Get the free Tip Rate Determination Agreement - gpo

Show details

This document is a notice and request for comments by the IRS regarding the Tip Rate Determination Agreement used by employers in the food and beverage industry for tax compliance.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tip rate determination agreement

Edit your tip rate determination agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tip rate determination agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tip rate determination agreement online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tip rate determination agreement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

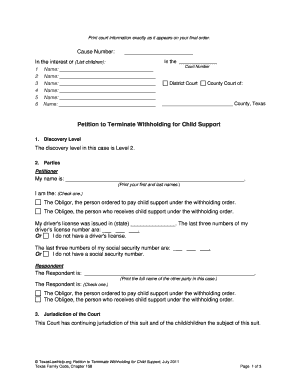

How to fill out tip rate determination agreement

How to fill out Tip Rate Determination Agreement

01

Start by downloading the Tip Rate Determination Agreement form from the relevant authority's website.

02

Fill out your personal information, including your name, business name, and contact information.

03

Provide details about your employment and the specific services you offer.

04

Indicate the average amount of tips you receive per shift or per week.

05

Include any supporting documentation that verifies your tip income, such as pay stubs or customer receipts.

06

Review the form for accuracy, ensuring all necessary fields are completed.

07

Submit the form to the appropriate agency or department as instructed, either online or by mail.

Who needs Tip Rate Determination Agreement?

01

Employees in the hospitality industry, such as waitstaff, bartenders, and taxi drivers, who receive tips as part of their income.

02

Employers who need to establish a fair tip rate in accordance with federal and state regulations.

03

Businesses that want to clarify tip distribution and ensure compliance with tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

Will I get in trouble for not reporting tips?

The main downside to not declaring cash tips is that omitting it from federal tax filings is a federal felony punishable by up to five years in prison and a fine of maybe $100k, though historically they don't apply that for a first offense over a low amount.

What is the tip rate determination agreement?

The TRDA requires that employees have a Tipped Employee Participation Agreement (TEPA) with the employer. With a TRDA, the IRS works with the establishment to arrive at a tip rate for the various restaurant occupations.

What is the IRS tip rule?

The Internal Revenue Code requires employees to report (all cash tips received except for the tips from any month that do not total at least $20) to their employer in a written statement.

How do you prove tips as income?

Complete an Employee's Report of Tips to Employer, Form 4070, or prepare a written statement, in duplicate, and provide the following information: - Employee's name, address, and Social Security number. - Employer's name and address. - Calendar month or other period covered by the report.

What happens if you don't report cash tips?

Penalty for not reporting tips. If you did not report tips to your employer as required, you may be charged a penalty equal to 50% of the social security, Medicare, and Additional Medicare Taxes due on those tips.

What is the best way to record your tips and additional income?

The most common method of how to show proof of income if paid in cash is creating your pay stub. Get a template for your use. You can complete the template and then print it out. You have to provide several pieces of information on the pay stub.

Can the IRS find out about cash tips?

The IRS can obtain records of any electronic (credit card) tips so you'd be wise to report ALL of those. Cash tips are sort of up to your discretion.

What happens if you didn't keep track of tips?

Penalty for not reporting tips. If you did not report tips to your employer as required, you may be charged a penalty equal to 50% of the social security, Medicare, and Additional Medicare Taxes due on those tips.

What happens if you don't claim cash tips as a server?

Not claiming any cash tips means you pay no taxes on what you made. It also opens you up to the possibility of IRS auditing, fines, ect. That's very rare but not unheard of.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tip Rate Determination Agreement?

A Tip Rate Determination Agreement is a form that allows employers and employees in the service industry to establish an agreement on the expected tip rates for employees, which can be used for the purpose of reporting tips to the IRS.

Who is required to file Tip Rate Determination Agreement?

Employers in the food and beverage industry, as well as other service industries where tipping is customary, are required to file a Tip Rate Determination Agreement on behalf of their employees.

How to fill out Tip Rate Determination Agreement?

To fill out a Tip Rate Determination Agreement, the employer must provide information such as the business name, address, the type of service provided, the expected tip rate, and signatures from both the employer and the employee.

What is the purpose of Tip Rate Determination Agreement?

The purpose of the Tip Rate Determination Agreement is to ensure that tip rates are reported consistently and accurately to the IRS, which helps in calculating the employee's taxable income and ensuring compliance with tax obligations.

What information must be reported on Tip Rate Determination Agreement?

The information that must be reported includes the employer's identification details, the employee's information, the type of business, the percentage of tips expected, and any specific conditions that pertain to tip reporting.

Fill out your tip rate determination agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tip Rate Determination Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.