System (FPLS), H...

Show details

This document outlines the amendments and operations of the Federal Parent Locator Service as part of the child support enforcement efforts by the Office of Child Support Enforcement under the Department

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal parent locator and

Edit your federal parent locator and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal parent locator and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit federal parent locator and online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit federal parent locator and. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal parent locator and

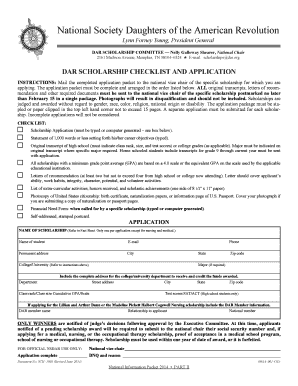

How to fill out Federal Parent Locator and Federal Tax Refund/Administrative Offset System (FPLS), HHS, OCSE

01

Gather necessary information such as the parent's name, Social Security number, and date of birth.

02

Complete the Federal Parent Locator Service form online or download it to fill out manually.

03

Provide details regarding the child, including their name, date of birth, and Social Security number.

04

Submit the completed form to the appropriate state agency or federal office as instructed.

05

Wait for confirmation and follow up if necessary to ensure that the information is processed.

Who needs Federal Parent Locator and Federal Tax Refund/Administrative Offset System (FPLS), HHS, OCSE?

01

Parents seeking assistance in locating non-custodial parents for child support purposes.

02

State child support agencies that need to locate absent parents for enforcement actions.

03

Individuals who are involved in legal matters related to child custody and need to track a parent's whereabouts.

04

Government agencies that require the identification of individuals for tax offset programs.

Fill

form

: Try Risk Free

People Also Ask about

How does tax refund offset work?

If your debt meets submission criteria for offset, BFS will reduce your refund as needed to pay off the debt you owe to the agency. Any portion of your remaining refund after offset is issued in a check or direct deposited as originally requested on the return. BFS will send you a notice if an offset occurs.

What does referral to the federal offset program mean?

The Treasury Offset Program (TOP) collects past-due (delinquent) debts (for example, child support payments) that people owe to state and federal agencies. TOP matches people and businesses who owe delinquent debts with money that federal agencies are paying (for example, a tax refund).

What is the federal tax refund offset program?

If you have a past due, legally enforceable California income tax debt and are entitled to a federal income tax refund, we are authorized to have your refund withheld (offset) to pay your balance due. We may charge a fee for federal offsets.

What is the government offset program?

BACKGROUND: The Government Pension Offset ( GPO ) adjusts Social Security spousal or widow(er) benefits for people who receive “non-covered pensions.” A non-covered pension is a pension paid by an employer that does not withhold Social Security taxes from your salary, typically, state and local governments or non- U.S.

What does it mean when the non-custodial parent was submitted to the federal tax refund offset program?

If you are due a federal tax refund but have not paid certain debts such as child support, back taxes, or state back taxes, all or part of your federal tax refund may be applied to these unpaid debts. The Financial Management Service (FMS) will offset your refund and forward it to the agency to apply to your debt.

Is the Treasury Offset Program real?

The Treasury Offset Program is a debt collection tool that allows the federal government to collect income tax refunds and certain government benefits (for example, Social Security benefits) from individuals who owe debts to the federal government.

How do I check my tax refund offset?

Not all debts are subject to a tax refund offset. To determine whether an offset will occur on a debt owed (other than federal tax), contact BFS's TOP call center at 800-304-3107 (800-877-8339 for TTY/TDD help).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

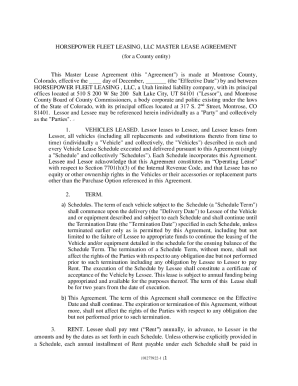

What is Federal Parent Locator and Federal Tax Refund/Administrative Offset System (FPLS), HHS, OCSE?

The Federal Parent Locator Service (FPLS) is a system that provides information to assist in locating parents for child support purposes. It is operated by the Office of Child Support Enforcement (OCSE) under the Department of Health and Human Services (HHS) and includes tools for using federal tax refunds to offset past due child support.

Who is required to file Federal Parent Locator and Federal Tax Refund/Administrative Offset System (FPLS), HHS, OCSE?

State child support agencies are required to file information with the Federal Parent Locator Service and may utilize the Federal Tax Refund/Administrative Offset System to collect past due child support from non-custodial parents.

How to fill out Federal Parent Locator and Federal Tax Refund/Administrative Offset System (FPLS), HHS, OCSE?

To fill out the necessary forms for the Federal Parent Locator and Federal Tax Refund/Administrative Offset System, state agencies typically need to provide relevant information related to the non-custodial parent, including names, Social Security numbers, and any outstanding child support obligations.

What is the purpose of Federal Parent Locator and Federal Tax Refund/Administrative Offset System (FPLS), HHS, OCSE?

The purpose of the FPLS and the Federal Tax Refund/Administrative Offset System is to help state child support agencies locate parents who owe child support and facilitate the collection of those arrears through tax refund offsets.

What information must be reported on Federal Parent Locator and Federal Tax Refund/Administrative Offset System (FPLS), HHS, OCSE?

The information that must be reported includes the non-custodial parent’s identifying information such as full name, Social Security number, date of birth, and information related to the child or children for whom support is owed.

Fill out your federal parent locator and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Parent Locator And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.