Get the free 100240018 NFS Form 10-900 (Oct - pdfhost focus nps

Show details

OMB No. 100240018 NFS Form 10-900 (Oct. 1990) United States Department of the Interior National Park Service DEC 1 3 1993 National Register of Historic Places Registration Form NATIONAL REGISTER This

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 100240018 nfs form 10-900 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 100240018 nfs form 10-900 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 100240018 nfs form 10-900 online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 100240018 nfs form 10-900. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out 100240018 nfs form 10-900

01

Start by obtaining the 100240018 nfs form 10-900. This form is typically used by individuals or organizations who need to request federal assistance for various purposes.

02

The form requires you to provide basic information such as your name, address, and contact details. Make sure to accurately fill in this information to avoid any delays or complications.

03

Next, you will need to clearly state the purpose of your request for federal assistance. Provide a detailed explanation of why you need the assistance and how it will benefit you or your organization.

04

The form will also require you to provide information about your financial situation. This may include details about your income, expenses, assets, and liabilities. Be thorough in providing this information as it will help determine your eligibility for assistance.

05

In addition to financial information, you may also be asked to provide supporting documentation. This can include documents such as bank statements, tax returns, or proof of income. Make sure to gather all necessary documents and attach them to the form if required.

06

Review the form before submitting it to ensure all information is accurate and complete. Any errors or missing information can lead to delays in processing your request.

07

Once you have filled out the form and attached any necessary documentation, submit it following the specified instructions. This may involve mailing it to a particular address or submitting it online through a designated portal.

08

After submitting the form, it is important to keep a copy of it for your records. This will serve as proof of your request and the information you provided.

Who needs 100240018 nfs form 10-900?

01

Organizations or individuals seeking federal assistance for various purposes may need to fill out the 100240018 nfs form 10-900. This can include requesting funding for research projects, community development initiatives, or social programs.

02

The form is typically required by government agencies or departments responsible for allocating federal funds. These agencies need the form to assess the eligibility and suitability of applicants for assistance.

03

It is important to carefully review the specific requirements and guidelines related to the form to determine if it is necessary for your particular situation. Consulting with the relevant government agency or seeking professional advice can help ensure you meet all the necessary criteria.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

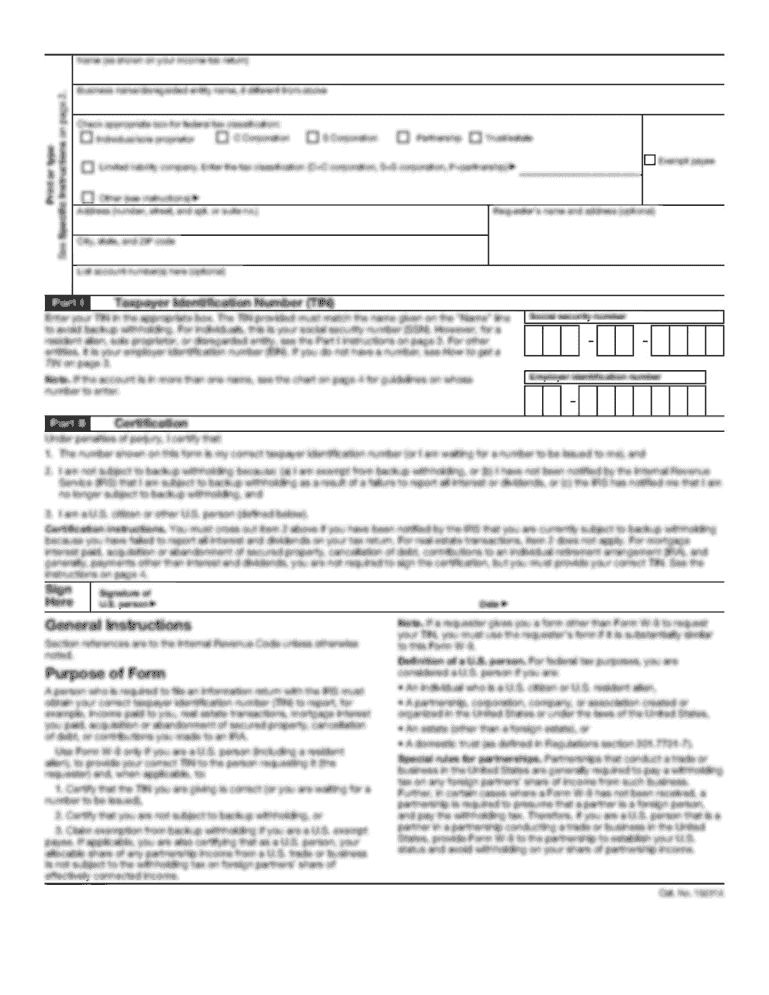

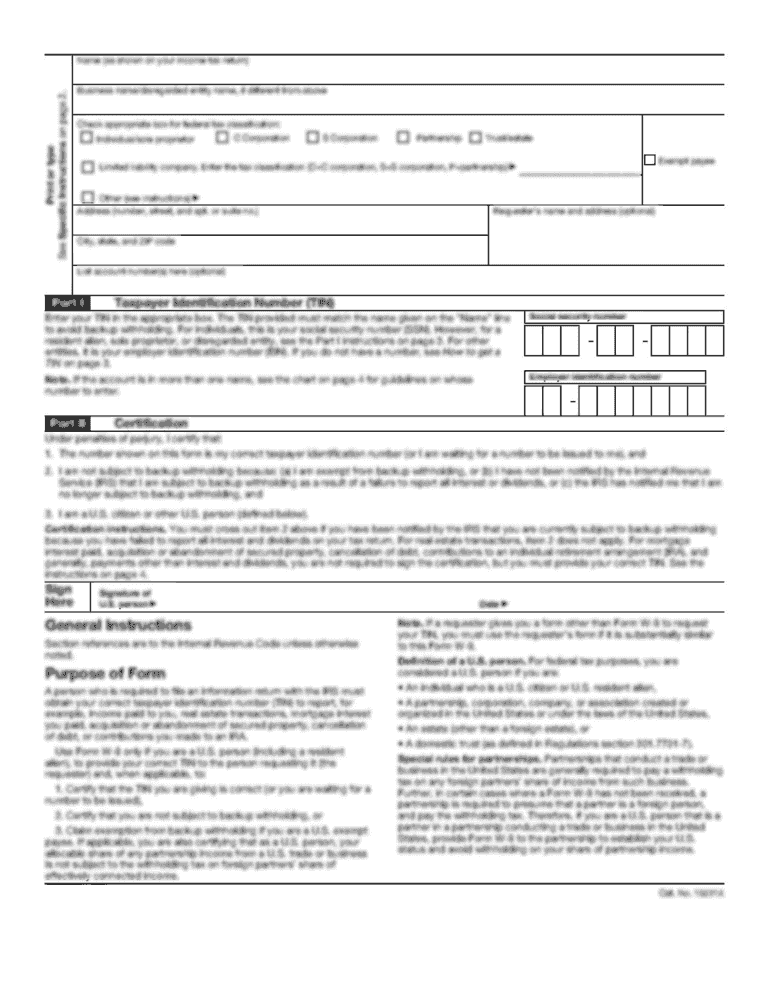

What is 100240018 nfs form 10-900?

The 100240018 nfs form 10-900 is a specific form used for reporting financial information for non-profit organizations.

Who is required to file 100240018 nfs form 10-900?

Non-profit organizations that meet certain criteria defined by the IRS are required to file the 100240018 nfs form 10-900. These criteria usually depend on the organization's annual revenue and activities.

How to fill out 100240018 nfs form 10-900?

To fill out the 100240018 nfs form 10-900, you need to gather the required financial information of your non-profit organization, including revenue, expenses, assets, and liabilities. The form can be completed electronically or by using a paper form provided by the IRS. It is recommended to consult with a tax professional or refer to the IRS instructions for detailed guidance on filling out the form.

What is the purpose of 100240018 nfs form 10-900?

The purpose of the 100240018 nfs form 10-900 is to provide the IRS with financial information about non-profit organizations, which helps the IRS verify their tax-exempt status, assess their compliance with tax laws, and monitor their financial activities.

What information must be reported on 100240018 nfs form 10-900?

The 100240018 nfs form 10-900 requires reporting various financial information, such as revenue, expenses, assets, liabilities, program-related activities, executive compensation, fundraising activities, and other specific details concerning the non-profit organization's financial operations. The exact requirements may vary depending on the organization's size and activities. It is important to refer to the instructions provided by the IRS for accurate reporting.

When is the deadline to file 100240018 nfs form 10-900 in 2023?

The deadline to file the 100240018 nfs form 10-900 in 2023 depends on the non-profit organization's fiscal year. Generally, the form is due on the 15th day of the 5th month after the organization's fiscal year ends. For example, if an organization has a fiscal year ending on December 31, 2022, the deadline to file the form would be May 15, 2023. It is advisable to check the specific deadline for your organization with the IRS or consult with a tax professional.

What is the penalty for the late filing of 100240018 nfs form 10-900?

The penalty for the late filing of the 100240018 nfs form 10-900 can vary depending on various factors, such as the organization's annual gross receipts and the length of the delay. The IRS may impose a penalty based on a certain percentage of the organization's annual gross receipts or a fixed amount per day of delay. It is important to comply with the filing deadline to avoid potential penalties. Specific penalty details can be found in the IRS instructions or by consulting with a tax professional.

How can I manage my 100240018 nfs form 10-900 directly from Gmail?

100240018 nfs form 10-900 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit 100240018 nfs form 10-900 online?

With pdfFiller, the editing process is straightforward. Open your 100240018 nfs form 10-900 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit 100240018 nfs form 10-900 in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing 100240018 nfs form 10-900 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Fill out your 100240018 nfs form 10-900 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.