Get the free Correspondent Concentration Risks - gpo

Show details

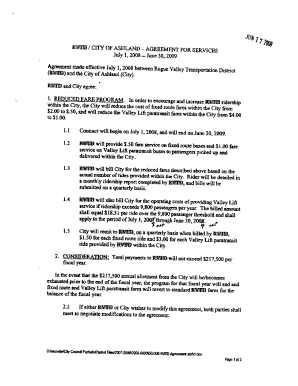

This document proposes guidance for financial institutions on identifying, monitoring, and managing correspondent concentration risks, outlining expectations for due diligence on credit exposures

We are not affiliated with any brand or entity on this form

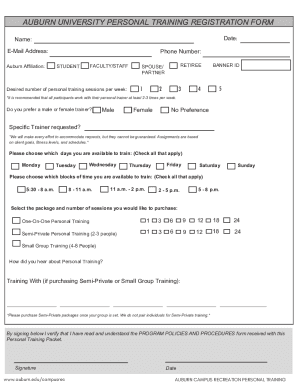

Get, Create, Make and Sign correspondent concentration risks

Edit your correspondent concentration risks form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your correspondent concentration risks form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing correspondent concentration risks online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit correspondent concentration risks. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

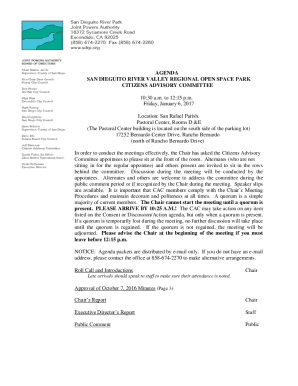

How to fill out correspondent concentration risks

How to fill out Correspondent Concentration Risks

01

Gather all relevant data regarding your correspondent relationships.

02

Identify and list all correspondents you are engaged with.

03

Assess the level of risk associated with each correspondent based on factors such as geography, financial stability, and transaction volumes.

04

Provide a detailed analysis of any concentration risks by evaluating the percentage of business each correspondent represents.

05

Document any risk mitigation strategies you have in place for high-risk correspondents.

06

Review and update regularly to reflect any changes in correspondent relationships or risk status.

Who needs Correspondent Concentration Risks?

01

Financial institutions that engage in transactions with foreign banks.

02

Risk management teams and compliance departments.

03

Regulators and auditors for compliance oversight.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a concentration risk?

The major risks faced by banks include credit, operational, market, and liquidity risks.

What is a bank's concentration risk?

Large loan concentration risk represents the collective risk/exposure a group of large loans presents. This is normally measured based on an institution's top ten loan commitments.

What are the 3 types of risk in banking?

A concentration of credit consists of direct, indirect, or contingent obligations exceeding 25 percent of a bank's capital structure. In general concentrations may involve one borrower, an affiliated group of borrowers, or borrowers engaged in or dependent on one industry.

What is an example of a concentration risk?

Concentration risk is a banking term describing the level of risk in a bank's portfolio arising from concentration to a single counterparty, sector or country. The risk arises from the observation that more concentrated portfolios are less diverse and therefore the returns on the underlying assets are more correlated.

What are the risks associated with correspondent banking?

Correspondent banking relationships can be exploited for money laundering, terrorist financing, and other illicit activities. By conducting risk assessments, you can identify potential risks and take steps to prevent these activities from occurring within your banking network.

What does concentration mean in banking?

Disclosure Criteria An event or events associated with the concentration or constraint that could cause a substantial impact have occurred, have begun to occur, or are more likely than not to begin to occur within 12 months of the date the financial statements are issued.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Correspondent Concentration Risks?

Correspondent Concentration Risks refer to the potential financial risk that arises from having a significant level of exposure to a single correspondent bank or a group of related correspondent banks, which can lead to a lack of diversification in banking relationships.

Who is required to file Correspondent Concentration Risks?

Financial institutions that engage in correspondent banking relationships are typically required to file Correspondent Concentration Risks, particularly those regulated by banking authorities to ensure risk management and compliance.

How to fill out Correspondent Concentration Risks?

To fill out Correspondent Concentration Risks, institutions must gather data on their correspondent banking relationships, assess the level of exposure to each correspondent, and complete the required reporting forms with accurate information detailing these exposures.

What is the purpose of Correspondent Concentration Risks?

The purpose of Correspondent Concentration Risks is to identify, assess, and mitigate the risks associated with concentrated banking relationships to enhance the stability and reliability of the financial system.

What information must be reported on Correspondent Concentration Risks?

Information that must be reported includes the identity of correspondent banks, the total exposure amount to each entity, the nature of the relationships, and any significant transactions that could impact the institution's risk profile.

Fill out your correspondent concentration risks online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Correspondent Concentration Risks is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.